The housing affordability gap is widening

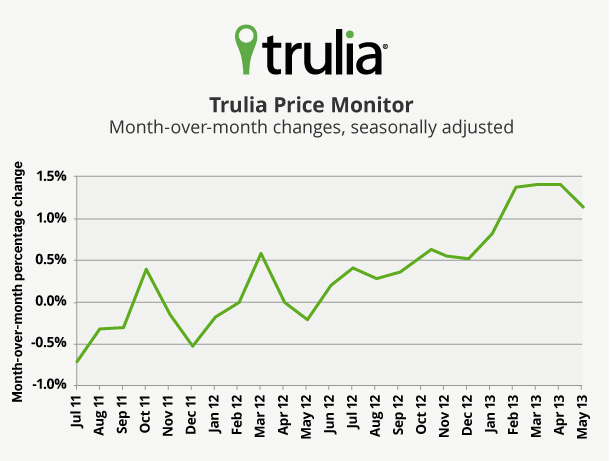

According to the May Trulia Price Monitor and Trulia Rent Monitor, asking prices for homes rose 1.1 percent compared to the previous month, and while it is a substantial improvement for one month, it is a slower pace of improvement than the previous three months. Home prices have risen 9.5 percent compared to May 2012, Trulia reports.

Of particular note, the report indicates that the housing price recovery has actually put the least affordable housing markets even farther out of reach, as prices rose over 20 percent annually in Orange County, Oakland, and San Jose, the three least affordable markets. Overall, in the 10 least affordable markets, prices rose 16.3 percent, substantially more than the national average of 9.5 percent during the same period.

The affordability gap is not just widening for home buyers, but for rentals, as in two of the least affordable rental markets – Miami and Boston – rents rose more than 5 percent annually while national rents only rose 2.3 percent.

People might think about relocating

Trulia says this affordability gap will make more people think about relocating from expensive to cheaper markets – and may create headaches for national housing policy.

“Home prices are rising fastest in the local markets that were least affordable to begin with,” said Dr. Jed Kolko, Trulia’s Chief Economist. “As the gap between the most and least affordable markets widens, more people in expensive markets like California will look to relocate to cheaper markets like Texas when the time comes to buy.”

“If you own in pricey markets like Honolulu or San Francisco, or rent in expensive places like New York or Miami, you could be spending more than half your earnings on housing,” Dr. Kolko added. “Even spending one-third of your pre-tax earnings on housing can stretch the family budget. But to own in more affordable markets like Detroit, Houston, or Atlanta, you’ll spend much less than one-third of your earnings on housing – leaving a lot more money left over to spend on other things or build up savings.”

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.