The amount of FHA loans has skyrocketed in the last few months, primarily because they require lower down payments than conventional loans. I’ve mentioned that this increase is possibly due to the fact that lenders can bypass the HVCC, thus still influencing directly contacting the appraiser.

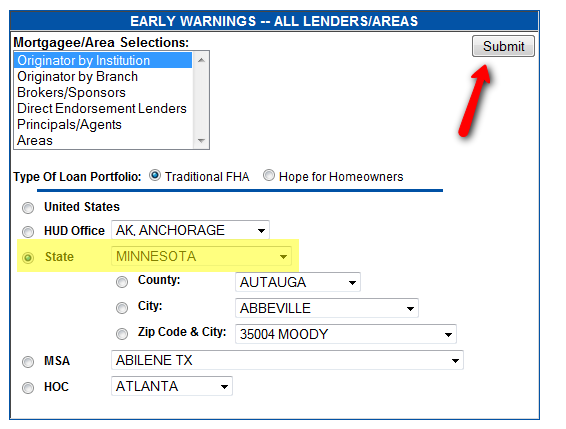

HUD now has a list of FHA lenders with high default rates in every state. Just head over to the early warning system website and start by choosing your state

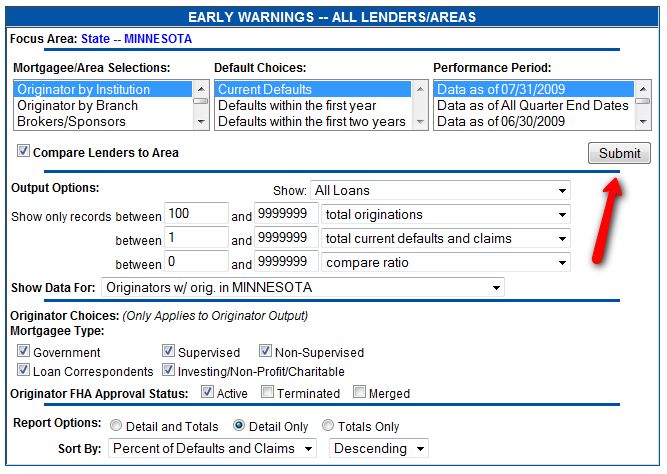

Then narrow down the options even further or just simply click ‘submit’ to see the results.

The highlighted ‘compare ratio’ field shows the largest discrepancies between the lender’s default and claim percentage and the default and claim percentage for the state.

I like to keep track of my clients. Did any lenders you work with make the list?

As the son of two music teachers, Ben spent his first 21 years trying to make a living with his slightly above average trumpet playing. After no return calls from Dizzy Gillespie and then a failed attempt at becoming a fly girl on "In Living Color," he switched gears and finally found his nichè in real estate. He's a Minnesota appraiser and also a Realtor with his better half, Stacia. Labeled “one to watch” from an anonymous source (thanks mom), Ben is smart, good looking, athletic and a rock star inside his own head. He also never passes up a chance to write his own bio. Find him online at twitter or selling Stillwater Real Estate.

Missy Caulk

September 11, 2009 at 7:35 am

Wow, interesting site there. Bookmarked to refer back to. Not surprising who was up there in high default rates for my county.

Matthew Rathbun

September 14, 2009 at 12:14 am

Hey, great find! Thanks for sharing…

Tony Mitidiero

October 9, 2009 at 10:01 pm

FHA default rates have always been considerably higher than conforming debt. The government products just plain have more lenient qualifying criteria (often times what they will let slide, at least in terms of doc’ing a file, would make a sub-prime underwriter of a couple years ago head spin). When things were booming, I remember hearing that Wells was running around 10% default on FHA debt. At that same time, if you wanted to run your mortgage banking firm to the max, you’d aim for about a 3% default rate on conforming products. That’s a HUGE difference when you’re originating any type of volume whatsoever. Some banks were a little higher than that, some of the more conservative ones were a little less (I was at one that was averaging around 1%).

You would have to expect for the default rate to go up today considering that default rates have gone up on all credit.

I do find it kind of funny that a lot of people have talked about how ridiculous some of ‘those crazy sub-prime loans’ were, but you never hear anybody mentioning ‘how crazy the FHA products are.’??? And NOBODY talks about how crazy the c.r.a. products were.

I think the fact that government product is really the only product for high LTV today (and that’s the one in most demand) will cause the FHA to develop some real legitimate qualifying criteria like the rest of the lending world had (i.e. real matrix, credit scores, rate premiums, etc.). We’ve already seen some of it with the use of credit scores. They have to, otherwise default will continue to rise. They will eventually realize that there are reasons why banks have criteria and that there is actually some actuary somewhere crunching enough figures to know where they need to be. They’ll get it together.