The evolution of broker price opinions

Broker Price Opinions- I spend a good portion of the working week completing quite a few of them, just as many other Realtors do. Even before the passage of the Dodd-Frank Act, BPOs could not be used for new, purchase, government backed loans. What they were used for (and are still used for) is dropping PMI, determining price (please note: price opinion – hence the name BPO, not value, appraisers determine value, as real estate agents determine price) for REO listings, short sales, refinance mortgages, bankruptcy, note sales, divorces, relos, sheriff or auction sales, for insurance companies, loan modifications, and even for estates.

While the forms will vary based on the company, a BPO usually contains information on a subject, the very local sub-market, as well as listing and sales comparables. Whether due to pressure from those in government or throughout different aspects of the real estate and banking industry, BPOs are becoming less than a highly detailed CMA and more an appraisal-esque report. Companies are also requiring more education, higher E&O insurance, if not outright asking to be added onto the policy itself, and lowering contracted fees as well.

Certification alphabet soup

Whacked out changes have occurred across the board from a number of different banks, and outsourcing companies in the last few years, none of them really seem to mesh with one another, or make a ton of sense other than maybe the education thing. Preferential assignment of BPOs may not be the preferred terminology to use, however there has been a push to attain additional education, actually, certification from any number of groups, be it NAR’s newly introduced BPO Certification, the certification offered by The National Association of Broker Price Opinion Professionals, online courses offered by other loss mitigation companies, or continuing ed classes from anyone else out there.

On at least a few instances, there have been requests to up E&O policies from a million bucks (probably the industry norm) to three million. For BPOs, and even tossing in REOs into the mix, it just isn’t cost effective to raise the limit for some real estate companies; including the fact that more than one agent is working this niche. The expense doesn’t justify the payout.

The new industry bidding war

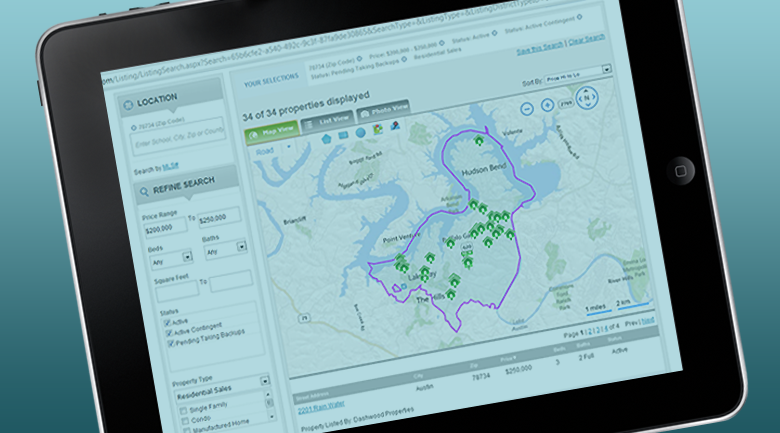

One notable company implemented the requirement of actually being added onto E&O policies a couple of years ago. This same company has recently started a bidding war between Realtors in regards to fees. Instead of an order being broadcast out to Realtors in a given area at say, $50, and the first one to accept, gets it. Now, Realtors can bid down or up in $0.50 increments, lowering their fee by $7.00, or raising it by a whopping $2.00 from the base price. There’s nothing like whoring oneself out in the name of getting business, right? Not when many of these companies are tightening their search parameters – try finding comps for a somewhat normal house, let alone an obscure one, within a third of a mile when it’s an urban area, on mile when suburban, or three miles in a rural area… seriously.

Additionally, some companies now require driving by all comps and original comp photos to boot. Another company wants Realtors to upload a copy of tax records as part of the order. Let’s not forget my favorite new requirement of all- a complete sales history not only of the subject, but of all the comparables to boot. We also enjoy the companies who charge us for using whatever jacked up flavor of the month online platform they are so inclined to use, none of which are exactly user friendly. The fees go from one to two percent to a flat fee of $5 or $10… per ORDER.

BPOs & appraisals- speaking up for the industry

Allow me one brief second to speak both for the masses, and to quote myself, dude, if I wanted to do appraisals, I would have gotten a freaking appraisal license. In some messed up way, many of these things are knee-jerk reactions to an equally messed up housing industry, and yeah probably some (albeit relatively few) scheming, shmuck, agent-types were out there falsifying or influencing BPOs. Newsflash- this is why we have real estate licensing laws and means of punishment for not following them. The sins of the father should not be revisited upon the son.

Katie Cosner, occasionally known as Kathleen, or KT, is a Realtor® with Cutler Real Estate and is active in her local Board of Realtors® on the Equal Opportunity & Professional Development Committee. She has been floating around online for a number of years, and is on facebook as well as twitter. While Katie has a few hardcore beliefs, three in the Real Estate World to live and die by are; education, ethics, and the law - insert random quote from “A Few Good Men” here. Katie is also an avid Cleveland Indians fan, which really explains quite a bit of her… quirks.

CJ

September 26, 2011 at 8:46 am

Could not agree with you more. One thing you did not mention is the manipulation of the BPO's by some vendors. They will tell you which comps you can use and which comps you can not use, make you adjust brackets and final evaluations, and even reject a comp that is right next door for another in a completely different neighborhood. What ever happened to location, location, location? What I have also found in doing over 100 BPO's a month is that some pay in a timely fashion but others take upwards of 60 days and are living on Broker/Agent floats. They get paid in 2 weeks and get $150 for the BPO you are providing for $35. One company recently went out of business owing BPO providers hundreds of thousands of dollars. I have been doing BPO's for over 20 years and with all these recent new developments I will probably fall by the wayside and let the hungry newbies who are desperate to work for $5 an hour take my place. Even Mickey D's and Wally World pay benefits for minimum wage. Guess what the quality of this new BPO product will be worth? That's right you ALWAYS get what you pay for and a BPO will be worthless at the rate this is going.

Jonathan Benya

September 27, 2011 at 5:03 pm

I think BPO's are already pretty worthless. I hate having to fight valuations on short sales because a BPO agent did a shoddy job, but it seems to happen all the time. You're right about the payment problems, too. I don't even know how much I have outstanding on BPO's owed to me right now, I just gave up on doing them completely.

Kathleen Cosner

September 27, 2011 at 5:08 am

Hey CJ-

I have had a company suggest what they thought was a more appropriate comp that they found on Zillow or someplace, if I had to go out of normal search parameters. Once it was explained why their comp was not good, they backed down, but have not seen this lately at all.