Swinging the pendulum

These past few years have been nothing short of a roller coaster ride and economists still do not agree as to when a recovery will arrive and at what pace. Each leading economic indicator is produced by a different company and is used by different analysts for different reasons.

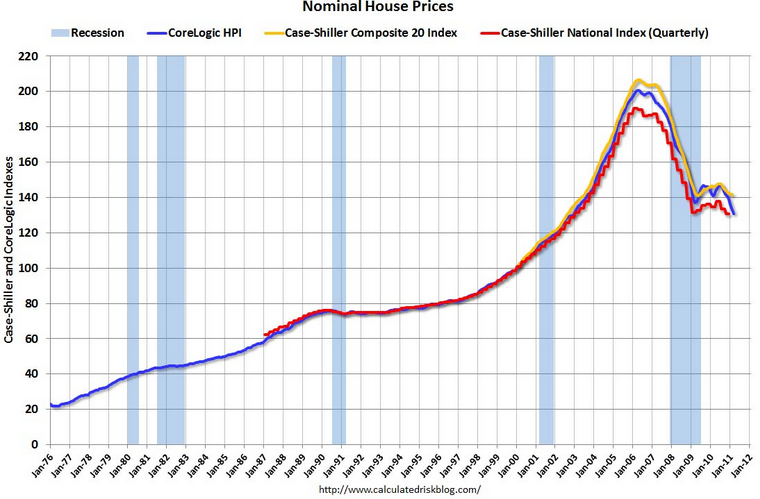

For example, traditional news outlets and national forecasters use the S&P Case-Shiller housing data which studies 20 of the largest American cities as well as the National Association of Realtors’ existing homes data which is also a metro study whereas their home pricing index is a sampling of MLS reports. Trulia and Zillow are also used as secondary indicators and RealtyTrac produces reports on foreclosures and Core Logic data is used by the Federal Reserve Board in its research.

New data today

Today, the National Association of Realtors (NAR) data for the first quarter of this year reveals that existing home sales are up 8.3% from the fourth quarter of 2010 and that sales prices have slid 4.6% compared to the first quarter of 2010[1].

NAR also reports that one in every three home sales in the first quarter were distressed sales with an average price cut of 20%[2]. Cable news anchors are shocked at these stats, but given that nearly half of all American homes are now distressed[3], we are surprised the number of distressed sales isn’t actually higher. In fairness, the number of distressed home sales has risen 36% from the first quarter of 2010[2].

CoreLogic announced today that home prices are down 1.5% and have dropped 4.6% below the lows of 2009[4]. Most likely because of the continued yet moderate pricing slide over the years, Trulia’s research indicates homeownership is currently more advantageous than renting[5].

Speaking of 2009, the most recent Case-Shiller data shows that the S&P dropped 3.3% in February reaching the level of April 2009 and its lowest point since 2003, revealing a double dip in pricing[6].

Bouncing back?

Home values could stand to drop in some areas, but economists will note that a national drop is not exactly an indicator of health. Existing and distressed home sales currently differ from new home sales, however which made a striking bounce last month, rising 11% in sales volume and 3% in median sales pricing[7].

Today, President Obama visited Texas to speak on immigration and Eric Boling of Fox News said, “one in three homes sold last quarter were distressed and this is the issue he chooses to focus on?”

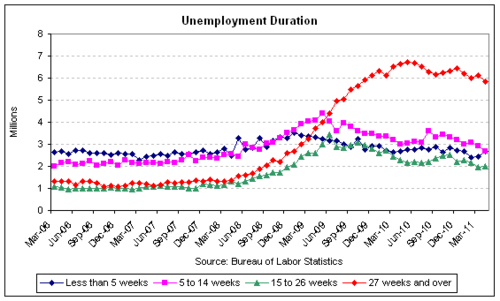

Housing is poised for a recovery, but we’re not there yet, nor has the recovery begun. The factor that is oft ignored by analysts yet is the most critical to housing is employment. Although employment is up across the nation, ironically, jobs posted in the real estate and real estate finance sector dipped 17% amidst rising stats[8].

The up tick in employment isn’t enough yet, however, to point to a recovery, but there is hope remaining in NAR’s recent report that pending home sales (contracts signed) rose 2.1% in February and another 5.1% in March[9] pointing to a possible rise of closings in coming months.

You weigh in

What is your opinion- will improving employment be the key to recovery or does it lie in the hands of the President to create more housing opportunities?

Overview of the national market via charts

Click on any chart to enlarge.

Story resources:

[1] “Existing-Home Sales Rise in Most States in First Quarter; Metro Area Prices Mixed”

[2] “Surveys of REALTOR® Sentiment/Regional Vice-Presidential Reports”

[3] “Distressed homes now half of the housing market, is there a silver lining?”

[4] “CoreLogic Loan Performance HPI March 2011”

[5] “Trulia Rent versus Buy Index reveals homeownership to be most advantageous”

[6] “Home price data confirms a double dip in housing sector”

[7] “New home sales drop from 2010 but rise from February”

[8] “Job postings reach 2011 high”

[9] “Pending home sales beat expectations for a second month in a row”

The American Genius is news, insights, tools, and inspiration for business owners and professionals. AG condenses information on technology, business, social media, startups, economics and more, so you don’t have to.