What is RESPA?

RESPA is the Real Estate Settlement Procedures Act (RESPA) that was first passed in 1974. It is designed to:

- Help consumers become better shoppers for settlement services, and

- eliminate kickbacks and referral fees that unnecessarily increase the costs of certain settlement services

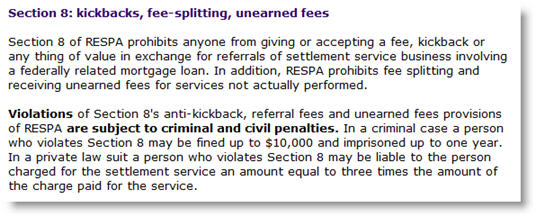

RESPA Violation

Referrals to non-licensed people (friends, family, past clients, etc.) is an enticement to refer business to a specific agent – not based on MERIT, but based on the reward they will get in return. This includes ANYTHING of value: cash, gifts, gift cards … ANYTHING of value.

We recently went to a RESPA class where we were told that MOST violations are reported – NOT by the public (because they do not really know/understand/care about RESPA) but by other real estate professionals.

I see why, too.

Blatant Bribery

In this current shifting real estate market, I have seen several local real estate agents reverting back to bribing non-licensed people to give them business. It has gotten so out of hand that I have seen advertisements blatantly advertising “referral fees” and “gifts” to anyone who brings certain agents business.

This bothers me on three counts:

- The consumer’s best interest is not being represented. These consumers are being “referred” to real estate agents that MAY NOT BE the best fit for them.

- I wind up having to spend MY time explaining to people WHY I don’t offer referral fees to non-licensed people. Why should I have to defend my legal way of doing business (lead generation) against people who are doing things they shouldn’t be?

- Referral Fees to non-licensed people is ILLEGAL. geesh.

Alternatives to RESPA Violations

Of course we want to thank people who help our business, and there are ways to do this that are NOT RESPA Violations. Here are a few of my favorite:

- Instead of giving them a gift card, take them out to lunch. (You must be there with them.) Not only is an acceptable form of saying “thank you” – it gives you a great opportunity to meet with them face-to-face and TRULY show how much you care. Heck! You may get another referral out of it!

- Mention them, by name, in your newsletter. People LOVE to see their name, especially when it is tied to praise.

- Have an “appreciation party” where you invite everyone who has “helped support your business” to come together for a seasonal party or BBQ. Take this time to genuinely thank them for helping your business grow.

- Refer THEM business. I have a lot of friends and past clients who are small business owners. Nothing says “thank you for helping MY business” more than helping them with THEIR business.

See? There are plenty of alternatives to playing the Section 8 RESPA Violation game.

So What?

I work very hard to do things the “right way” and I get frustrated when people don’t follow suit. So, instead of notifying the RESPA Violations Department every time I see a Blatant Bribe – RESPA Section 8 Violation, I decided to ASSUME that people just don’t understand that what they are doing is wrong.

Instead, I have written this post and will forward it to each agent that I see/hear violating this. Please feel free to do the same.

Mariana is a real estate agent and co-owner of the Wagner iTeam with her husband, Derek. She maintains the Colorado Springs Real Estate Connection Blog and is also a real estate technology trainer and coach. Mariana really enjoys helping real estate agents boost their businesses and increase their productivity through effective use of technology. Outside of real estate, blogging and training, she loves spending time with her husband and 2 sons, reading, re-watching Sci-Fi movies and ... long walks on the beach?

Ashley Drake Gephart

December 5, 2008 at 3:56 pm

Mariana – I find that most agents really don’t understand RESPA. Our local board has spent the last week analyzing RESPA section 9 due to an issue with lo/so remarks. I hope we can educated more agents about the different guidelines so everyone can do their job correctly. For those that do know they are violating it then they should be reported.

Thomas Johnson

December 5, 2008 at 6:15 pm

“I have seen advertisements blatantly advertising “referral fees” and “gifts” to anyone who brings certain agents business.”

Mariana, if this is so bothersome, rather than blogging about it in generalities, post the ads for all to see and then, I suggest filing an ethics complaint with your local board, and with the state licensing authority. A RESPA violation, if reported, should trigger a HUD audit at the offender’s brokerage.

A blog post about your experience with our enforcing bodies would be enlightening and probably very entertaining to all of us who care about cleaning up our own mess.

