Hitting lower lows

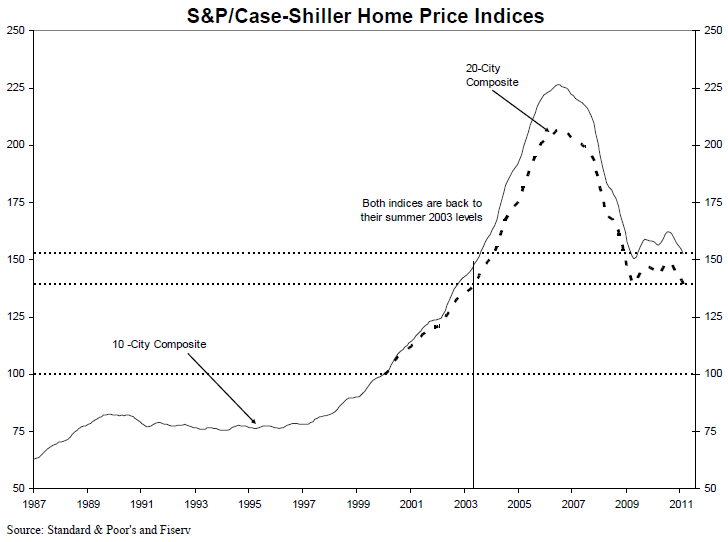

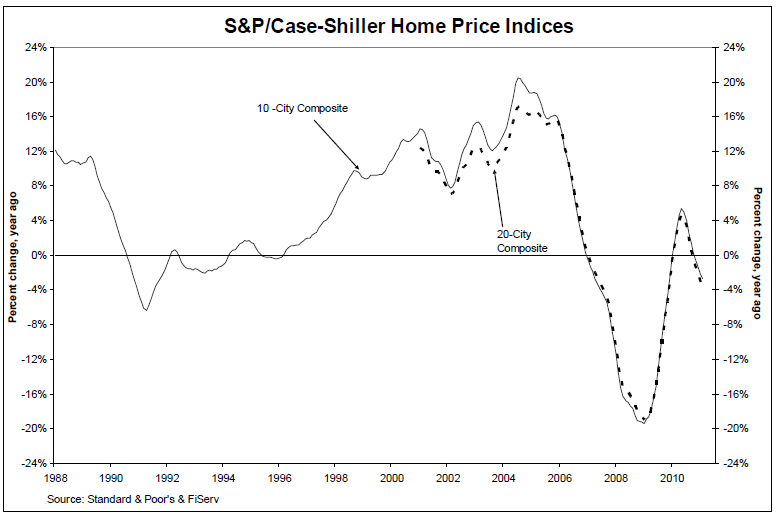

The S&P/Case-Shiller data for February is showing the American home price index is back to the low reached in April 2009, the lowest point since 2003. The S&P dropped 3.3% with 19 of 20 cities studied experiencing declines. Overall, this is the seventh month in a row of dipping home prices according to Case-Shiller.

Washington DC remains the lone city on the rise in home prices, up 2.7% from the previous year while Phoenix homes are now at low levels not seen since 2000. Last month, we reported that San Diego prices were slowly rising alongside Washington DC’s, but months after the continuing trend, DC is alone in rising prices.

Economists are no longer speculating a possible double dip, rather noting the double dip is here and asking if we’ll hit lower lows or bounce back up. Most are leaning toward a continued decline, given 2011 trends.

Charting the double dip:

Tell us what you’re seeing in your city- are prices in a double dip scenario where you are?

The American Genius is news, insights, tools, and inspiration for business owners and professionals. AG condenses information on technology, business, social media, startups, economics and more, so you don’t have to.

Ken Brand

April 27, 2011 at 4:09 pm

I've decided that from now on, I am of the opinion that there is no such thing as a National Housing Market or American Home Price Index! The idea is a marketing fabrication for the news media complex.

It makes for interesting conversation, but in fact, all real estate markets are hyper-micro-markets. This is the same reason we don't have a National or American Weather Forecast for everyone. Depending on where YOU live the market and the weather can be better or worse than the National Average. They should change the name to "Sensationalism In Some Cities Housing Report".

Lot's of things are getting under my skin these days, I think it's my age. Never the less.