National Foreclosure Report

Analytics and business services company, CoreLogic has just released the National Foreclosure Report for January, noting 69,000 completed foreclosures in January 2012, compared to 80,000 in January 2011, and 65,000 in December 2011. The number of completed foreclosures for the previous twelve months was 860,128, and there have been roughly 3.3 million completed foreclosures since the beginning of the housing crash in September 2008.

“We are encouraged by the noticeable progress we are seeing over the last several months in the mortgage industry,” said Anand Nallathambi, chief executive officer of CoreLogic. “During the last several years the industry has faced enormous challenges working through difficult and complex issues. We are hopeful that these recent improvements are early signals of revitalization in the mortgage market.”

Foreclosure inventory down

Fully 3.3 percent of all homes with a mortgage (1.4 million homes) were in the foreclosure process as of January 2012, down 0.3 percent from January 2011. The number of loans in the foreclosure inventory decreased 9.5 percent over the year. Borrowers over 90 days late on their mortgage payments dropped to 7.2 percent of borrowers, down from 7.8 in January 2011, and unchanged from December 2011.

“The pace of completed foreclosures is gradually increasing again, but the clearing ratio is falling as REO sales have slowed in the winter months. Judicial foreclosure states1 are continuing to process foreclosures more slowly than non-judicial foreclosure states,” said Dr. Mark Fleming, chief economist with CoreLogic. “Non-judicial foreclosure states completed almost twice as many foreclosures per 1000 active loans as judicial foreclosure states in January.”

CoreLogic notes that one in three homeowners own their homes outright.

Regional performance varied

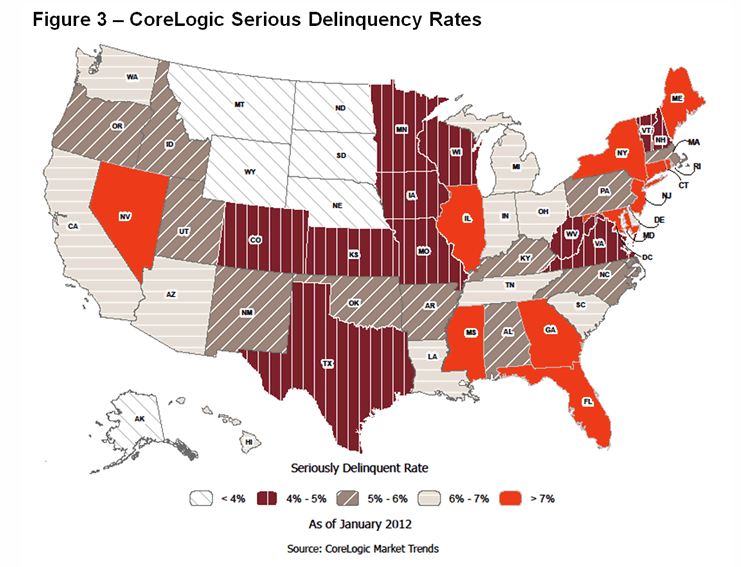

Of the top 100 markets, measured by Core Based Statistical Areas (CBSAs) population, 32 are showing an increase in the foreclosure rate in January 2012 compared to a year ago, the same as from December 2011 when 32 of the top CBSAs were showing an increase in the foreclosure rate compared to December 2010.

The five states with the largest number of completed foreclosures for the twelve months ending in January 2012 were California (155,000), Florida (86,000), Arizona (65,000), Michigan (65,000), and Texas (57,000). CoreLogic reports that these five states account for 49.7 percent of all completed foreclosures nationally.

The five states with the highest foreclosure rates were Florida (11.8 percent), New Jersey (6.4 percent), Illinois (5.3 percent), Nevada (5.0 percent) and New York (4.7 percent).

The five states with the lowest foreclosure rates were Wyoming (0.7 percent), Alaska (0.8 percent), North Dakota (0.8 percent), Nebraska (1.1 percent), and Texas (1.3 percent).

The report does not detail the stalls in foreclosure, nor the clogged pipeline, rather focuses on the available data.

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.