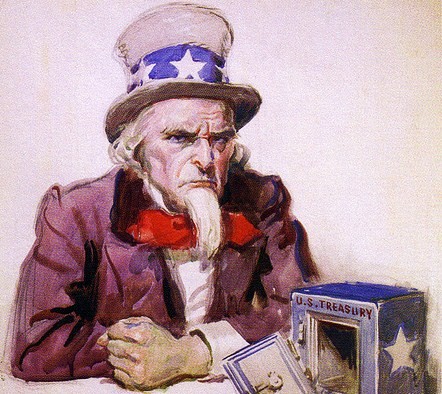

Dear home buyer, sucks to be you:

If you are an agent assisting a buyer with applying for the $8,000 tax credit, you might want to advise them to have all of their tax returns in order and squeaky clean going back a few years because according to The Real Estate Bloggers, the IRS is auditing 100,000 home buyers who applied for the tax credit.

Your client might have to have a panic attack if there is one tiny thing out of order, because as Tom Royce points out, the IRS tax code is over 67,000 pages long making the chances pretty high that a T wasn’t crossed or an I wasn’t dotted properly. But of course, the IRS is saying they’re auditing 100,000 claims of the million applicants due to their being “suspicious.”

What does it all mean?

- Is this a merited reactive measure because of the terrible loan situation and subprime loans the market endured?

- What will the expense be to taxpayers to investigate “suspicious” applicants?

- Why such a drastic measure when the credit was meant to stimulate housing (350,000 closings occurred that otherwise wouldn’t have, according to WSJ.com) yet now that the market is stimulated, the attitude shifts from pro-consumer to anti-consumer?

- Who on capitol hill spearheaded this effort or how was some proverbial whistle blown calling applicants suspicious?

- With the National Association of Realtors lobbying for the credit to be extended, how are agents being educated and prepared to deal with potential results (positive or negative)?

- Do agents that aren’t actively reading blogs or news sources even know this is going on?

- Will the 100,000 applicants raise eyebrows and cause audits for all applicants to the credit?

So what do you think- is this a safeguard to protect the market from the days of no doc loans (or “liar loans” as the media calls them), or is this a political play by the powers that be? On a sidenote, what do YOU think of the $8,000 tax credit?

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

Joe Loomer

October 21, 2009 at 1:41 pm

First of all – what you’re doing on here writing away on your BIRTHDAY I’ll never know – go have a drink with an umbrella in it!

This is scary, I suspect some will turn out to be shady, down-payment reimbursement deals that just didn’t stand the light of day test (closed AFTER getting the credit, for example). Either way, it’s not something I had heard of – thanks for putting the link in – looks like the WSJ had the original story, too…

Navy Chief, Navy Pride

Barb Dragotta

October 21, 2009 at 3:50 pm

Lani, really your birthday–Happy day to you. This IS a Black Hole if ever I saw one; couple this with some of the SS stories out there and it is enough to bring on nightmares or insomnia.

As to 2dragottas’ opinion of the $8,000 credit:

…iffy in the first place [ note the number of lapses in payments already ]

…extending it ?…NO–wait and see How & / or If it actually works before continuing for more months.

Paula Henry

October 21, 2009 at 5:32 pm

I’m really not surprised! I wonder how many first time home buyers know they MUST stay in the home 3 years or they owe the credit back.

On a side note: Only a few of my closings have been first time home buyers, but I believe we may see some backlash from this. If someone bought a home (only) for the tax credit, how many may not be prepared for home ownership.

The first new tax bill at a higher rate, the first baby, the $5000.00 HVAC system goes or any number of things could force a few unprepared home owners to foreclosure, and then they owe the $8000.00 in addition.

Joe Spake

October 21, 2009 at 8:11 pm

Lani, these audits are for cheaters. From the inception of the $8000 credit, it seemed incredibly easy to cheat or game the system, almost as if cheating was encouraged. Closing attorneys were reporting buyers bringing the $8000 to the closing table. How did they pull that off? The IRS did not require tax returns, just a form be filled out. And recipients got their check quicker than any tax refund I have ever received. I think we are seeing the backlash of the government’s not thinking through this program before implementing it. It would be interesting to know how many Realtors, out there rushing buyers to go for the free money, know the rules.

Toby Boyce

October 21, 2009 at 9:55 pm

I agree with Joe that the audits are to catch those that are “cheating” on the game. The number of people looking at this from the IRS’s survey shows that there is going to be a disparengent number of audits for first-time home buyers.

As to the tax credit, my concern is that we leveraged 2010’s first-time home buyers in exchange for a decent 2009 by shoving a majority of those buyers into this year’s selling season.

Betty Byrnes

October 21, 2009 at 10:26 pm

Good points made by all…

One thing that stikes me though is the microscope being applied to those taking advantage of an $8,000 maximum tax credit vs the lack of oversight to the billions of dollars in bail-out money that’s gone to prop up various entities.

Cheats should be caught everywhere – not just on Main Street!

Paul

October 23, 2009 at 2:11 pm

@ Joe – I had no idea people were getting away with that.

Rebecca

November 18, 2009 at 7:55 pm

Well, I have been waiting on my $8000 tax credit for 4 months now. I am not a cheat, and there is nothing at all suspicious with my amended ’08 return, or my 3 prior returns. I received a letter in the mail saying they needed additional documentation so I sent in my settlement paperwork. A month later I get another letter in the mail saying they received my paperwork and may need ADDITIONAL DOCUMENTATION! It will be a year until I see that credit, if I see it at all! And these people want to take over the healthcare system…

Brenda

March 24, 2010 at 1:29 pm

I am one of the lucky people being audited also. I just want to say I have not owned a home and filled a 1040 ez for the past 13years. I mailed my paperwork 6 months ago and had to take out a loan to pay off debt for home repairs that the $8000 was going to be used for. I feel like the person above it will probably be a year before I see my cash if I ever see it. So don’t be so quick to judge somone. Without the $8000 tax credit it would not be possible to pick out a house in my prive range as a single person on one paycheck and pay for repairs. The system was supposed to help people make it easier to be a home buyer not destoy thier credit.