Ka-ching

As an entrepreneur or freelancer, it’s a balancing act to keep track of everything you’ve got going on, especially when the fuel that keeps the lights on (your cash flow, baby) is the most complicated of all.

![]()

The time it takes to sit down and jot out your budget goals, check over your bank statement and takeinto account your pending transactions, stay on top of who is invoicing when and the amount (on top of your own invoices, and in what amount), plus rent and living expenses – all of this can result in more than a few dropped balls.

Cleo’s got your back

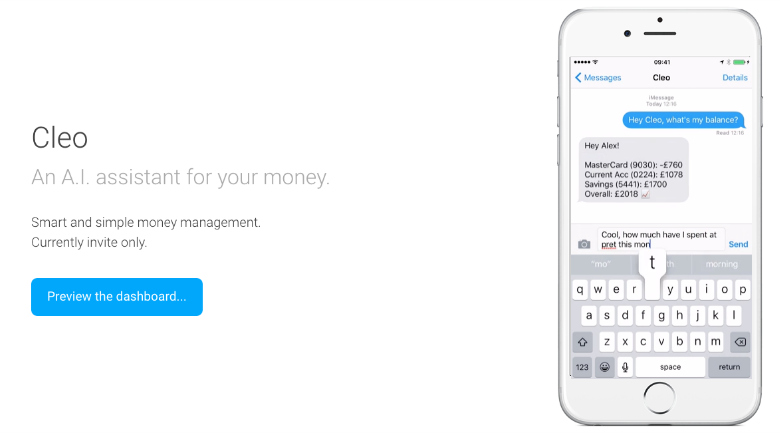

Cleo seems to do a good job of taking that heard-earned money of yours and letting you know not only how much you are spending, but on what, and maybe more importantly – how much money you have left until the next payday.

This AI assistant for your money is a smart and simple way to manage your finances.

Yeah, but how does it operate?

According to TrendHunter, “the startup Cleo uses artificial intelligence to handle sensitive monetary matters. The mobile platform was developed by a technical team with experience in machine learning and academic authorities.”

Using the app, you can ask Cleo for your balance in various accounts, spending patterns, budget tracking and bill reminders.

You can get a good idea of how Cleo breaks down your spending here.

Bonus features

Although a startup, Cleo has been set up for a number of tasks, but mostly administrative ones. This includes scheduling meetings, responding to emails and other basic activities. This instance of using artificially intelligent technology in personal finance goes above and beyond, with much potential in the future.

Currently Cleo is only available by invite only.

#Cleo

Nearly three decades living and working all over the world as a radio and television broadcast journalist in the United States Air Force, Staff Writer, Gary Picariello is now retired from the military and is focused on his writing career.