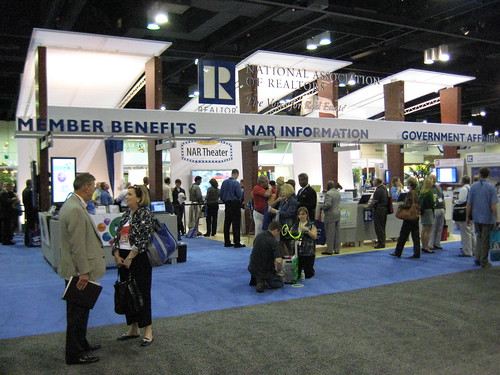

NAR 2008 Day 2

Members Have Issues

One of the common threads in blogs written by real estate sales people is a disconnection from the National Association of REALTORS. They feel that NAR is some faceless entity run by anonymous individuals who have some secret agenda that is disconnected from the lives of the working real estate professional. The truth is far different, and as someone who participates in that process, I thought that transparency would be served by showing how things work.

NAR Listened

At the NAR meetings in May and November, committees meet, and forums are held to disseminate information and to solicit the concerns and suggestions of the members.In November of 2007, at the Risk Management Committee meeting, there was concern expressed regarding the growing number of short sales and the lack of experience and information among the general membership. Issues of compensation, disclosure, and potential liability were brought to the attention of the committee.

The 2007 Chair (Bob Most – a working REALTOR) and his newly appointed successor (Diane Disbrow also a working REALTOR) went to President Dick Gaylord (a working REALTOR) and asked that a Working Group be appointed to investigate the issue and make recommendations for the consideration of the Leadership Team as well as the committees whose work would be impacted by the issues of short sales.

NAR Acted

President Gaylord appointed a Working Group and a meeting was scheduled for January in Chicago. Talk about dedication! Have you ever been in Chicago in January? Members of the working group arrived from all over the country, carrying with them tales of horror from their specific markets. By the end of the day, the Working Group had met, defined the issues facing the industry and made suggestions for solutions which might resolve them.

They determined that suggestions needed to be made to the Multiple Listing Systems around the country to help avoid problems for consumers, and reduce potential commission disputes among members. A work flow for members to use in the Short Sale Process was created along with a Power Point Presentation to use for instruction. And suggestions were made that NAR reach out to large lenders and the GSEs.

Short Sales are a Fact of Life

Because the Short Sales Working Group acted so quickly, the report of that working group was received by the MLS Issues and Policies compensation work group so they could create suggestions for the consideration of the full committee when they met in May in Washington.

And some other developments resulted from the efforts of this small group of working REALTORS;

- NAR is developing a voluntary pilot program that would include a few MLSs who would agree to share data on current listings (and asking prices) with Fannie and Freddie to give them current market information so they can make faster decisions on short sales contract offers.

- Freddie Mac (with NAR input) is developing a Webinar to introduce Realtors to the short sales process–what it is, likely road blocks, who’s involved, a typical example (showing mortgage balance, current value, closing costs, forgiven amount, etc.), etc.

- NAR has talked to the MBA and plans to meet with them to discuss the confusion and delay that afflicts the short sales process.

- Wells Fargo is developing short sales materials (not yet public) to help educate everyone involved in the process and make the process work better. NAR is talking to Wells and will consider putting links to the Wells information on the NAR website to give members information. NAR is considering doing the same thing with other major mortgage lenders.

And it is all a result of the concerns and efforts of working REALTORS – not some faceless entity

Bill is an unusual blend of Old & New - The CEO Century 21 Advantage Gold (Philadelphia's Largest Century 21 company and BuzzBuilderz (a Social Media Marketing Company), He is a Ninja CEO, blending the Web 1 and 2.0 world together in a fashion that stretches the fabric of the universe. You can follow him on twitter @Billlublin or Facebook or LinkedIn.

Bob Wilson

November 18, 2008 at 11:21 am

Fannie requires two opinions of value in the form of an appraisal or BPO. Sharing MLS info with Fannie doesn’t do much good.

OK, so they are going to put on short sale 101, that doesn’t change anything.

The MBA has no say or leverage in the short sale process. What is the point of this?

