Offers of Success

My inbox is full of offers for education about ways to make more money as a real estate agent. Apparently, when the chips are down and the market slows, everyone becomes an expert or a coach, promising “their” previous experience will surely lead to my ultimate success. I only have one question – what are they doing in today’s market? If their program is so vitally important to my success, why aren’t they out using it for their success?

You know the offers I am talking about; it is not my intent to discredit any training or coaching program. There are many great education and coaching opportunities available which truly are a benefit. I am personally involved in coaching programs.

In the past I have signed up for more info, using my “junk” email account to listen to the ideas and success stories and usually find out what is being sold is the agent who signs up for such programs. It’s amazing the insight you can gain anonymously.

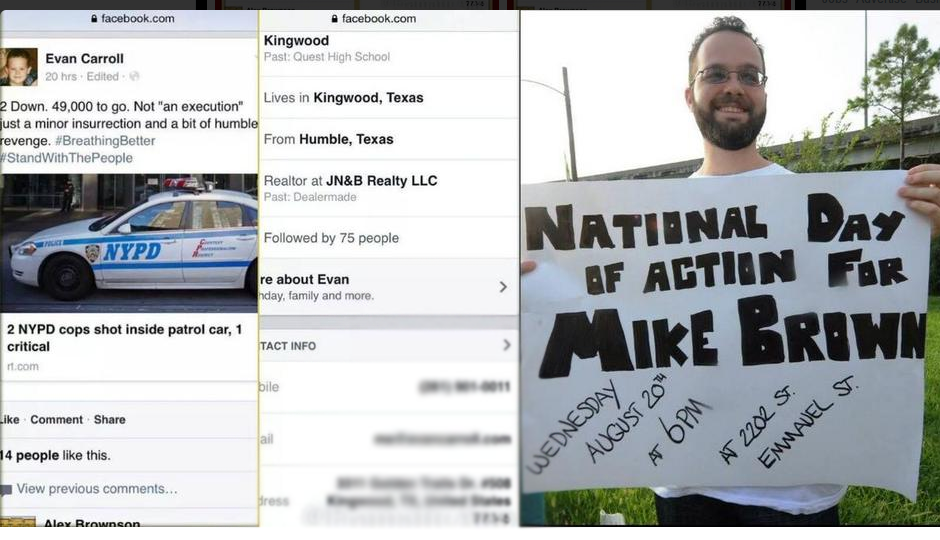

Know the Law

The newest pitch for REALTORS® is doing Loan Modifications. You know you can make as much as $3500.00 doing loan modifications? Per loan! It doesn’t matter if you succeed; you get paid up front, so says some of the ads. Hold on a minute! Did you also know it is illegal in some states to be paid upfront? In some states, you have to have additional licensing to modify loans.

I’m not here to be anyone’s moral compass or ethical guide. You either have it or you don’t! I do have a question, though, why would I throw up a website as a “loan modification” expert, unless I had experience actually helping people get their loans modified. There is probably a legitimate way of helping homeowners who don’t know how to begin the process, but why do these companies who offer training on loan modifications choose REALTORS®?

Jack of all Trades

The message I get from some of the programs offered is, we are desperate to do anything for money and I abhor that message. This is a tough market, no doubt. I just don’t believe we are to be experts in everything. It reminds me of the saying, “Jack of all trades, master of none”.

I would love to hear your thoughts.

Paula is team leader for The "Home to Indy" Team in Indianapolis . She is passionate about education and client care and believes an empowered client is better prepared to make good decisions for themselves. You'll find her online at Agent Genius,Twitter and sharing her insights about her local real estate market at Home To Indy.

Danilo Bogdanovic

January 22, 2009 at 12:13 pm

I agree with the phrase “Jack of all trades, master of none”. One can’t be an “expert” in a lot of things because, to be an expert, you have to fully dive into the subject and practice and be involved in it all the time.

It’s impossible to do that in multiple areas – there are only 24 hours in a day and you have to sleep and do non-work related stuff as well.

Know what you know and know what you don’t know. Leave what you don’t know to the real experts even if it means referring it out or paying them to do it for you.

Elaine Reese

January 22, 2009 at 1:58 pm

Regarding the credibility of some of the training experts, there was a couple here that had both their licenses revoked. They are now in another state giving training seminars on being a “successful” agent.

Caveat emptor! 🙂

Mark Eckenrode

January 22, 2009 at 6:13 pm

sort of along the lines Elaine mentioned, one way to gauge “expert” status is by credentials.

now, one place you’ll find a gob of “experts” is on Twitter and social media sites. oi! there are so many folks with “social media expert/guru” there it begs the question… by whose/what standards?

Vicki Moore

January 22, 2009 at 7:53 pm

I guess they figure if they get one sucker who pays a hundred bucks for their junk they’re further ahead than they were when they started.

Ken Brand

January 22, 2009 at 9:26 pm

Hugh MacLeod of GapingVoid.com fame sez, “The market for hope is infinite.” In markets such as today’s, there are well and ill intentioned people who are desperate for hope. A way to make it and make it fast. It’s sad for all involved, the trainer, the trainee and the client/victim/customer.

Like you, Im in this tribe; stick to what you do best, burn your boats, make a stand, dig in, fight, scratch, work, work, work, push, pull, attract, serve, help, aid, abet, support, learn, share, create, promote, etc.

Cheers.

Darren Kittleson

January 23, 2009 at 10:10 am

Great post! It saddens me to see agents put so much energy in some of these newfound ways to “make money”. I often think if they’d put that much energy in simply touching their database, reconnecting with past clients/customer or friends they’d find that money will follow.

I haven’t seen it yet, but I’m sure the “residual income” dialogue will start again with hooks for agents to start selling other products vs. simply focusing on their core compentencies…being great in a real estate transaction.

Missy Caulk

January 24, 2009 at 9:22 pm

I see it too Paula, so many in my junk mail folder it is overwhelming. delete

I am finally jumping into short sales because it is the going to be this way for awhile.

Paula Henry

January 24, 2009 at 9:38 pm

Danilo – You just can’t be a master of all things! Even if you don’t have a life 🙂

Elaine – You would think the Boards of REALTORS would check someone’s credentials from a previous state. Sad!

Mark – I never even knew what a social media expert was until Twitter came about.

Vicki – Yep, another hundred, another sucker:)

Ken – Everyone wants the “fast” way without paying the dues of education and experience.

Darrell -Focusing on core competencies is what makes us the expert. You are so right about expending the same amount of energy on touching our database.

Missy – I started studying short sales back in ’05, when the Phoenix market started to shift – It was the best education I could have given myself and my clients. Good Luck!

Mack

January 26, 2009 at 1:26 pm

It seems as though the only thing missing from the expert emails is the return address in Nigeria to send the wiring instructions for my checking account.

Paula Henry

January 26, 2009 at 2:37 pm

HI Mack – With most of these, you might as well send the money to Nigeria – you would receive the same value:)