State of the real estate economy

Last month’s S&P Case-Shiller reports shows home prices trending up in most cities despite a national average 2.5% dip but also revealed that 25% of home loan holders are under water, news that rocked the real estate industry.

Last month’s S&P Case-Shiller reports shows home prices trending up in most cities despite a national average 2.5% dip but also revealed that 25% of home loan holders are under water, news that rocked the real estate industry.

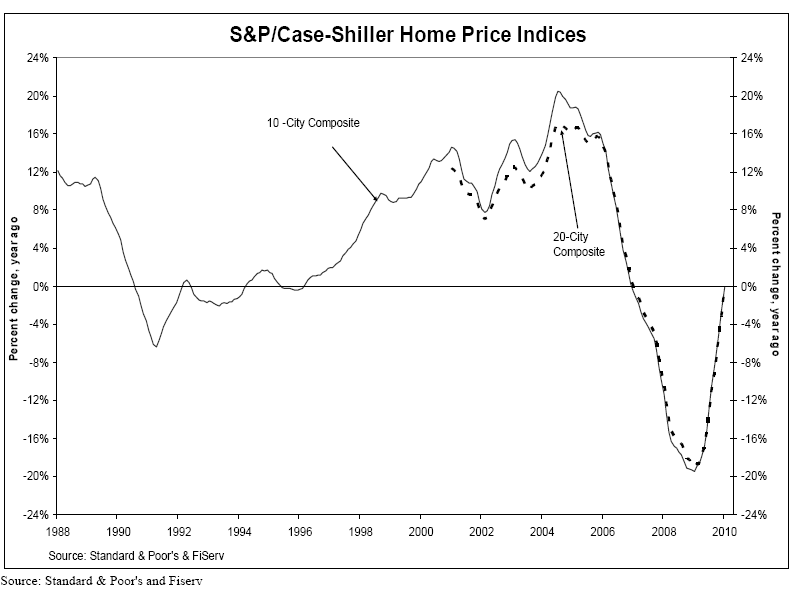

Today, S&P Case-Shiller reports that their home price index is improving comparing January 2010 to December 2009. S&P reports that their ten city composite is almost unchanged from where it was 12 months ago (which is a heck of a lot better than a decline), and the 20-city composite is down less than 1% in home prices.

According to Standard and Poor’s, “Annual rates for the two Composites have not been this close to a positive print since January 2007, three years ago.”

How it all looks (note that beautiful rebound):

Interestingly, media coverage by CNN and others took a negative spin, hollering that home prices are down. They are, but the real story is that there’s a rebound, just look at this chart! Spin it how you will, but I see sad news in comparison to several years ago, but in the last two years, this is beautiful news.