Wells is a debt collector. NAR asking a debt collector to define the process is absurd. Wells has a stake in the outcome that is frequently at odds with the best interest of the Realtor’s client.

Are you aware that Wells, as an investor on loans serviced by Downey Savings, has agreed with DS to not process short sales for those loans? Loan mod or foreclosure are the only options they are offering.

I understand that the NAR is not faceless, but the 4 examples you gave provide no value to the 20+ short sales I’m dealing with now and illustrate the pie in the sky approach NAR continues to take. If you want results, bring in attorneys, both from the private sector and the various state AG offices.

The way the industry has dealt with short sales is flawed because they treat them in a general manner. Dealing with a portfolio lender where the short sale is an asset loan is different than dealing with a loan servicer. Dealing with a loan servicer who has full delegation is different than dealing with a servicer where the investor is Fannie, Freddie or an MI company.

The fact that a NAR committee like this is made up of working Realtors doesn’t mean much to me for two reasons:

1) I don’t know their knowledge base or expertise with a)laws, b)tax issues and c) myriad of variant policies with the many different lenders and servicers.

2) I don’t know how they approach their business.

The latter is important because of the inherent conflicts of interest presented by short sales.

The most distressing omission was the lack of any reference to legal and tax issues. While we cant give legal and tax advice, having a clue about them should be the absolute starting point for a Realtor. The short sale needs to be seen as a consumer protection tool for those where it would serve that purpose, not as the attractive low hanging fruit, as it is arguably the most difficult and liability laden transaction we do.

bryanslist

November 18, 2008 at 12:53 pm

Nice comment Bob.

This topic is just hilarious. I would probably have to add my opt which is that in an entire section of this post titled “NAR Acted,” I seem to have missed the action part.

Seems to me like they RE-acted. They took a bunch of high profile REALTORS, took them away from a day or two of work, in order to come to a conclusion that everyone has known for years.

Short sale is a better way for everyone to do business, not just the Government, even if the only reason was for all of the paper it would save. There is another anti-trust case on the horizon, count on it.

The long and the short of all of this is that with the internet and more importantly GOOGLE, there in no longer a need for the NAR. With the way that the industry is shifting there is no way for them to reasonably justify the false sense of security and the money they extort from hard working salespeople for a well marketed WORD & pin with the WORD on it.

Pop Quiz:

What’s the difference between a REALTOR and a Real Estate Salesperson?

NOTHING!

Lisa Sanderson

November 18, 2008 at 6:01 pm

You really should be ashamed of yourselves for bashing these volunteers who try to make a difference. Are either one of you doing anything to help us get where we need to be? Do you have any clue about how much time these people invest in trying to enhance YOUR profession? Much more than a day or two, that is for sure…most of these people have devoted a good portion of their entire careers to the Association. Don’t just sit there and criticize. DO something.

And say THANK YOU for crying out loud!

Bill Lublin

November 18, 2008 at 8:37 pm

Bob:

I would suggest that several of the points you made are less than accurate;

1. You imply that the pilot program to be set up by Fannie Mae would mirror their REO value requirements. There is no reason to believe your statement to be accurate. We’re talking about short sales not REOs (and before you question that statement- I would point out that I have been selling Fannie Mae REO properties for 20 years and am familiar intimately familiar with that valuation process- it just doesn’t apply to what I was talking about)

2. You stated “OK, so they are going to put on short sale 101, that doesn’t change anything.” Notwithstanding your perception, there are a huge number of real estate professionals who need education and information about short sales. Personally I think that additional education for people in our business does change things drastically. I also think that Freddie taking that initiative indicates a clear willingness on their part to encourage lenders to participate in short sales rather than forcing properties through the foreclosure process

3. You the say “The MBA has no say or leverage in the short sale process. What is the point of this?” Obviously you have not thought through the problem of dealing with the large number of lenders that are dealing with short sales across the country. Since they are all independent businesses, it is difficult to get them to act in concert. Their trade association however, could potentially generate standards which if adopted by their members, could create a consistent pattern for short sales, making the process more uniform, and thereby more accessible to real estate professionals and consumers.

