Hope for homeowner initiatives is diminishing

There were many issues up for discussion leading into the presidential election last year, through the fiscal cliff talks at the beginning of this year, and now leading into other proposed budget cuts scheduled for the first of March. Calls for a decrease in military spending and the eradication of decreased tax cuts and deductions – specifically those enjoyed by homeowners – were on the tip of everyone’s tongue.

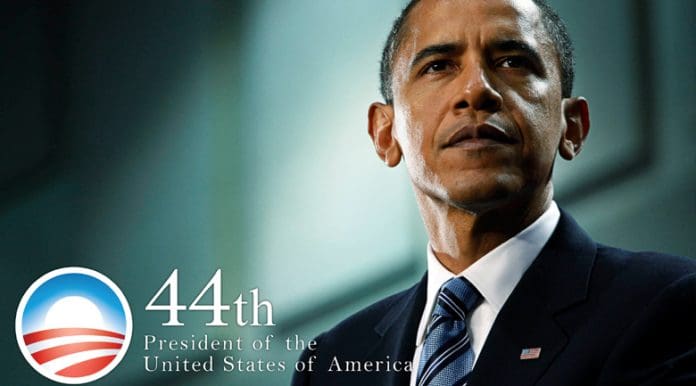

There were high hopes that new housing policies would be put in place to improve the industry, however it doesn’t appear that those initiatives will come to pass. Analysts in Washington doubt the initiatives President Obama has proposed will make it past Congress, which will be frustrating for many homeowners hoping to benefit from the changes that were outlined.

The president currently has the Home Affordable Refinancing Program (HARP) and the Home Affordable Modification Program (HAMP), however the former is only available to homeowners with loans that are backed by the government. Homeowners with negative equity or that received financing through a private lender have restrictions regarding available refinancing options, and are often ineligible for securing lower interest rates.

Politicians butting heads over homeowner initiatives

President Obama has suggested that owners with private loans be allowed to refinance through the Federal Housing Authority, but many are saying this will likely be blocked by Republicans in the House and Senate. The housing authority is already underwater; therefore, representatives don’t think it viable enough to handle mortgage refinancing.

Analysts also find the government’s other proposal to offer refinancing through the Treasury department (HAMP program) problematic as there are currently insufficient funds to cover these costs.

The success of these programs is restrained by the government’s inability to agree on the reduction of principal balances on home owner mortgages. With the momentum slowing down, homeowners may not see any movement on these housing initiatives as quickly as they had hoped.