Mariana the Wagner

December 5, 2008 at 6:25 pm

Ashley – I agree. There needs to be more education.

Thomas – I do not operate that way. I have notified the agent, and do not plan on pursuing that specific incident any further unless I see it repeated. Ratting out an agent was not the purpose of this post.

The intent of this post was more general – a reminder to everyone about what is and is not acceptable, in regards to RESPA Section 8.

Bridget Magnus

December 5, 2008 at 7:31 pm

Time spent explaining? How long does it take to say “I’m sorry, that’s against Federal law”?

It’s against state law here too, can’t speak for your jurisdiction. It’s against the law enough places that I once heard a CNBC interviewer ask somebody from one of these online apartment directories how exactly their business was legal.

Brian Brady

December 6, 2008 at 12:51 am

“The consumer’s best interest is not being represented. These consumers are being “referred” to real estate agents that MAY NOT BE the best fit for them.”

Do you really think that revenue sharing, with an unlicensed “agent”, is detrimental to the consumer? If you do then I have an answer to that; do away with the anti-kickback law so that the unlicensed agent can refer the client to the best-suited licensee.

Licensing laws aren’t about consumer protection, Mariana.

Mariana the Wagner

December 6, 2008 at 9:29 am

Bridget – Funny. This is not a state law, here. But RESPA overrides our state laws, so it doesn’t matter.

Brian – I believe that licensing laws ARE about consumer protection.

How I see it: If a consumer knows of someone looking to buy a house, and agent A offers $ and Agent B offer $$ and Agent C offers nothing, oftentimes the consumer will just refer the home buyer to whomever offers more $$. At this point, experience, expertise and legitimacy are not even considered. To me, that is NOT in a home buyer/seller’s best interest.

To me kickbacks are bribes and I am glad that RESPA sees it the same way as I do.

Steve Simon

December 6, 2008 at 11:31 am

The educational aspect has been addressed in a robust manner in almost all of the FL. courses (sales, Broker, Post-lic.). I don’t think it is a matter of education; it is a matter of enforcement. There are virtually no RESPA police, andas with all unenforced (or sparsely enforced) rule or regulation it gets trampled.

I have to tell you in my local area the adherence to the rules and regs of our business is suffering a terrible drop-off. The tough times is producing a “Free For All” mentality among a large number of those in the field. I hope this is a wave and will be washed away soon; the level of some of the folks is akin to petty criminal. I am not making an overblown comment here. I teach and I sell (not a lot:) I see breach of fiduciary duty regularly. I have seen everything from failure to disclose to forgery in the last couple of years. It happened years ago as well, but not at this level of frequency. Very sad…

Bob

December 6, 2008 at 11:56 am

Nice job Mariana. Thank you. This is a matter that, as a consumer protection Don Quixote titling at windmills, is important to me.

The intent of RESPA is all about consumer protection.

Agents frequently require a certain title company be used, and for various reasons. Few of these reasons have anything to do with what is in the best interests of the title company.

We also know how frequently Section 8 is ignored by both agents and title companies, so Section 9 was added to give the consumer some recourse.

The buyer has one year to bring suit, but a state AG, insurance commissioner, and HUD have three years.

I think some would be amazed at how many are turned in by settlement providers who follow the rules but are told by the agent that they use others because of what they are given by other vendors. They actually cop to violating RESPA.

Brian Brady

December 6, 2008 at 12:01 pm

Mariana,

My first KW Family Reunion had licensees at the entrance, armed with flyers, with the fee split percentage in 72 pt type. In the back of real estate trade magazines, I find classified ads competing on the percentage amount. Is that advertising acceptable because of the license?

“To me kickbacks are bribes and I am glad that RESPA sees it the same way as I do.”

I think you’re missing something here. Reciprocal business agreements, which you suggest as a legal way to “skirt” this law, is often the WORST form of bribery to permeate our business. Ask Ed Rybczynski.

Bob

December 6, 2008 at 12:15 pm

Absolutely. And Ed is a great example.

Brian Brady

December 6, 2008 at 2:08 pm

“Ed is a great example”

Ed’s the one who showed me the light, Bob. After a conversation with him, I recognized how tainting they can be

Mariana the Wagner

December 6, 2008 at 2:11 pm

Steve – It is sad when anyone (in any industry) feels the need to go against the laws to try and get a sale.

