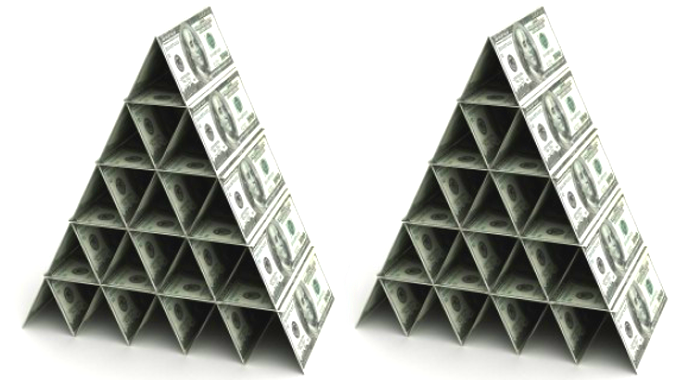

In yet another example of fraud committed by millionaire miracle workers, NPR reports Johanna M. Garcia, founder of MJ Capital Funding LLC in Fort Lauderdale, Florida, has been accused by federal prosecutors of scamming millions from investors in a Ponzi scheme.

Garcia connected investors with companies that needed short-term financing, promising miraculous returns on their money.

Investors like Pavel Ruiz, who the Securities and Exchange Commission and Justice Department accuse of getting $6.5 million of the $42 million defrauded by Garcia and MJ Capital. Ruiz has been charged with conspiracy to commit wire fraud.

The federal investigation shows Garcia took money from 15,400 investors from June 2020 to August 2021.

MJ Capital’s archived site states Garcia started as a community tax prep helper. Then she realized her clients needed help in other areas including immigration, finding service help, and funding general contractors to start projects. What a perfect Ponzi scheme storm.

“Johanna began to collect a portion of the dividends for directing her clients in the right path, but she never did it with the intention to profit financially,” the company site stated. “She did it with the intention of helping her community.”

Garcia established MJ Capital to provide loans to small businesses through “Merchant Cash Advances,” known as MCAs.

The Securities & Exchange Commission says MJ Capital sent millions of dollars to company insiders – insiders like Ruiz – and used the new investments to show huge fake returns, up to 120%.

“But only a small fraction of investor funds were used to make MCAs,” the SEC filing against Ruiz said. Instead, most of the investor funds were used to pay fictitious returns to existing investors, undisclosed commissions to sales agents who promoted investments in the MJ Companies, and personal expenses for insiders of the MJ Companies, including Ruiz.

As such, investors’ ability to receive the promised returns and repayment of principal was dependent on a rising stream of funds from new investors, and by convincing existing investors to renew their existing investments, thus deferring the MJ Companies’ need to repay investors their principal investment.”

The Miami Herald reports The SEC has reached partial settlements with Ruiz and Garcia regarding the Ponzi scheme.

Market Watch says Garcia, who was initially sued by the SEC last year, has partially settled the case, agreeing to turn over assets for auction. She has not been charged criminally.

Ruiz Hernandez faces up to 20 years in prison if convicted of wire fraud charges. He was released last week on a $250,000 bond.

And yet again, regular investors looking to earn a quick return on investment find themselves victims of fraud, proving once again that if it seems like a miracle where money is concerned, it’s probably not.

Mary Beth Lee retired from teaching in Texas this year after 28 years as a student media adviser. She spends her time these days reading, writing, fighting for public education and enjoying the empty nester life in Downtown Fort Worth.