FOMC statement offers good and bad news

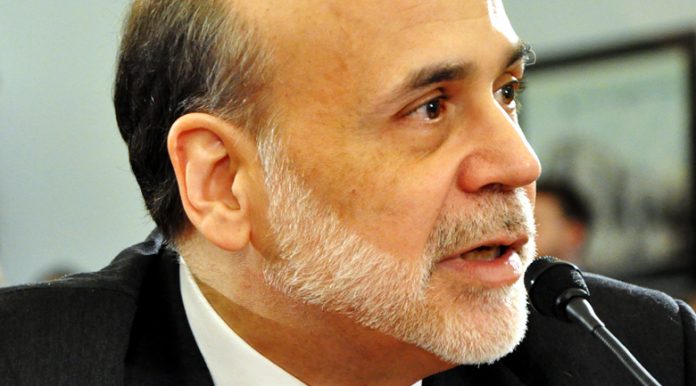

Bonds are selling off after Ben Bernanke’s Federal Open Market Committee June statement yesterday. Following the announcement, the 10-year Treasury note had a yield of 2.31 percent, which is 10 basis points higher than it was just prior to the statement release. Bernanke also stated that unemployment rates have moderately improved, and that the Fed’s purchase of securities could begin to taper off as soon as the end of 2013 and by mid-2014 if improvement continues.

In its June statement, the Fed did lower its estimate for economic for GDP growth in 2013, but increased its projection for 2014. Officials also project that unemployment rates will drop at rates faster than previously estimated for 2013-2015, and should hover at a rate of 5.7 to 6.4 percent by 2015. Ideally, Bernanke would like to see the unemployment rate below 6.5 percent before the Fed dials back on its purchase of bonds and securities.

Fed to continue securities spending

Inflation rates are currently running below the Fed’s estimation of two percent, and these rates are expected to continue to run at or below this estimation ‘over the medium term.’ In order to ensure that inflation rates remain stable and to encourage greater economic growth, the FOMC will continue purchasing $40 billion mortgage-backed securities and $45 billion Treasury securities per month. These purchasing decisions should lead to lower long-term interest rates and better support mortgage markets. The FOMC notes that the housing sector “has strengthened further, but fiscal policy is restraining economic growth.”

While the Fed will continue its securities spending, the FOMC’s statement that securities spending could be tapered off as soon as the end of this year if positive trends continue is key. If the economy improves, interest rates will gradually rise, which will impact investors, homebuyers, businesses and many others. The June statement provides an estimated target date for when these changes could start to happen, and if improvements continue, those changes will begin within the next 6-12 months.