Millennials’ spending habits

According to a new Bankrate study, Millennials (born after 1980) surprisingly don’t have credit cards.

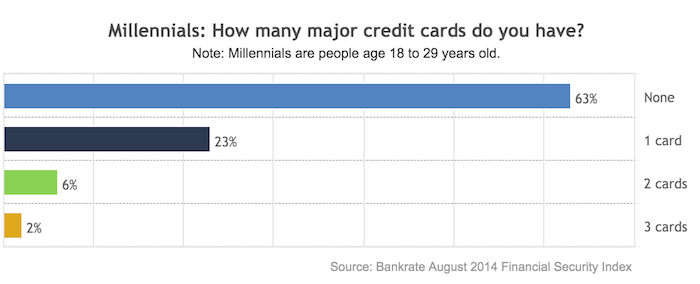

This new generation grew up with credit and debit cards, so it is quite shocking that nearly two in three Millennials don’t have a single credit card. Not one. Fully 63 percent have no credit cards, and only 23 percent of them have one card.

![]()

Conversely, 65 percent of Americans over 30 have at least one credit card. Check out Bankrate’s findings below:

So why is this the case?

While most people over 30 have credit cards, those under 30 simply do not. Why?

One might point to the tremendous student loan debt that this generation has racked up to attempt to be competitive in the job market, and starting adulthood in the red is a tough pill to swallow, making that a priority for so many. Further, many can’t qualify for quality credit given their situation.

The most obvious reason is that Millennials have seen this movie before and watched their parents overextend themselves, lose their homes, and end up with mountains of unsurmountable debt. Millennials simply don’t want any part of that – the pain, the embarrassment, the frustration, and the loss.

How can your brand adapt?

Every chain retailer impresses upon consumers, particularly younger buyers, that they can and should sign up for a credit card through that retailer, lining wallets with debt. Millennials aren’t buying in, so watch for those programs to disappear.

Want to rope in younger consumers? Try what Texas liquor company, Spec’s Wine, Spirits and Finder Foods do – offer a discount for using cash or debit. Why? That’s the main currency for Millennials. Easy way to attract those buyers.

It’s time to adapt – younger buyers don’t want to collect any more debt than they have or that they’ve seen their parents be burdened with, so attract them by rewarding their ability to pay with real money.

Marti Trewe reports on business and technology news, chasing his passion for helping entrepreneurs and small businesses to stay well informed in the fast paced 140-character world. Marti rarely sleeps and thrives on reader news tips, especially about startups and big moves in leadership.

DebtNEUTRALITYPetition.com

October 1, 2014 at 3:55 pm

Millennials have debit cards, no? Many retailers charge ridiculous interest rates on their credit cards as high as 24% so its up to the retailer to simply accept their debit card.