Bob – You are right. Section 9 is also a very important part of RESPA.

Brian – “Is that advertising acceptable because of the license?” In my opinion, yes…

When we are talking about Dallas Agent A refers a client to Seattle Agent B. – A client that Seattle Agent B does not need to “convert”. I believe that (if he so desires) Dallas Agent B deserves the right to ask for a referral fee.

How would that agreement be “skirting” the law, when the law is only addressing referral fees or kickbacks to non-licensed persons?

Bob

December 6, 2008 at 3:01 pm

Mariana,

I assumed Brian was referring more to affiliated business relationships that agent to agent referrals. You refer clients in need of a mortgage to Brian on the condition that he refer his buyers or sellers to you. The compensation is the conditional expectation of business.

Personally I dont like any referral fee. If I send you a buyer or seller, all I’ll ask is that, if legal in your state, you give the dollar amount of the referral to the client as a closing cost credit.

Now the consumer knows I get nothing out of it, other than maybe goodwill and a thank you from the other two parties. If I don’t refer someone who does the job right, then I look bad.

Brian Brady

December 6, 2008 at 5:45 pm

“How would that agreement be “skirting” the law, when the law is only addressing referral fees or kickbacks to non-licensed persons?”

What service, other than delivering a rock-solid,pre-sold customer, does a referring agent bring to a licensee?

Mariana Wagner

December 6, 2008 at 6:20 pm

Bob – Oh. I guess I don’t understand what “affiliated business relationships” are then …

Brian – “What service, other than delivering a rock-solid,pre-sold customer, does a referring agent bring to a licensee?”

When one professional RE agent refers a “rock-solid,pre-sold customer” to another professional RE agent, I believe that the 1st agent has the right to receive a fee (if they want). Without the hard work on the 1st agents part (pre-home qualifying, maybe selling their home, being related …) the 2nd agent would not have that client.

When WE refer business out, we also do A LOT OF RESEARCH to make sure that the the agent we choose will be the best match for our client. When we DO accent referral fees (which is rare), they are well-earned.

Brian Brady

December 6, 2008 at 6:45 pm

“When one professional RE agent refers a “rock-solid,pre-sold customer” to another professional RE agent, I believe that the 1st agent has the right to receive a fee”

What did they do that requires a real estate license, Mariana. It’s a name, number, and maybe a three-way phone call. I refer 3-4 buyers a month to agents across the nation. What does a referring real estate licensee do differently than I do?

Mariana Wagner

December 6, 2008 at 9:39 pm

As a lender, are you NOT allowed to get/receive referral fees from another lender?

Matthew Rathbun

December 6, 2008 at 10:19 pm

Mizzle,

Sorry, I’m late reading this. It’s terrific and I am going to incorporate this into our pre-licensing lecture.

The ongoing debate about a need for a license is much deeper rooted than this level of engagement could sort out.

The bird-dogging that many lenders and settlement agents do (without a license) is harvesting names and selling to the highest bidder. I don’t see that really different than these lead generator websites. The reason that the the licensing laws prevent this is to keep agents from paying the mail carrier to solicit consumer information only to get a few bucks by selling it to agent. Same with the lenders / settlement companies.

The consumer has a right to know that when they are talking to someone, what that someone’s motivation is. If I share with my mail carrier that I am moving, and they offer a name; it’s important to me to know that they are only giving me this recommendation because they are getting paid – not that they actually trust the agent.

Same with the lender. However, RESPA nor Real Estate commissions have jurisdiction over the mail carrier who is unlicensed; to force disclosure that the unlicensed lender, mail carrier or whomever is getting paid for the “referral.” So, to make the mail carrier be less interested in giving the name of an agent they don’t really know or trust; most RE commissions make it illegal to pay the mail carrier, since the licensee (from where the money may come from) is the only one they can put the screws to.

My best advice is to create a small packet for the consumer on how to interview an agent and tell them how to find an agent in the area that they are seeking a referral from. Be the source of the source, but not the source.

