First time for everything

In their August Mid-Cities Report, Altos Research notes that this is the first time low interest rates, high unemployment and high housing inventory have occurred simultaneously and echoes many analysts’ sentiment that “volatility is the norm and the rules of yesterday’s market no longer apply.”

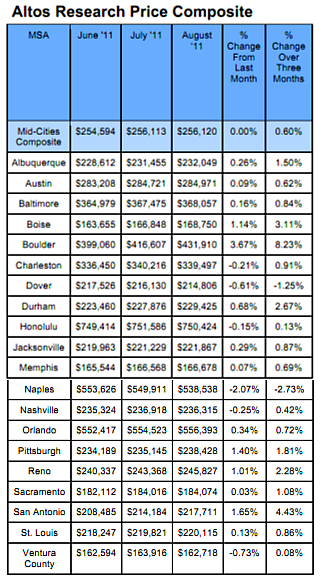

The Altos Research Mid-Cities Report for August analyses real estate market trends for mid-sized US markets “not commonly reported in the media,” noting that in 70 percent of markets studied, home prices increased while inventory levels increased in 60 percent of the markets.

“A long, cold winter” for housing

Noting the slowing pace of the market in recent weeks, Altos Research reports that the “summer price bump is over” and prices as well as inventory are declining in performance. Further they note that “the next few weeks will set the stage for a long, cold winter” given that “there’s nothing on the immediate horizon with employment or the economy that suggests a spike in fall or winter housing market activity.”

When asked if their analysis yielded any surprises, Altos Research Marketing Director Jon Sterling said, “The only thing I would classify is a “surprise” is the consistency of the seasonality in housing. Year after year, regardless of what the economy is doing, we see certain patterns that stay constant.”

Eight takeaway statistics

According to Altos Research, the key points in the report are:

- The median price was $256,120 in July, up $7 from $256,113 in June.

- The leaders in the three-month price increases are Boulder (8.23%), San Antonio (4.43%), and Boise (3.11%).

- Only two markets had decreasing prices over three months. Naples (-2.73%) and Dover (-1.25%).

- Boulder had the largest one-month increase in median price, with a 3.67% increase.

- The largest one-month increase in inventory was Boulder, with a 3.26% increase.

- The largest one-month decrease in inventory was Naples, with a 5.32% decrease. Naples also had the largest three-month decrease in inventory (-10.95%).

- Eight of the 20 markets reported a decrease in inventory and six of the 20 markets reported a decrease in median prices.

- The 7-day numbers have been declining and 90-day averages in the mid-cities composite are flattening for median prices and inventory. The 7-day trends are always the first indication of a shifting market and should be watched closely.

The 20 cities analyzed:

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.