Modest improvements in housing

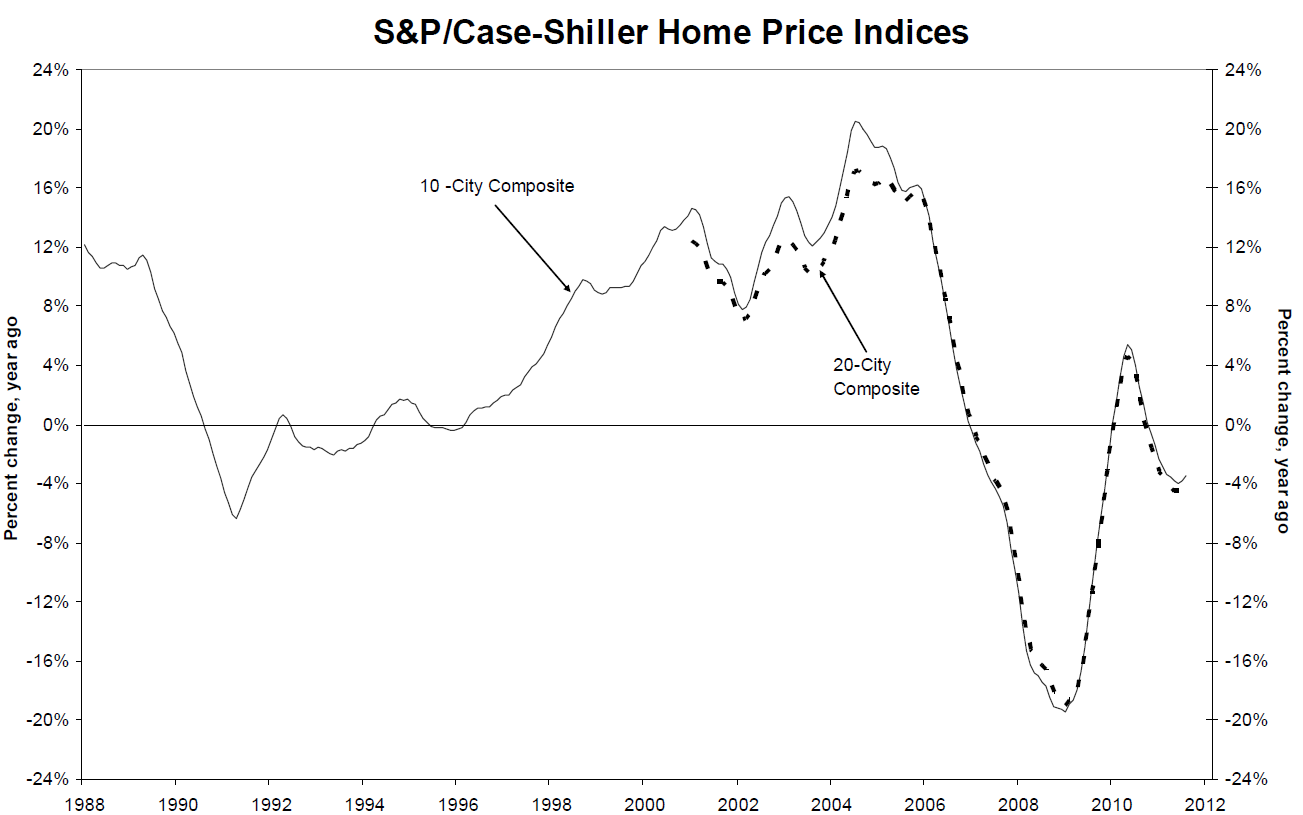

Although other housing factors continue to struggle, home prices are seeing modest improvements, according to S&P/Case-Shiller data which reveals pricing is up 0.2 percent in August, but remain down 3.8 percent from August 2010. Most economists note that this is proof that the housing sector is bouncing at the bottom and although no one predicts a recovery in coming months, especially given the plague of foreclosures, any economic indicator that shows improvement is welcomed news in such a terrible economic climate.

Case-Shiller studies the 20 largest metro areas in America as an indicator of overall health and is reporting that Washington D.C. saw the largest value gain, up 1.6 percent in August with Detroit and Chicago hot on its trail at 1.4 percent. Although modest increases in home prices, it remains positive news for homeowners. D.C. has garnered a great deal of attention in 2011 for continually improving and being the top performer, but Detroit is outpacing D.C.’s improvement along with the other cities, having risen 2.4 percent since August 2010.

It’s not all good news though – Atlanta dropped 2.4 percent from July, and has plummeted 6.3 percent from August 2010. Although Atlanta posted the largest monthly home price dip, Minneapolis is suffering the worst decline in the past year, dropping 8.5 percent.

Various reporters are positioning President Obama’s executive order to amend HARP (Home Affordable Refinance Program) as a potential boost to the housing market that could ultimately improve home values, but given the deep restrictions of the plan and the government’s proven inability to qualify homeowners under the programs designed to help them, it is unlikely that the few hundred thousand that might receive HARP assistance will impact home prices, nor will it help sales.

These indicators most likely point to the possibility of home values leveling out in 2012 before regaining some of the losses in recent years as shown in the graph above. Real estate is bouncing at the bottom after a long descent into an unhealthy situation, but with banks continuing to misbehave and foreclosures dragging down the sector, a recovery is not imminent.

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.