All that being said, there is nothing stopping the mail carrier from getting a RE license. The education is minimal and in our states, it cost all of $300 for the training and $65 for the license. That’s less than one good referral fee. However, it does give the Commission to force you, as a licensee to say ‘hey, thanks for letting me know that you’re moving – I’ve got a good agent for you and oh, BTW the law requires me to tell you that I am getting paid to give you the name”

1st grade level: You want a referral fee – get a license and hang it on referral at some broker’s office. You don’t need MLS, lockboxes of associations – just saying.

Matthew Rathbun

December 6, 2008 at 10:20 pm

…sorry to post-jack in the comment stream. I didn’t mean to rant.

Bob

December 6, 2008 at 10:31 pm

“What does a referring real estate licensee do differently than I do?”

Not expect to get a loan out of it.

Bob

December 6, 2008 at 10:37 pm

Well said Mr Rathburn.

I would like to see referral fees removed from the process completely. You cant take a referral fee as an attorney. No reason why agents should get them either.

teresa boardman

December 7, 2008 at 9:24 am

I knew that offering gifts or money for referrals to non licensed persons was against the law here in Minnesota but did not realize it had anything to do with RESPA except when it comes to lenders paying agents. Guess I need to study up on RESPA a bit more. 🙂

Missy Caulk

December 7, 2008 at 11:09 am

We’ve studied RESPA quite a bit in MI with all the subprime mortgages. Even having some FBI agents come in and speak.

When I get a referral from my sphere of influence or a past client. I send them a candy bar with my name and thank you molded into it.

I did not ask them for it, nor do I solicitate it but I want to thank them and acknowledge them in a tangable way.

I don’t think I have heard of this type in MI, Mariana

Mariana Wagner

December 7, 2008 at 12:27 pm

Matthew – Your rants are always welcome on my posts. Supplying an information packet is a great idea, but in most cases, the client I am referring is a client/friend/relative of mine – someone I owe either a fiduciary duty or another kind of duty to. I feel the need to HELP them find the right agent. Of course, the client needs to interview them first hand, but I believe that the bulk of the research should come from ME – I already know the right questions to ask.

Teresa – This small little section of RESPA has some far-reaching fingers. I swear … I learn more about the implications everyday.

Missy – My hard-nosed response is that even the candybar is an “item of value” … though probabably never will cause you a problem.

Brian Brady

December 7, 2008 at 3:51 pm

“As a lender, are you NOT allowed to get/receive referral fees from another lender?”

No. Lenders are governed by HUD and HUD is explicit about revenue sharing among lenders.

I think Bob nailed it when he suggested that I expect a loan out of the referral. My interest in picking the right agent is purely economic. I pick agents who can close deals so I get paid.

I refer sellers to agents across the country, however.

Should I be able to be compensated for that referral? (I am providing a service, as Mariana defines the service)

The answer will most likely be, if I’m licensed. My company is a licensed real estate brokerage, in California. Should my referral garner a fee for my employer then?

What makes my referral different from my wife’s hairdresser? (she’s owned more homes than most agents have sold)

Mariana Wagner

December 7, 2008 at 4:12 pm

“Should I be able to be compensated for that referral? (I am providing a service, as Mariana defines the service)”

No. If RESPA starts allowing referral fees to those that are NOT licensed real estate agents, then where would the lines be drawn? We need to compare like services for like services. I am only referring business to people who I cannot geographically service myself.

“My company is a licensed real estate brokerage, in California. Should my referral garner a fee for my employer then?”

I do not believe in paying referral fees to companies – just individuals… Individuals who are personally and professionally referring me clients.

“What makes my referral different from my wife’s hairdresser? (she’s owned more homes than most agents have sold)”

I would not give a hairdresser a referral fee, either.

Bob

December 7, 2008 at 10:03 pm

That is illegal in most states. The fee goes to the broker who then pays the licensee (and frequently at the normal split). I know this is just semantics, but that is the point Brian is making – in his situation, RESPA compliance is only a matter of semantics.

In California, Brian’s license is no different than mine and the broker license held by the broker of record for his firm is no different than my broker’s license. He could come to work for me and sell homes or I could work for him and do loans.

The idiocy here is that as purely a mortgage broker, Brian (or more correctly, his company) can’t receive a referral fee from you for a buyer/seller, but I can. However, if Brian and I started SD Homes & Loans tomorrow, Brian could take a listing, originate a loan, AND receive a referral from you.

Easiest thing to do here is eliminate the referral fee, because you cant close the loopholes.

