Organized chaos

Setting up a business is daunting. The process is complicated, time-consuming and resource draining. To take advantage of this chaos, Stripe, the Silicon Valley based payments processor company, launched Atlas a year ago to help international businesses get incorporated within the U.S.

![]()

Little did they know that the demand within the U.S. would explode as well!

Business model

Their original premise was brilliant: focus on international clients, and automate starting a business for them.

Shrink a trail of paperwork into a short web application.

Provide on the spot financial, legal and operational tools. Get a foreign business incorporated ASAP, hassle free.

The move proved wildly popular right away.

Within a short year, thousands of businesses got incorporation through the Atlas program spanning 124 countries.

“We wanted to see if we could help entrepreneurs in emerging markets to be on the same playing field as Silicon Valley startups. It’s been heartening to see that it’s working,” said Taylor Francis, Atlas project lead.

Business is boomin’

But then came the real unexpected surprise—growing demand from businesses within the country. Stripe could not ignore it anymore.

The $9 billion startup announced last week that it was expanding its Atlas program to U.S. based companies.

“It’s a slightly different problem, but even in the US, the process was time consuming,” acknowledged Francis.

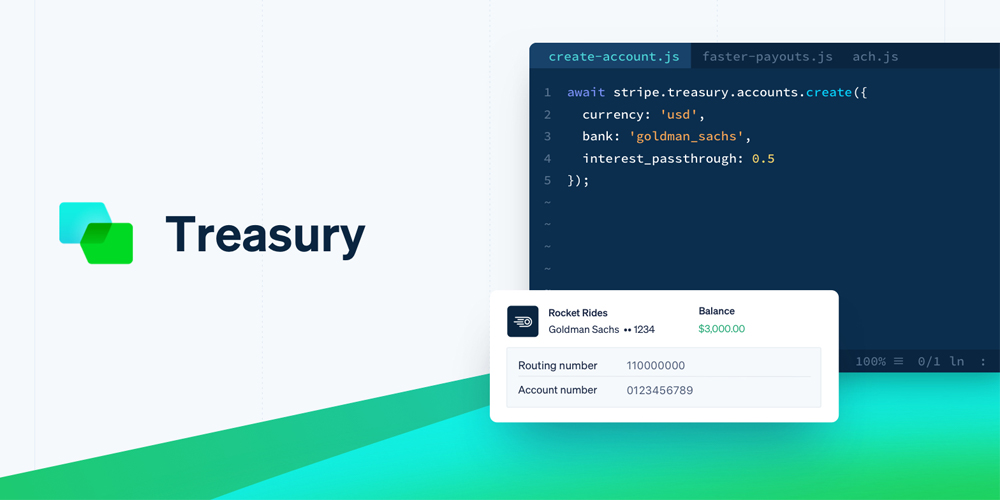

For a mere $500 fee, Atlas now guarantees incorporation as a Delaware C Corp., a business bank account with Silicon Valley Bank, and registry with the IRS. The company has also collaborated with Orrick for legal corporations, PricewaterhouseCoopers for tax guidance, and Amazon Web Services for cloud services.

To make things more user-friendly, Stripe has also recently added new features for Atlas users, like how-to guides, templates, and online forums for exchanging tips.

Stripe looks poised to expand its reach

Current members can use the Atlas to invite new clients to join the feature. Additionally, Stripe expanded its partnership program to include crowdfunding platforms like Kickstarter and Indiegogo.

It is important, however, to note three things:

First, being a Atlas customer does not require you to sign up for Stripe.

Secondly, Atlas remains an invite-only tool, for several reasons. Stripe wants close oversight of businesses that are being set up in order to weed out illegitimate ones, for example, those engaging in gambling or virtual currencies.

There is also no hiding that Stripe wants to attract more international clients who would use their payment APIs.

However, mostly, Stripe wants to focus on high-growth start-ups, like small businesses or solo entrepreneurs. Francis put it this way, “If you’re starting a new yoga studio, that’s probably not the right corporate structure for you.”

Thirdly, it may be important to note that Stripe Atlas may not be necessarily the best fit for you, even if you qualify and invited to join. Delaware has a long history of offering attractive business law, coupled with business-friendly state courts, and customers being lured by its no sales tax policy. That is why Atlas, by default, offers a Delaware base.

Whether you’re in Delaware or Denver, if you’re looking to start a business this tool is a good starting point.

#Atlas

Barnil is a Staff Writer at The American Genius. With a Master's Degree in International Relations, Barnil is a Research Assistant at UT, Austin. When he hikes, he falls. When he swims, he sinks. When he drives, others honk. But when he writes, people read.