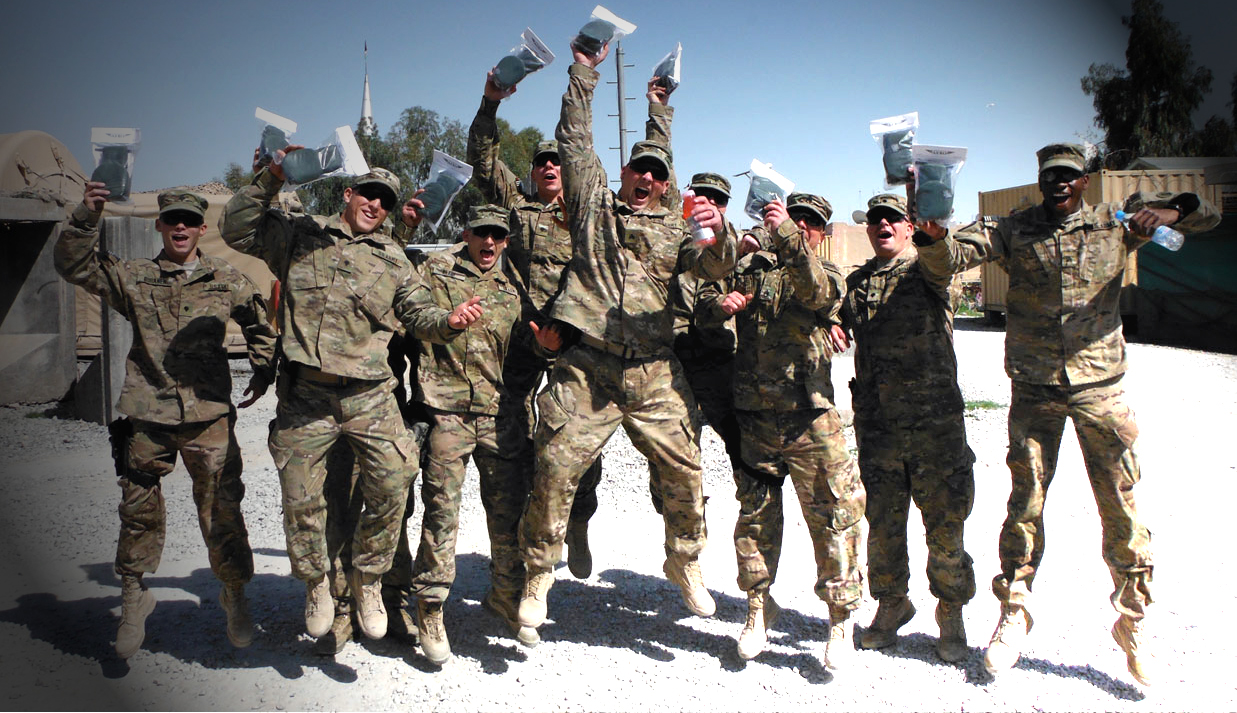

CFPB protecting our military

There have long been protections in place so that lenders can’t hurt military servicemembers or their family, but the rules have been weak and poorly enforced, so the young Consumer Finance Protection Bureau (CFPB) is taking a crack at better protecting mortgage borrowers that are active military servicemembers so they can focus on protecting our nation.

![]()

A new set of rules issued by the CFPB are meant to protect all mortgage borrowers, but we are particularly drawn to the protections outlined for active military, because when someone is fighting on the front lines, or shipping out at an inopportune time, their family is left behind to pick up the pieces. Recently, the CFPB has tackled predatory lending as well as irrational bank fees targeting military members, and these new rules offer better service, streamlining help for borrowers and dual tracking.

Better service for borrowers

Under the new rules, loan servicers are required to “train their people to answer your questions and, if you do run into trouble, the servicer has to assign people to help you.” Lenders must also now implement policies to prevent losing paperwork, one of the key reasons many illegal foreclosures went forward during the housing crash.

Previous rules implemented by the federal government include requiring Fannie Mae and Freddie Mac to consider Permanent Change of Station (PCS) orders as hardships, allowing military families to qualify for assistance programs instead of missing mortgage payments before qualifying for aid. Existing rules also require lenders to immediately and clearly communicate policies when PCS orders are presented.

Dual tracking now in place

Lenders who proceed with a foreclosure against a homeowner, while simultaneously working with that borrower on a loan modification are dual tracking. The CFPB has said that mortgage servicers may no longer engage in dual tracking in any way, shape, or form.