One of the big problems we face in trying to do a successful short sale is that each lender has different ways of addressing the situation. Though you later suggest that we should bring is attorneys and Attorney Generals in the different states, I don’t think you fully appreciate how ineffective that would be. There is no uniformity in the states regulations, and the Attorney Generals would therefore be unable to generate uniformity in their responses. And what you think attorneys could do is beyond me – aside from there not being a client for them to represent, I don’t see the what they could do other than initiate litigation (the point of which is not obvious to me, but is a solution that would be not only be ineffective but time consuming and expensive)

4. You make a statement that I have to totally disagree with “I understand that the NAR is not faceless, but the 4 examples you gave provide no value to the 20+ short sales I’m dealing with now and illustrate the pie in the sky approach NAR continues to take.” The approach here was not “Pie in the Sky” and the job of the work group was not to help you with your 20 sort sales – it was to identify that issues facing practitioners, and come up with suggestions for dealing with them. Oddly enough the work group did what is was convened to do.

5. You then said “NAR asking a debt collector to define the process is absurd. ” NAR is not asking a debt collector to “define the process” NAR is providing information from a debt collector to its members which they can then use to best serve their clients – And since one of the biggest problem real estate professionals face in this process is the lack of information from lenders, NAR is helping its members if they are able to compile links to this information in one place.

6. You then make the following point – to which I take exception

“The fact that a NAR committee like this is made up of working Realtors doesn’t mean much to me for two reasons:

1) I don’t know their knowledge base or expertise with a)laws, b)tax issues and c) myriad of variant policies with the many different lenders and servicers.

2) I don’t know how they approach their business.

The latter is important because of the inherent conflicts of interest presented by short sales. ”

To begin with, if you want to be the one to decide who gets put on a committee or work group at NAR, you have to start by being part of the leadership at NAR. That would involve spending time as a volunteer, earning the respect of the other people in the leadership of NAR, and then earning the right to be appointed to groups like this.

That being said, you need to understand that when the work group was convened, it was not made up of random participants, any more than any other committee or work group that is placed into action by NAR. This work group was hand picked from a number of appropriate committees, and was an exceptionally experienced and qualified group of working REALTORS – I was the chair of the work group with almost 21 years of REO & Short Sale experience, 37 years of real estate experience, the 2008 chair of Pro Standards, and a member of the Risk Management committee that initiated the request for the work group. In addition I have been a real estate instructor in my state for over 30 years and I am also a member of REOMAC (an organization dedicated to default management) and because of my background have thorough experience in dealing with national and regional lenders through their corporate offices. Every person in that group had substantial REO and short sale experience- several of the participants were also attorneys, and several came from states like California, Arizona and Florida where short sale issues were rampant. They came from a wide variety of companies and business models, but were all focused on the problems facing the industry and applied their considerable expertise to working on them.

And BTW There is no inherent conflict of interest for a group to approach the short sale process. If you want to articulate the conflict of interest that you feel is inherent, I will be glad to show you where you are wrong – and why whatever you have in your mind is not inherent but more likely the function of a fixed set of circumstances that you have created to develop that conflict.

And your final paragraph needs an answer that is more complete – you said

“The most distressing omission was the lack of any reference to legal and tax issues. While we can’t give legal and tax advice, having a clue about them should be the absolute starting point for a Realtor. The short sale needs to be seen as a consumer protection tool for those where it would serve that purpose, not as the attractive low hanging fruit, as it is arguably the most difficult and liability laden transaction we do”

There was no reference to tax or legal issues because they have nothing to do with the post, written about what NAR was doing – and the short sale is not a consumer protection tool. We are possibly facilitating a result that may be preferential to a foreclosure (though legal and tax advice would need to be sought prior to that determination) but we are certainly not protecting consumers from anything. Neither my post, nor NAR’s efforts to help its members and the public indicate that anyone besides yourself has that viewpoint. As far as its being difficult and liability laden, I would agree that they may be difficult (though they may not be the most difficult- that would depend upon your experience) but in terms of liability, NAR’s efforts worked to reduce member’s liability through education and information gathering – and a properly educated real estate professional is his or her own best safeguard against liability.

