Disappointing jobs, housing numbers, and the economy

While March jobs report a modest rebound with 192,000, and the unemployment rate remaining at 6.7%, overall economic acceleration is being brought into question, according to a recent report by Transwestern, offering the big picture on the state of the national economy.

In the United States, there are still several issues that need to be addressed. There are disappointing jobs and housing numbers early this year, which make them question whether or not the economy is actually decelerating.

The fourth quarter gross domestic product (GDP) has actually been revised down to 2.4 percent compared to early reports of 3.2 percent. Holiday shopping came in at 2.2 percent, well below the initial report of 3.3 percent. The Federal Reserve has lowered growth expectations for 2014 to 2.8% from an initially projected 3.0% and reduced the monthly stimulus to $55 billion. Short-term rate increases could occur as early as summer 2015 instead of the fall.

So is there deceleration or not?

And contrary to government predictions, government bond rates have fallen, sending 10-year Treasury rates to 2.7% or below.

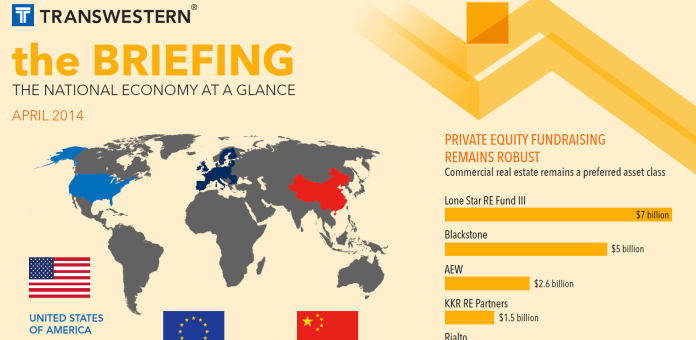

Commercial real estate remains a preferred asset class for investors, supported by a robust private equity fundraising atmosphere. With the top five in fundraising being: Lone Star RE Fund III with $7 billion, Blackstone with $5 billion, AEW with $2.6 billion, KKR RE Partners $1.5 billion, and Rialto with $1.3 billion.

“The main thing people should understand is while the economy has not performed at a level people may have expected given some of our other recoveries, we have been making slow steady progress for five years,” Tom McNearney, Transwestern’s chief investment officer, stated. “At the end of the day, that is more growth and attraction than many other areas of the globe.”

And perhaps this is the point of the briefing: even though some areas are struggling, the economy is still better than many others.