It’s this sort of thing that makes RESPA a confusing issue for the honest folks out there who dont think they are doing anything unethical or illegal.

Brian Brady

December 7, 2008 at 10:55 pm

“I do not believe in paying referral fees to companies – just individuals… Individuals who are personally and professionally referring me clients.”

Only licensed real estate brokerages are permitted to receive compensation, Mariana. Agents who work for that brokerage receive all compensation from the broker.

“I know this is just semantics, but that is the point Brian is making – in his situation, RESPA compliance is only a matter of semantics”

…but it’s not semantics! It’s the heart of the argument. Mariana could pay a referral to my brokerage and the broker could refuse to pay me…yet I’m the referring “agent”.

This is what I mean, Mariana. Bob suggests that abandoning the practice of referral fees is good. I suggest abandoning the requirement that it be paid to a licensed real estate brokerage. Either way works if you are truly concerned about the consumer.

The hypocrisy of the middle ground is the argument with which I take umbrage.

Matthew Rathbun

December 8, 2008 at 5:52 am

Brian,

In the Commonwealth, in which I live, there is no licensing requirement for the Broker to pay the licensee for any service. The agent needs to choose wisely when working with a Broker. So the concern of not getting paid from a Broker always exist, unless you are in fact the broker. An agent can only get paid by the broker if they are currently licensed or was at the time of the service. So even a non-licensed employee of the Broker could not get paid for those skills which are otherwise defined as needed a license (such as client referrals), without a license. Staff may get a salary, but it must be consistent and not connected to services rendered for a transaction.

We’ve seen civil trials where an agent tried to sue for commission earned while at the brokerage and lose. The courts said that the money belongs to the broker – period. They can decide to share with licensee, therefore the argument that a broker may not pay you is valid.

I agree with the notion to disallow referral fees outside of one’s own brokerage. However, the second they do that, the practitioners will either a.) abandon the client to find someone on their own (I’m ok with that) or b.) find a new way around it, yielding the need for even more legislation.

Mariana Wagner

December 8, 2008 at 8:38 am

BRIAN AND BOB – You MUST HAVE misunderstood me.

I KNOW that paying referral fees to unlicensed people is ILLEGAL – THUS the point of my post.

By “individual” I mean “INDIVIDUAL AGENT” … not some lead-selling company.

Mariana Wagner

December 8, 2008 at 8:47 am

Brian and Bob – You both have issues with this RESPA section but have 2 different approaches to the answer.

Personally, I am perfectly fine with paying a referral fee to a LICENSED RE AGENT if/when they refer me a client.

However, if I HAD to choose between Brian or Bob’s side of the coin, I would have to go with Bob.

IMHO … If we start allowing “referral fees” to people who are NOT ON THE HUD-1 and NOT LICENSED RE agents, then pretty soon people are going to want referral fees for recommending a specific lender, inspector, appraiser … and all of a sudden we have an “ENTICEMENT TO DO BUSINESS” issue where NONE of the consumer’s BEST interests are kept in mind.

Mariana Wagner

December 8, 2008 at 8:49 am

(Basically, I think that the BEST answer is to just keep the ball in the same court. Referral fees among within the same profession.)

Mariana Wagner

December 8, 2008 at 9:41 am

Matthew – I think that this particular RESPA section is an interesting balance. Adding MORE people to whom we can give referral fees to or taking them away all together will, in my opinion, just cause MORE need for legislation.

Brian Brady

December 8, 2008 at 9:12 pm

Matthew,

I hear you. Agents aren’t paid referral fees, their brokers are. Isn’t that dumb?

Matthew Hardy

December 9, 2008 at 10:41 am

Brian Brady Says: “What service, other than delivering a rock-solid,pre-sold customer, does a referring agent bring to a licensee?”

Brian, you always have such a way with words.

Of course no one (Congress notwithstanding) would consider a free meal or free advertising or a free party or new business referrals as a bribe. Everyone (I’m certain of this) would ONLY see these as friendly gestures that have nothing to do with reciprocation.

James

October 12, 2009 at 7:03 pm

Forgive me my ignorance, but my understanding is a referral fee between two real estate brokerages (or within a brokerage) is not actually covered under RESPA. Do inter- or intra-brokerage referrals actually get listed on a HUD?