Bill Lublin

November 18, 2008 at 8:52 pm

@Bryanslist – I’m glad I amused you – You certainly returned the favor.

Your comment that the work group came “ to a conclusion that everyone has known for years. “ is patently absurd. For those of us who deal in reality instead of bombast and rhetoric, education of real estate professionals is important and should not be taken for granted. The workgroup was convened at the request of a large number of members in a number of states who indicated that they had a need for the information and the education. Obviously they missed your memo that “everyone has known for years”.

You also say’ “Short sale is a better way for everyone to do business, not just the Government, even if the only reason was for all of the paper it would save. There is another anti-trust case on the horizon, count on it.” How is this silly? Let me count the ways – first of all short sales are not always better for the consumer – sometimes not better for the lender, and who do you think is acting in a manner that would leave them open to an anti-trust suit? NAR? The MBA? The Lenders? The former GSEs? All of the above? What have they done that might rise to that level? Or is this just another case of empty rhetoric?

Finally you say “The long and the short of all of this is that with the internet and more importantly GOOGLE, there in no longer a need for the NAR. “

I have no idea what you think NAR does, but it is not a search engine, and the information that it provides is of superior quality and held to a much higher standard than the Wikipedias of the world.

And then you said” With the way that the industry is shifting there is no way for them to reasonably justify the false sense of security and the money they extort from hard working salespeople for a well marketed WORD & pin with the WORD on it.”

This whole sentence is so silly I almost hesitate to respond to it. What “false sense of security” are you referring to? NAR is an organization comprised of members with a volunteer leadership and a world class staff who are constantly planning, working and re-evaluating the best possible way to serve their members, the public and the industry. And they extort nothing from any one. If you don’t feel your membership has value, you have the option to learn more about the organization so that you recognize the value it offers or decide not to renew your membership- no one is forcing you to belong.

Bill Lublin

November 18, 2008 at 8:52 pm

Lisa – Thanks – Gotta Love a Girl from the Poconos!

😉

Bob Wilson

November 18, 2008 at 11:16 pm

Bill, I responded to your 4 bullet points. I didn’t infer anything. Let’s see if we can clarify this a bit, because after reading your responses, I think you missed my points as well.

1) You didn’t say that Fannie would change how they value short sales. You said it would speed it up. How? As of Sept. 1st, Fannie now requires two opinions of value. Their valuations are based on BPOs and appraisals. How will sharing MLS data make a difference? Is someone at Fannie or Freddie going to do a desktop review of a field valuation using the same MLS info the BPO agent or appraiser used? How will that speed anything up?

2) I won’t argue that agents need more education, but teach them what? Fannie and Freddie handle short sales differently than other investors, or even the FDIC for that matter.

3) Does NAR honestly think that a psuedo organization like the MBA will have the ability to require anything when the Feds can’t even do anything? Maybe down the road member lenders will adopt something, but today, dealing with loans already sold & resold, or sliced and diced into mortgage back securities, the MBA cant do anything, let along streamline a process where the players are way bigger than the MBA.

You stated later that there were attorneys involved, so why are you arguing that their involvement would be ineffective?

I don’t expect uniformity in the responses of the AGs or lawyers schooled in the various state legal differences. That fact that no uniformity exists is the reason the need for their input. Where I was going with that was that without understanding the vagaries of the laws in 50 different states, NAR’s goal of trying to streamline a process, even at the educational level, is impossible. NAR can’t even come up with a sample HUD that would be accurate for one lender in different states.

FWIW, I have met with people from the AG office. They have single handedly had a greater impact on the lenders than anything else. The AG has leverage. The MBA does not. If you want to change something, you are going to have to wield a stick bigger than what you have described so far.

If it wasn’t for the AGs that filed suit against Countrywide, there would not have been 175k loan mods processed by CW, with another 225k targeted. If it wasn’t for the AG in California, CW wouldn’t have stopped seeking deficiencies or asking for promissory notes in California on non-recourse loans where the short sales they approved provided for only the release of the lien, but not the original note. They now state that they don’t do this because it is illegal. Well, it was illegal before, but it took the AG to get them to stop.

