Be sure you’re paying the right price for electronics

It can be tough and expensive to own and run a small business, especially on a budget. Then, when it comes to purchasing worthwhile and useful gadgets or technology that can take your business to the next level—laptops, high-end cameras, smartphones, or printers or scanners—it can put added stress on your already thin budget.

Without extensively researching each new gadget or piece of technology, it can be quite the gamble to make an expensive purchase. It is challenging to identify when you’ve paid too much for any one item and you may find yourself wondering if it was worth the price. But now you can ask the experts, Retrevo, what you should pay for any electronic item. And all it takes is a simple tweet.

Send a tweet, get a price recommendation immediately

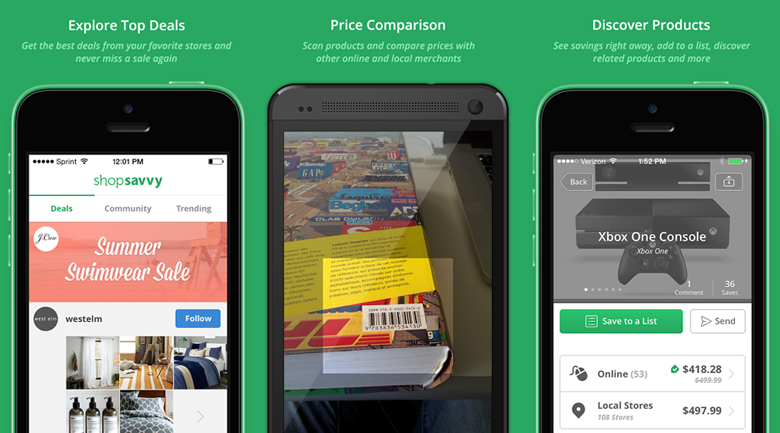

Just send a tweet to @RetrevoQ indicating the brand name and model number and they’ll respond with a recommended price range and a fair price, so you can identify if you’re actually getting a good deal or if you need to take your business elsewhere. You also have the option to send a direct message to Retrevo with the same information and get a private DM back. Alternatively, you can visit the Retrevo website with more detailed information as depicted above.

This information will give you a great knowledge base when you are browsing, comparing, and preparing to purchase. It gives you a little more power when making a deal for electronics, as you’ll know the price range a product is worth.

As a small business pro, it’s important to cut back where you can so you can allocate that money to important parts of your business, like marketing efforts or hiring an employee or two. Using Retrevo’s service can ultimately save you money and give you the power and control you need while making important purchasing decisions. The best way to take control of your business is to be fully informed on all topics and areas that can and will affect your business. No longer do companies who markup prices on electronics have the upper hand. Retrevo has given the power back to the individual and the small business owner, and that only means more benefits for you.

The American Genius Staff Writer: Charlene Jimenez earned her Master's Degree in Arts and Culture with a Creative Writing concentration from the University of Denver after earning her Bachelor's Degree in English from Brigham Young University in Idaho. Jimenez's column is dedicated to business and technology tips, trends and best practices for entrepreneurs and small business professionals.