Streamlining help for borrowers

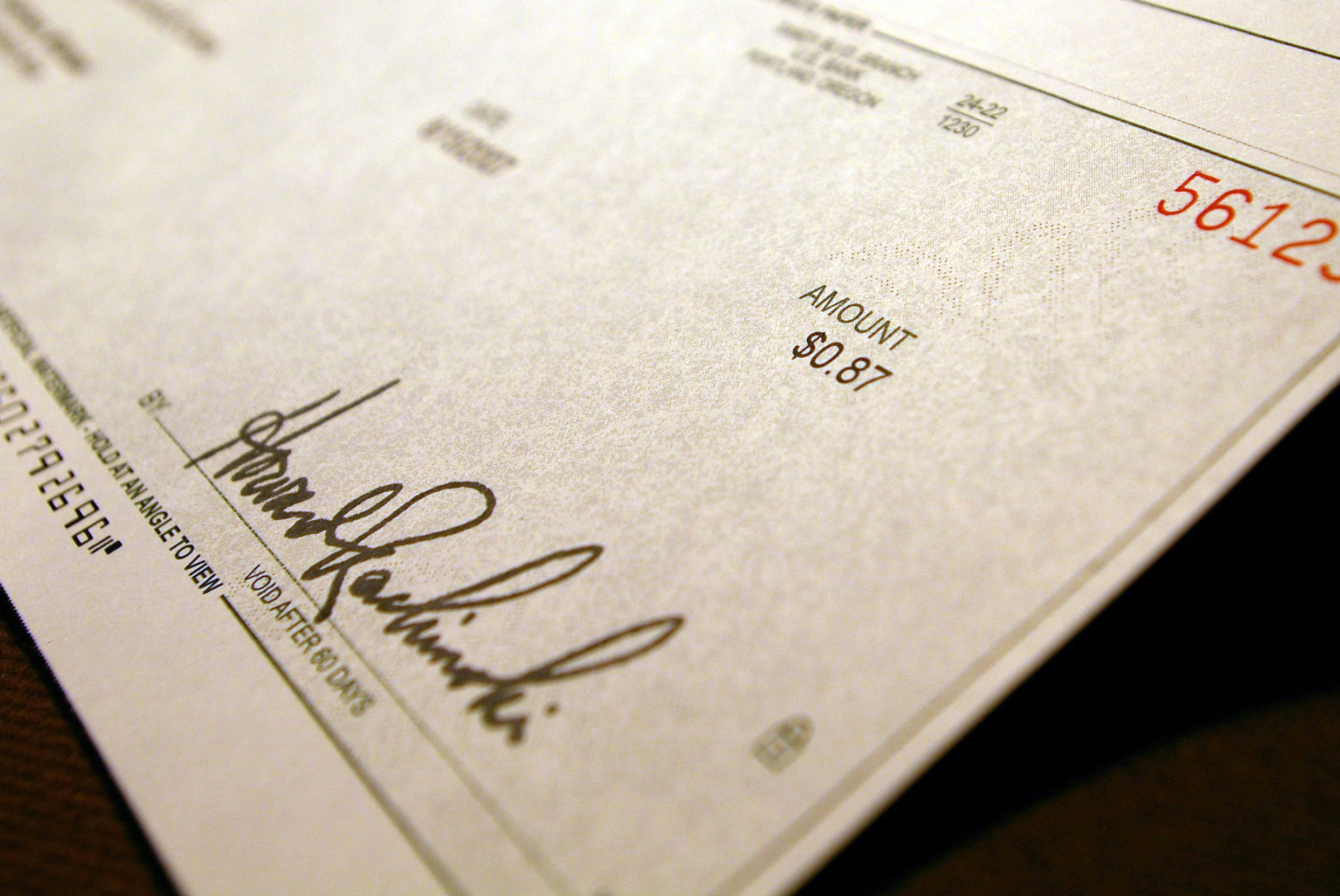

One of the biggest problems with homeowners that are seeking loan modifications instead of a default is that they end up in an endless cycle of paperwork with no light at the end of the tunnel, with new documents requested each time a new service representative is reached on the phone.

Under the CFPB’s new rule, lenders must consider all options for which a borrower is eligible, immediately, without endless document swapping.

Some of these protections are specifically targeted to help servicemembers, and others make mortgage servicing more simple for all borrowers, but the bottom line is that our nation’s defenders will be less abused under these new rules.

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.

Pingback: CFPB makes public 7,700 grievances against financial institutions - AGBeat