The lack of info from lenders is a red herring. This assumes a transparency on their part that does not and will not exist. For example:

Countrywide has a publicly stated process that is, in theory, fairly streamlined. But nowhere is it stated that that if a file is ‘aging’ (open and nearing 90 days) and the likelihood of it closing within those 90 days is doubtful, that they’ll close the file. This is because CW’s policy is that short sales are to be processed within 90 days. The unintended consequence of this policy is that negotiators and supervisors within the short sale department will kill the file to reset the clock. Ever wonder why a file was closed because they don’t have a document that you know was sent in more than once?

More importantly though, who is filtering the info provided by the lender to determine what is in the best interest of the borrower? They are a debt collector. By definition, that is an adversarial relationship with our client, the borrower. If you want to educate the agent, bring in the lawyer who can teach them where the pressure points are – the requests for financial info the lender can make that can be countered with a legal request that involves the lender explaining their RESPA compliance. We have seen Wells, BA and CW roll over and approve short sales that wouldn’t have happen if the agent followed the lender directions without the leverage a good attorney can provide.

While lenders are inefficient when it comes to consistently processing short sales, the biggest issues are not primarily about the “short sale process” that the average agent sees, but about the legal chess game that is played out by the lenders that most agents don’t know how to play.

I do not understand this statement at all. How so?

I do appreciate the effort, Bill, but the problem is systemic, and goes deeper than NAR is digging. Until NAR decides to play hardball, you guys are wasting your time. Instead of freezing in Chicago, go to Capital Hill and educate the lawmakers as to how these lenders are playing games. You have a mob of legislators armed with $700b looking for ways to make their bones. Or go to Sacramento, California and push them to extend the mortgage debt forgiveness law on non-recourse acquisition debt past Dec 31, 2008. As it stands now, on New Years Day, 2009, many short sale sellers will be forced to choose the lesser of two financial evils and opt for foreclosure instead of a CA state tax bill.

Yes Lisa, I am. I meet with lawmakers. I met with someone from the AGs office. I had a conference call last week with a senior VP from CW where I was able to point out that their 90 day policy was being abused. If you knew me, you would know that i don’t sit back and bitch. I suffer from a Don Quixote complex and i tilt a windmills. I educate agents and consumers alike. I have a series of blogs posts on short sales that have generated over 1000 comments.

I’m also sorry that you can’t handle feedback or a dissenting opinion of which we’re all entitled. However, your reprimand did remind me of a scene from “A Few Good Men” (just think NAR instead of Marine Corp):

Bill Lublin

November 19, 2008 at 4:29 am

Bob;

Let me review your points as you clarify them;

Fannie indicated that they would be able to use the information to assist them in speeding up the process – the details to that I would leave with them. Their effort and assurance that they would do so should be sufficient. Again their determination of value and what is need to determine value is internal to them and the decision how to do so is in their hands. Your stating that they have to have something doesn’t mean that they are compelled to follow your direction.

Freddie wanted to teach them how to handle short sales that involve Freddie loans – since that’s about 10% of the housing stock it would strike me as a reasonable education effort. Other than bashing someone else’s efforts, I don’t understand why you would be critical of that.

I don’t know what a pseudo-organization is, and I really don’t think you do either – its just an example of words that sound like they might mean something, however let me answer this question. As a trade organization, the MBA creates a single entry to discuss an issue with their many members, who could then voluntarily agree to create a uniform program, or agree upon standards that they would all comply with. It is easier to gain compliance from people voluntarily than it is to try to legislate that compliance, and much quicker, since there is no need to promulgate laws or regulations and have them approved or passed.

This is just an out of context response – Your suggestion was that somehow attorneys were needed to resolve the short sale issue. I still don’t understand what you think that would accomplish – My mention of attorneys was in response to your question as to the background of the individuals on the workgroup, noting that some of them were attorneys since you were concerned about the legal implications of any effort. I will repeat that I don’t understand how you think attorneys could accomplish something in this arena, and what that has to do with NAR’s efforts.

