PATH Act at the center of controversy

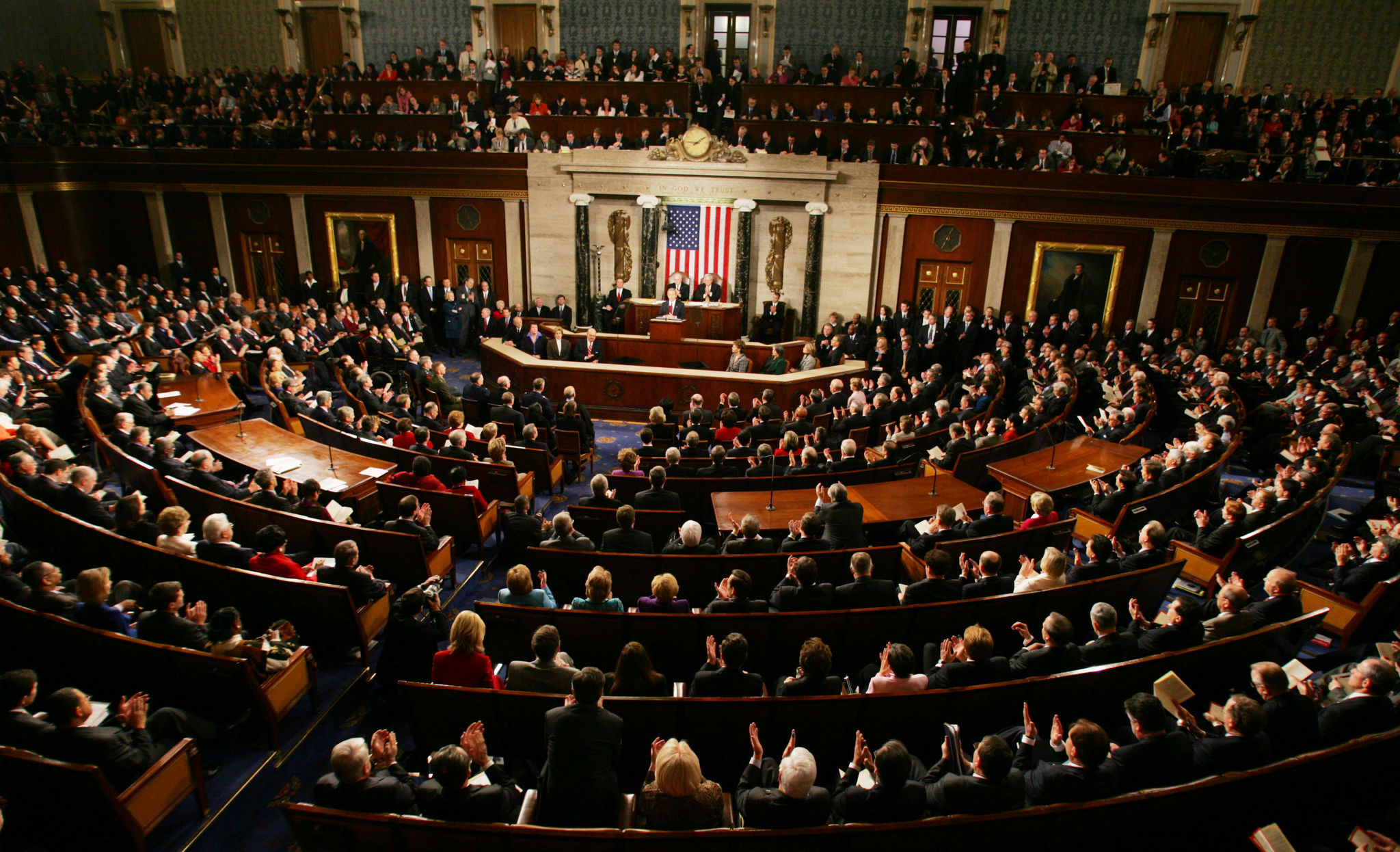

The House Financial Services Committee held a hearing last week regarding the Protecting American Taxpayers and Homeowners (PATH) Act discussion draft, introduced by Chairman Hensarling (R-TX) which seeks to reform housing by reforming the Federal Housing Administration (FHA) and other Government Sponsored Enterprises (GSEs) as well as reforming the Dodd-Frank Act. Gary Thomas, President of the National Association of Realtors (NAR) and Jerry Howard, CEO of the National Association of Home Builders (NAHB) testified before the committee today, asking for substantial changes to the PATH Act.

NAR says they oppose the legislation as currently drafted not only because they “strongly oppose the end of federal guarantee for a secondary mortgage market,” but because they also “strongly oppose the dramatic restructuring and targeting of FHA.”

“NAHB believes federal support is particularly important to ensure that 30-year, fixed-rate mortgages, the bedrock of the nation’s housing finance system since the 1930s, remain available at reasonable interest rates and terms,” said Howard. “As currently drafted, the PATH Act does not provide the federal support necessary to ensure a strong and liquid housing finance system, and we urge the committee to make the necessary changes.”

Thomas testified that the PATH Act would wind down Fannie Mae and Freddie Mac over a five year period and create a new Utility to promote the securitization of mortgages but fails to provide for a federal guarantee for the Utility. NAR also notes that the draft alters the current FHA program including income targeting, downpayment increases, and loan limit decreases which they oppose “without a federal guarantee and a removal of the FHA Title.”

The NAHB CEO agreed, urging lawmakers to modify changes to the FHA. “The PATH Act would drastically diminish FHA’s vital liquidity mission,” said Howard. “By simultaneously leaving all federal support for housing to FHA, and then by greatly reducing the overall scope and reach of FHA’s programs, the PATH Act would greatly limit homeownership and rental housing opportunities for many financially responsible and qualified Americans.”

Not all of the bill is opposed

In a statement, the NAHB noted, “There are some positive elements in the PATH Act, and NAHB agrees that private capital must be the dominant source of mortgage credit, Howard said. However, ensuring the safety and stability of the housing finance system cannot be left entirely to the private sector.”

Similarly, the NAR stated, “The bill does include some positive changes including language to fix the definition of fees and points in the ability to repay/qualified mortgage (QM) regulation so that consumers have more options when choosing a lender, and language related to mortgages seized under eminent domain.”

According to Thomas’ statement before the Committee, NAR supports six key provisions of the bill: covered bonds, 3 percent cap for Affiliate Fees, regulatory relief, Basel III, manufactured housing protections, and the Common Sense Economic Recovery Act.

Next steps for the PATH Act

NAR notes that the draft is moving quickly and the Committee intends to mark up the bill this weeks. NAR submitted a written statement for the hearing, opposing the discussion draft and states they will continue to work with the Committee and Congress to oppose this legislation.

NAHB has recommended to the committee that Fannie Mae and Freddie Mac be gradually phased into a private sector oriented system, where the federal government’s role is explicit but its exposure is limited. Federal support would be limited to catastrophic situations where carefully calibrated levels of private capital and insurance reserves would be depleted before any public funds were employed to shore up the mortgage market.

Because there is currently a great deal of uncertainty among consumers and home builders due to the unresolved debate on reforming the housing finance system and the government sponsored enterprises, Howard urged the committee to move forward in a careful, prudent manner to provide needed assurance for the industry and consumers.

“At a time when housing is just starting to get back on its feet and provide job and economic growth, we don’t want to do anything that would reverse this positive momentum,” he said. “It’s definitely important that Congress be mindful of housing’s important role in the economy going forward.”

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.