What will the Fed do about unemployment?

It’s clear the U.S. unemployment rate is top of mind for the Fed with their most recent announcement – as long as the unemployment rate remains above 6.5 percent, it will continue to curb interest rates. The Federal Reserve plans to continue its monthly purchase of mortgage-backed securities and bonds, which it first started back in September, in the hopes that it will stimulate the jobs market.

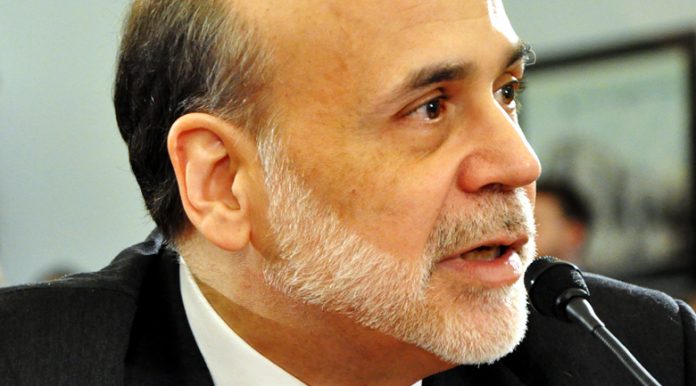

Those opposed to the plan say this aggressive buying could negatively affect inflation rates. However Fed chairman, Ben Bernanke, says such a high unemployment rate is a “waste of human and economic potential.”

Fed purchasing $85 billion securities

The Fed is currently purchasing $85 billion in Treasury and mortgage securities, but even with these efforts, they estimate the unemployment rate likely won’t drop below 6.5 percent until 2015. The last time the rate was that low was September of 2008, showing the goal will be hard-fought one to achieve, requiring patience from those on all sides.

“If we could wave a magic wand and get unemployment down to 5 percent tomorrow, obviously we would do that,” said Bernanke. “But there are constraints in terms of the dynamics of the economy, in terms of the power of these tools and in terms that we do need to take into account other costs and risks that might be associated with a large expansion of our balance sheet.”

The Fed’s track record

History shows the Fed’s usual top priority is U.S. inflation rates, with minimizing unemployment rates falling second in command. However with inflation rates holding steady and projected to remain at or below 2 percent through 2015, the Federal Reserve can shift their efforts to decreasing unemployment rates.

In fact, the Federal Open Market Committee says it will continue to place the lion’s share of its focus on the unemployment rate unless the medium-term outlook for inflation rises above 2.5 percent.

The process is certainly a balancing act, as insufficient attention to either of these areas can result in dangerous increases. But analysts show a target unemployment rate of 6.5 percent is just enough to get the economy moving back in the right direction without causing inflation rates to spike.