This one is just fuzzy thinking. First of all the lack of uniformity would mean 50 different people working on fifty different solutions with 50 different perspectives and political agendas, that would only impact their area. In addition, holding the post of Attorney General doesn’t indicate any understanding of the short sale process or the issues of the real estate or mortgage industry. Our members indicated a need for means to address this problem in a national manner because we are a national organization. In addition, this is not an issue that could be effectively legislated in that manner. Secondly, while I agree with you that NAR is unable to streamline this process (because we are not the people in control of the process) . I do not agree that NAR cannot provide effective education for our members. Finally, your last sentence is again just uninformed and not relevant to the conversation – the HUD-1 is a form developed by the Department of Housing and Urban Development – NAR is not involved in its development or approval of its development- it’s a Federal Form mandated by a Federal Law – RESPA.

Nobody – that’s not the purpose, nor do I think it is even an issue. If they provide information we can determine what we may use.

As I said before an educated real estate professional is the best risk reduction measure in the world.

And here we acknowledge (backhandedly) that the efforts fueled by RPAC are important to the industry, and are another important function of NAR. However the decision to lobby for anything on a state level is made there and on a national level by NAR. If you want to impact that, participate in CAR and NAR, and move in that direction. I assume that you make a large RPAC contribution as I do every year so that your money is where your mouth is.

In your answer to Lisa Sanderson you said;

Exactly how does that help anyone except you? What impact to the national issue doe your blog or its 1000 comments have? Does you ego lead you to believe that you are the only real estate professional speaking with senior executives at different companies around the country? Or that the conversation somehow affects the entire industry? Do you think the fact that you pointed out a flaw in the system of one lender will motivate that lender to do anything that they don’t want to do voluntarily? (and if your answer is that they may make the change voluntarily, then your argument about reaching out to the MBA falls to a grinding halt) Or do you imagine that your individual private efforts are more significant to the greater good of the industry than the efforts of the volunteers and staff at NAR? Or even that your efforts are aimed at doing that rather than solving your individual problems?

Untrue- I have no problem with dissenting opinions at all and am happy to engage in dialogue. I just demand that you make sense and speak the truth. Not being aware of what you have done to “provide me with the blanket of freedom I sleep under”, or what any military service would have to do with your NAR bashing, I won’t respond, but I will point out that I and the other volunteers at NAR do “pick up a weapon and stand a post “ in defense of our industry and our profession. In this instance it is you who do not serve but criticize – however I do enjoy a good Mamet quote – not matter how inappropriate

😉

Bob Wilson

November 19, 2008 at 11:38 am

Bill, I went after your points, not you. But obviously when NAR’s positions are critiqued, then the tack is to go after the ‘NAR basher’.

As you stated, the MBA is a trade organization. They have no ability to do anything other than lobby. Period. They can’t compel lenders to make any changes simply because of membership, any more than NAR can force SAR to stop suing their own agents.

Fannie, Freddie, or any other lender teaching agents how to handle short sales isn’t an answer because the problem is how Freddie and Fannie handle short sales. None of what you have stated addresses that.

Wells providing info is great, but it’s already available. It doesn’t change anything with regard to Wells’ refusal to do short sales with some of their loan servicers.

Instead of NAR asking the lenders to show us the ropes, what we need is the ability to show them the ropes. Make it known to those in the right places where their processes are broken, or having unintended consequences.

We all have seen buyers walk because the approval is taking to long. So what happens when you have a Fannie short sale and the buyer walks prior to approval, but you then get another buyer? The process goes back to square one and another 30-45 days. This happens even if the terms and HUD1 are exactly the same. Treating it more like an REO where the approval isn’t specific to just one buyer would shave 30 days off many deals.

No. However you assume that is what happened. The meeting was put together at the behest of someone at CW because we made them aware of the liability exposure this ‘aging’ policy created. This opened CW up to class action bad faith lawsuits, in addition to providing AG with more evidence for their own suit against CW. It is the legitimate threat of legal action that brings about change at this juncture – that and the threat of the Henry Waxmans in Congress who want more accountability and oversight. Do you still not see how that involves leverage applied from the legal side of things? Every lender is relying on their legal team to minimize what they have to do. For us not to be as equally well armed is naive.

