It’s not hard to retire comfortably

The idea of retiring rich after a successful career has become a quintessential representation of the modern American dream. We’re absolutely infatuated with this notion; in fact, were you to ask any group of people if they realistically envisioned themselves as being rich at any point in their lives, chances are pretty high that all of them would answer in the affirmative.

So, how easy is it to retire rich?

“Easy” isn’t the word to use. “Simple,” however, is perfectly fine, according to David Back, author of Smart Couples Finish Rich.

![]()

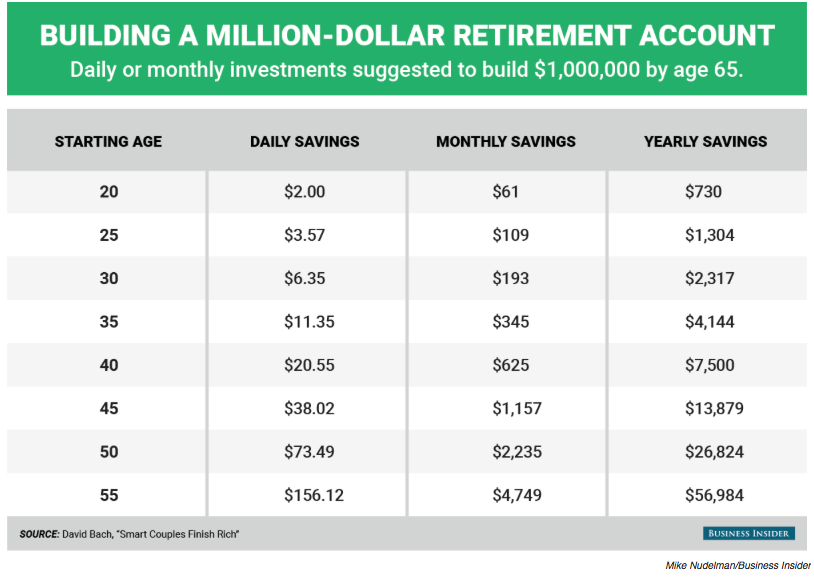

By now, you’ve probably heard that the secret to saving a fortune lies in investment. With a modest twelve percent return rate, Bach suggests that somebody as young as twenty—with a simple saving rate of two dollars a day—can bank a million bucks by sixty-five. Such an insignificant figure should be motivating—after all, fourteen dollars per week is about as much as most of us allow ourselves in day-to-day indulgences.

Exchanging habits for a wealthy retirement

The most important message here is not so much that anyone can be a millionaire by age sixty-five, though—it’s that anyone can put aside a buck or two a day while they’re young and have it come back in spades.

Consider the following: if you have a casual habit—be it coffee, tea, cigarettes, or hot dogs—you probably spend an average of about twenty dollars a week supporting it; if it’s a more aggressive development, you could be spending much more (i.e., a six-pack a night—even an inexpensive one—adds up incredibly fast).

If you were to take even a quarter of the money you spend on those habits and toss it in a mason jar behind the toaster every week, at the end of the year you would have a sizeable chunk of change—and it wouldn’t be coming out of your hard-earned savings or, God forbid, your retirement fund. Even without the component of investing, saving money—like any habit—becomes easy and incredibly productive with very little effort over time.

#RetireRich

Jack Lloyd has a BA in Creative Writing from Forest Grove's Pacific University; he spends his writing days using his degree to pursue semicolons, freelance writing and editing, oxford commas, and enough coffee to kill a bear. His infatuation with rain is matched only by his dry sense of humor.

Pingback: Based on your current spending, when can you retire? - The American Genius