I got the following from RealtyTimes, “Under RESPA, there is only one basic restriction on brokers in carrying out this mission. They are forbidden from accepting a referral fee from providers of such services — title insurers, mortgage banks, escrow companies (in states where applicable), and others whom a broker may steer to the transaction. ”

I have been practicing real estate in two states (associate broker in one state and sales associate in the other) and have always worked to be ethical and, of course, to work well within the bounds of the law. I am not looking to argue the merits of referral fees, but unless I am grossly misinformed this discussion doesn’t really fall under the bounds of RESPA.

mariana

October 12, 2009 at 9:19 pm

This discussion is about giving referral fees to unlicensed people, which IS a violation of RESPA.

Jim Bardes

December 9, 2009 at 1:28 pm

Mariana, I noticed your article about RESPA violations in the Agent Genius magazine online when I Googled “RESPA violations real estate advertising”.

I have a question and wondered if you could direct me to the appropriate RESPA authority.

I’m considering development of a separate yard sign, or a Broker’s yard sign rider to advertise a total monthly payment (PITI) at the current list price. My question is: If I clearly and visibly disclose the Loan Amount, interest rate, APR, loan term, and type of mortgage program, may I confidently display/advertise the monthly payment amount in the front yard of the home I have listed?

Can you direct me to a RESPA “Answer Person” – authority with whom I could address my question?

I will appreciate your reply.

Thank you.

Dan Wilkewitz

December 21, 2009 at 2:11 pm

Couple of areas I am working through and would appreciate input on:

1) Practical difference between real estate agents and mortgage brokers in RESPA

What I am confused about is the difference between the real estate license law and the mortgage broker license law. Both categories of activity are regulated by DORA and also RESPA (for residential deals). But there seems to be a stark difference that I cannot find actual, literal regulation to support the difference on.

Licensed real estate agents share in commission on a regular basis. This is not frowned upon, nor prosecuted, even though one agent may do a disproportionate amount of work on a deal. If real estate broker A refers a client to real estate broker B, Broker A can be compensated at whatever level the two agents have agreed upon. They can work for different brokerages and might even be from different states. Sometimes the referring agent does no more than make a phone call to refer the client, though usually there is some measure of follow up and involvement.

I am completely aware of (and compliant to) that if a mortgage broker were to pay a referral fee to a real estate agent that this would violate section 8. Likewise, a title company cannot compensate real estate agents or mortgage brokers for referrals. These have been prosecuted vigorously by HUD. This seems to center around the cross-category payment of referral fees.

What I am unclear on is why real estate agents can make and take referrals within their own profession with no concern, while mortgage brokers, similarly licensed and regulated, are apparently not able to do so?

2) Difference between simple referral (“unearned fees”) and sharing the workload of services

Section 8 is specific in its distinction between simple referrals and payment for services actually performed. I understand that the focus is on unearned fees. But what if two licensed mortgage brokers each accomplished sufficient items on HUD’s list of services to qualify to earn commission? What specific violation would occur if neither broker was receiving a referral fee, but rather being compensated for actual work performed in originating and competing the transaction on behalf of a client?

Thanks for any information you can provide on the two items above.

Mariana Wagner

December 22, 2009 at 9:25 pm

Jim and Dan – Thank you for your comments. If I were you, I would check out this site: https://www.hud.gov/offices/hsg/ramh/res/respamor.cfm and contact a HUD official who can answer your questions better than I could.

Christopher Rodriguez

October 20, 2010 at 6:51 pm

It is perfectly legal for an unlicensed friend or family member to receive a “finder’s fee” for referring real estate clients to you and being paid through or after the closing from your real estate commissions. Using the term Referral fee is incorrect as this is the term used when a licensed broker refers/pays to a licensed broker. Paying a finders fee from real estate commissions earned in no way violates section 8 of RESPA

mariana

October 20, 2010 at 7:13 pm

Please share where you are getting this information. Thank you.

Katherine

September 5, 2011 at 10:25 am

For whatever reason, this blog post is making the rounds again nearly 2 years later! Great discussion.

My question is this. As I read RESPA, I understand it means no items of value to un-licensed people for REFERRALS. What about a closing gift for your own client? Is giving your first time home buyer a Lowe's gift card so they can buy paint a RESPA violation? Apparently that's what someone in my office is interpreting as an issue.

What's your take on gifts to actual clients, not the person who referred them?