You and Lisa have both attacked me for not serving. I am not a NAR foot soldier, but like others who have lost some faith in NAR, we can bring about change via other channels. I used my files as examples and you have twisted it to appear that I’m motivated for purely selfish reasons. That disappointed me. It isn’t about only my sellers, but about all the short sale transactions people at CW outside of the short sale department are seeing fail for no apparent reason. If I can get that 90 day aging policy to be changed nationally, then yes, I’ll have had as great an impact as your last meeting. Maybe it will even help one of your clients.

Again, I appreciate the effort and time, and I believe you when you say you have assembled quite the brain trust, but I whole heartedly believe that NAR is taking the wrong approach. We don’t need another suggestion making committee, but a Special Forces strike team. Go on the offensive. Document the various policies and procedures (both legal and bureaucratic) they have seen that are screwing up the process and then demand that they be corrected. Your membership would respond overwhelmingly, as would the consumer.

Bill Lublin

November 19, 2008 at 3:18 pm

Bob:

You said:

That’s just disingenuous. In your earlier reply you said, “ I’m also sorry that you can’t handle feedback or a dissenting opinion of which we’re all entitled.” And that statement was framed just before you choose an inappropriate quote to make yourself seem superior However I have not and will not attack you personally. I just think that your response shows a lack of global view. Your comments and experiences are specific to your state, your attorney general, and your needs, rather than to the needs of the larger community.

In your last response you say;

This doesn’t minimize NAR’s efforts, it merely shows that there is still more to do. To go back to the point of the post – NAR was aksed to act by their members, NAR acted on that request and took steps to help their members. The Workgroup pointed out some places where we might start to get a handle on the problem and the lenders we spoke to listened to their voices because NAR was involved, and the voice of all of the members is greater than the voice of any individual.

You also state;

Actually NAR is busy working with the lenders making them aware of what we perceive as the problems in the systems. However there is no single place to fix the problem because there are (as I pointed out in my last response) many independent companies involved in the problem. Again, it doesn’t diminish what NAR is doing or has done, and should not detract from the credit they should receive for attempting to address the problem as best they can. Nothing you mention here is new, and all of it was considered by the committee, but as a group we realized that what we wish would happen, and what we can make happen are often different things. We went for what we could make happen.

You then responded to a question of mine without answering it.

Even in your response, you are talking about one case, and what you perceive to have been the motivation of one lender in one state. It is a huge leap from that incident to a cure for a problem, especially when that cure boils down to threatening every lender with a different law suit in every state.

I didn’t twist anything – in your response you indicate that your concern is the files you are working on. And in your response you indicate that you did what you did to resolve your issue. If it has a greater impact that’s terrific, and you should be applauded, but its more of an unintended benefit then it is a goal of your course of action. And I would submit that the term “NAR foot soldier” is another derogatory term (from the man who doesn’t attack anyone personally). I find your belief that you as an individual have more foresight and impact than the entire staff and volunteer leadership incredibly egotistical. At best it would be unseemly Hubris.

As far as criticizing you for not serving, I can only say that if you don’t serve, your criticism of those who do, or the plans they embark on is certainly lacking in impact. It is those who not only “talk the talk” but “walk the walk” that can really criticize with validity.

I can appreciate that you think NAR might have take the wrong approach. However as a representative organization, its committees must be responsible to the whole membership, and like any large organization, the first step in addressing any problem is to research the problem and make suggestions. That aside, I don’t understand what steps your “Strike Team” is going to take. How would they assemble the information you suggest that thy document? How many people would it take? Would they be staff or volunteers? How would the information be compiled? How long would they take? What states would they work in? How many lenders should they compile information on? And what right would they have to “demand they be corrected”? Your suggestion is one of those things that sounds great by the campfire, but is exceedingly difficult to actually implement.

I have no problem with you personally (though I will not allow you to be inaccurate, disingenuous, or condescending) but I think that if you participated in the group, you could be more effective than sitting outside the group and criticizing the efforts of others. In fact, a man of your passion and experience could contribute a lot I’m sure.

Bob Wilson

November 19, 2008 at 9:14 pm

You win Bill. You have twisted and perverted everything I have said, even attributing comments to Lisa as aimed at you.

I have seen the light though. Clearly it is only NAR and their volunteers that have the answers and are competent enough to be allowed to debate. Anyone else is short-sighted, selfish, and egotistical.

