Reality Check?

In reading the multitudinous stories about the Fannie/Freddie bailout/debacle/needed reform/callitwhatyouwill, one of the more stalwart voices in the economic world demonstrated the need for perspective. In Monday’s Wall Street Journal story titled Plan Skirts Housing’s Biggest Troubles, this sentence was striking and bewildering:

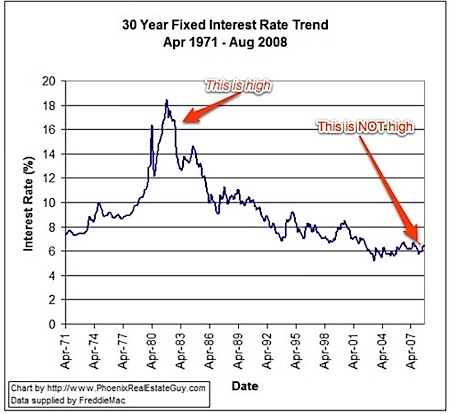

The most immediate change could come in the form of lower mortgage interest rates. They have remained relatively high — above 6% — for much of the past year amid credit-market troubles.

Really? 6% is relatively high? Perhaps to the collective short-sightedness that has been one of the contributing factors to the current housing market shift, but not to those who see housing as a long-term, buy (and live in) and hold investment.

Take a look at the above chart, share it with your colleagues and clients. Relative to the recent real estate market, 6.5% may be considered high, but relative to historical trends, six to eight percent is LOW. Let’s shift the perspective from one that tracks the housing market on a week-to-week and month-by-month basis and recognize that “relatively” 6% is as close to free money as we’re likely to see.