January home price data

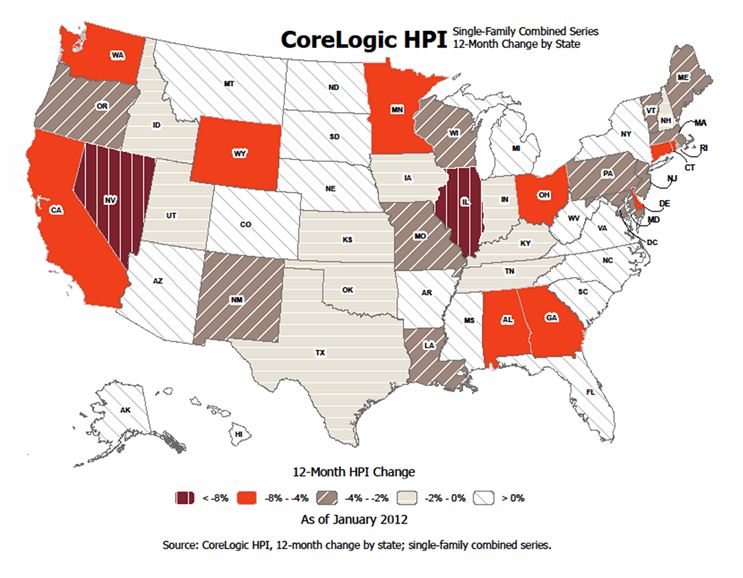

National home prices, including distressed sales, declined on a year-over-year basis by 3.1 percent in January 2012 and by 1.0 percent compared to December 2011, the sixth consecutive monthly decline, according to the CoreLogic January Home Price Index (HPI) report.

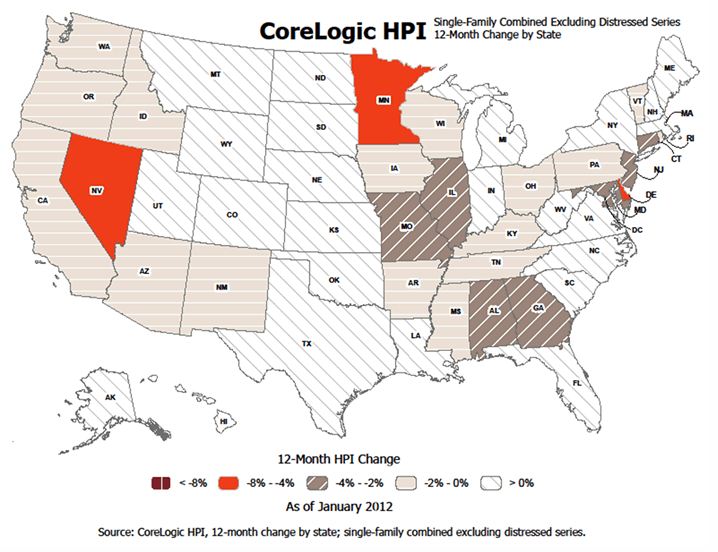

When you take out distressed sales, prices only dropped 0.9 percent in January 2012 compared to January 2011, and without distressed sales, the monthly home price index actually increased 0.7 percent in January.

“Although home price declines are slowly improving and not far from the bottom, home prices are down to nearly the same levels as 10 years ago,” said Dr. Mark Fleming, chief economist for CoreLogic.

Regional performance varied

According to CoreLogic, the five states with the highest appreciation (including distressed sales) were South Dakota (+5.7 percent), North Dakota (+4.0 percent), West Virginia (+4.0 percent), Montana (+3.6 percent) and Michigan (+3.0 percent).

Excluding distressed sales, the five states with the highest appreciation were South Dakota (+6.4 percent), Montana (+5.9 percent), North Dakota (+3.8 percent), Alaska (+3.7 percent) and Indiana (+2.7 percent).

Including distressed sales, the five states with the greatest depreciation were Illinois (-8.7 percent), Nevada (-8.0 percent), Delaware (-7.9 percent), Alabama (-7.7 percent) and Georgia (-7.5 percent).

Excluding distressed sales, the five states with the greatest depreciation were: Nevada (-6.7 percent), Delaware (-5.5 percent), Minnesota (-4.1 percent), New Jersey (-3.5 percent) and Georgia (-3.3 percent).

Of the top 100 Core Based Statistical Areas (CBSAs) measured by population, 71 are showing year-over-year declines in January, eight fewer than in December.