Resistance is futile. Long live Lawrence Yun!

Bill Lublin

November 20, 2008 at 3:19 am

Bob;

I twist and pervert nothing but I did hold you accountable for the direct meaning and impact of your words.

Yes I responded to your comment to Lisa since it was part of the conversation and was reflective of your response to me.

At no time do I indicate that “only NAR and their volunteers that have the answers and are competent enough to be allowed to debate”. I did say, and still believe that any large group can be more effective in the public arena , and if you wish to debate, you should stay on point, eschew rhetoric in favor of fact.

And yes, long live Lawrence Yun, he’s a good guy, and even Long live Bob Wilson – after all why not , even if I disagree with him wouldn’t he deserve all that a long life has to offer?

Resistance is not futile – its not even part of the conversation – which started about how NAR is trying to do some positive things as a result of request of its membership – of which you are a part. NAR would listen to you too if you chose to participate with other members in their (the members) to positively impact the industry and the profession.

Bob Wilson

November 20, 2008 at 11:40 am

Bill, you stated more than once that all I cared about was my own files. Nothing is further from the truth.

I used them as an example because they are a pretty good cross section or sampling of the short sales that are out there. Nothing you covered will benefit those sellers or the thousands of others that are similar. I used CW as an example because at one point in the last 18 months, they serviced 1 out of every 7 loans. That is a huge percentage and they do it for Fannie, Freddie, and almost every other lender, not to mention every major MI company.

I also take issue with the assertion made by you and Lisa that my criticism and lack of involvement with NAR means I do not serve to bring about positive change. My involvement with CW is now at the level of the Office of the President and they are very mindful now of how short sales have been screwed up as a result, even to the point of seeing CW rescind a trustee sale and get back to approving a short sale.

I’m one guy with a big mouth and no budget, and I got far enough up the food change to address something concrete that could impact thousands. I’m truly sorry that you and the others at NAR don’t see the benefit using the bully pulpit and ramping up the fight and taking it to the lenders.

There is a window of opportunity that exists right now where the lenders’ Achilles heels are exposed.

I would like to see your committee be as willing to immediately hold lenders and servicers as accountable for their words and actions as you are with me. We would then make some real progress that would have an immediate impact.

I believe that to be a very ineffective requirement for input. Did you know about CW’s 90 day aging policy? Did anyone in your committee bring it up? Do you know how many failed short sales there are as a result? But I now have to run the gamut of

to get pertinent info to a NAR committee? We don’t have time for that, and I’m not willing to kiss up and pretend to be something I’m not for the purpose of getting on a committee.

I’ll tell you what. You take your approach and meet in Jan and May and I’ll put out a call to action to the legions of “non-serving”, “NAR bashing” Realtors out there who can provide stacks of documentation and would like to see something more concrete and immediate. We’ll take our different tacks where NAR can continue to throw BP and we’ll throw the heat high and tight and we’ll see what we can both get done.

Think of it as playing good cop, bad cop.

I’ll have a site up for this shortly.

Al Perry

November 20, 2008 at 1:24 pm

@bobwilson I respect your frustration with the short sale process and also admire your strong desire to assist your client’s sucessful navigation through the process.

However I have to take exception to your position on NAR. I am starting to get involved at NAR after years of volunteering at the state and local levels. I have always had a strong opinion and the Associations have often provided a forum where I could share and learn. If that qualifies me as a foot soldier then I am happy to be in such good company.

There have been times I have not agreed with an Association position. Sometimes through my involvement I was able to help sway a position into another direction and there are other instances where my position was the one that changed after hearing what my peers had to say.

Sure peer opinions vary and there are times when I get frustrated. Large organizations are not always as mobile as we would like. However it is amazing what you can accomplish through an organization such as NAR when you simply participate. Your words often turn to action if you can make a compelling case. After all I think we want the same thing here…systems that we can count on to navigate through a difficult process to ensure a better outcome.

BTW I have seen our REALTOR organizations carry and occasionally use a big stick when needed.

@BillLublin Count me in on the wall!

teresa boardman

November 21, 2008 at 5:43 pm

Did you apply for the social media job? You should have.