How has the dream of homeownership changed?

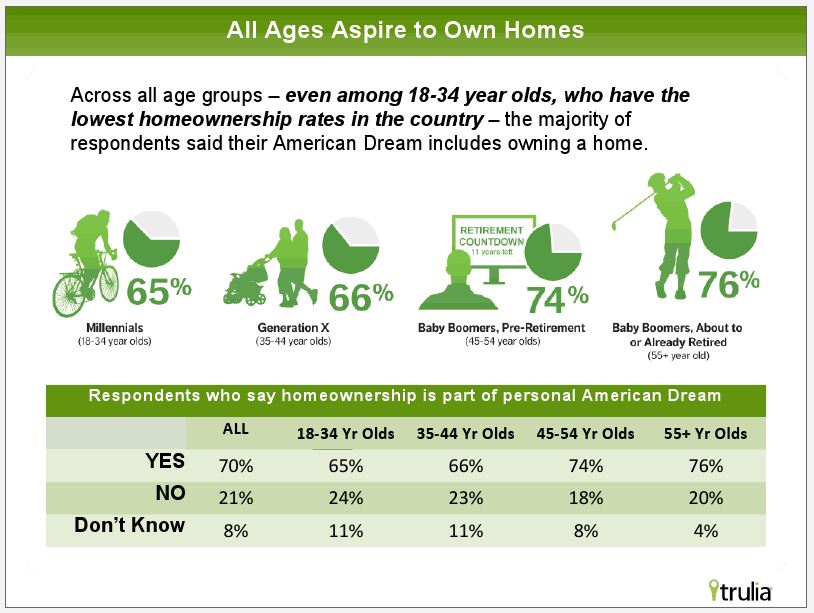

As threats of a second recession loom, housing remains a critical wound to the economy and political rhetoric heats up leading up to an election year, real estate practitioners are feeling the heat. Do Americans even care about owning a home any more? According to a Trulia.com study, 70 percent still say that homeownership is still central to their American dream which is unchanged from January despite declining economic conditions.

The dream of homeownership has changed, however, as demand for McMansion sized homes over 3,200 feet has declined 36.5 percent in just the last twelve months. Trulia cites a variety of reasons from environmental awareness, practicality and even the political discussion surrounding removal of the mortgage interest deduction (MID). If the MID is no longer offered to homeowners, it could reduce demand on larger homes which Trulia’s newly appointed Chief Economist, Dr. Jed Kolko said “could be a permanent shift.”

Although Americans still want a home, the dream of mansion living is being removed from the national ethos and being replaced by the idea of more compact, city living and as demand shifts from oversized suburban homes, suburbs won’t end up abandoned, rather, the absorption rate will take longer to recover than urban areas, according to Trulia.

Good news, bad news

The good news highlighted by the study is that there is long term demand for housing as the dream of homeownership is still alive. For example, 59 percent of current renters say they aspire to own and over two thirds of respondents over the age of 55 say they still plan on buying a second home.

The largest obstacle to those wishing to by is saving up for a down payment, according to half of everyone surveyed. This presents a problem on Capitol Hill as Congress has proposed requiring all home buyers to put 20% down. Furthermore, nearly one in three respondents cite job instability as a barrier to their owning a home, pointing out the toll unemployment has taken on housing. Independent of income, 36 percent feared they would not qualify for a mortgage.

Based on current data, Kolko told AGBeat that he expects to see the number of Americans aspiring to own a home to stay flat or increase in the next twelve months, noting there is pent up demand in the youngest demographic, many of whom are not living alone, but with parents which has held back demand and lowered expectations, therefore, demand has been deferred to the future.

The takeaway

Americans still want to own homes, but the dream is that of a smaller footprint, more urban living, and finances are the top obstacle that buyers perceive to be standing in their way. People over 55 still plan on buying a second home, and there is pent up demand with Americans under 34 who do not yet live alone. Housing may be limping, but the future looks hopeful based on the perception consumers have about homeownership- the dream is not dead, it’s just a different dream.

Click to enlarge any of the images below:

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

Devery Rielly

September 21, 2011 at 12:35 pm

I just never understand why everyone keeps referring to the "Proposed" 20% downpayment? CAN WE PLEASE TALK ABOUT RIGHT NOW??? There are plenty of loan programs that require a very small downpayment (3.5%)to none at all. They are great programs – GREAT! PLEASE PLEASE PLEASE Tell people about HomePath, tell people about VA, tell people about USDA, tell people about FHA. Quit trying to keep people out of the market by scaring them, misleading them and not truly helping them. I would love for a day to go by where I don't have to "dispell" the myths about home ownership that are out there and perpetuated by so called experts in our industry.