CFPB was supposed to change the world

In 2011, the Consumer Finance Protection Bureau (CFPB) was formed and in the agency’s earliest days, they set out to change housing, hoping that every step of the home buying process is more clear, particularly through the forms being used, because many have pointed out that the lending process can be pretty confusing for the average buyer.

The “Know Before You Owe” forms will be required by August 1, 2015, so the industry has just short of two years to implement the new disclosure forms.

So, the agency created a symposium filled with experts on behavioral economics, linguistics, public policy, and graphic design that came together to focus on redesigning the often overlooked mortgage disclosure form (MDF) in order to better communicate lending terms in a universal way. During the symposium, they agreed that the form needed to speak in layman’s terms and pare it down to data that matters most. The stated goal was literally to bubble-proof the nation by making the process clear at every step.

Here is how it went down. After the symposium, the agency worked for over two years to revamp the form so that it would go from this…

…to this:

Looks good, right?

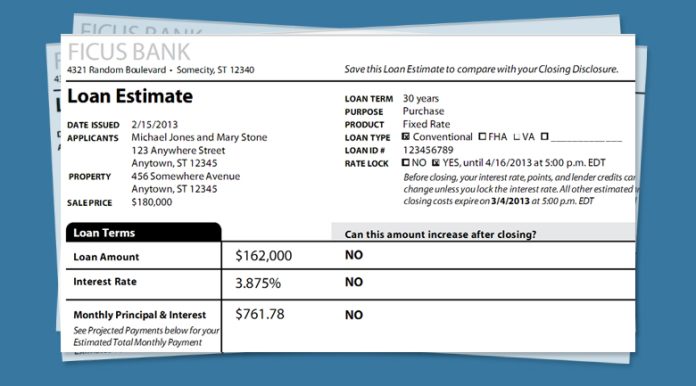

Unfortunately, that modern form above was simply one of the submissions from Continuum Innovation Design, just one of the firms invited to submit redesigns. It wasn’t the final option chosen, this was:

and this:

What happened?

We never expected forms to start looking like infographics, but the changes could have offered a more aesthetic answer to the complex. Are the forms better than they were? Of course! The yes/no system is phenomenal, tiny fonts have been eliminated, and it is organized better. But, it falls very short of what was floating around in 2011 as possible design options, and with the youth of the organization, we were somewhat surprised that the final version was only slightly better aesthetically.

Aesthetics aside, the National Association of Realtors (NAR) praised the new forms, challenges remain. The agency is pushing for more electronic closings, but the new forms come with new rules, for example, the rule that the final Closing Disclosure form (the new HUD-1) must be provided to the borrower within three business days of the closing. Any real estate professional can tell you, however, that most closings have last minute changes, so requiring a final form be given three days before a closing could begin pushing closings back and delaying the process.

At this point, it matters not that the aesthetics fell short of expectations, the next 20 months before the forms are required to be implemented should include continued examination of the CFPB’s rules associated with the forms so there are no unintended consequences.