Millions of homeowners back in the black

According to CoreLogic, 2.5 million more residential properties returned to a state of positive equity in the second quarter of the year, leaving 7.1 million homes in negative equity territory, down from 9.6 million in the first quarter of 2013.

The national aggregate value of negative equity was $428 billion at the end of the second quarter compared to $576 billion at the end of the first quarter of 2013, a decrease of more than $148 billion. CoreLogic reports this decrease is due in large part to an improvement in home prices.

Good news / bad news

While millions of homeowners returning to positive equity is good news, they’re not out of hot water yet – of the 41.5 million residential properties with positive equity, 10.3 million have less than 20 percent equity. In this state, a loan is considered “under-equitied,” and with tightened lending conditions, new financing is difficult to obtain.

Under-equitied mortgages accounted for 21.1 percent of all residential properties with a mortgage nationwide in the second quarter of 2013. At the end of the second quarter of 2013, 1.7 million residential properties had less than 5 percent equity, referred to as near-negative equity.

Properties that are near negative equity are at risk should home prices fall.

The pace will slow

“Equity rebuilding continued in the second quarter of this year as the share of underwater mortgaged homes fell to 14.5 percent,” said Dr. Mark Fleming, chief economist for CoreLogic. “In just the first half of 2013 almost three and a half million homeowners have returned to positive equity, but the pace of improvement will likely slow as price appreciation moderates in the second half.”

“Price appreciation obviously had a positive impact on home equity over the first half of 2013, especially the second quarter,” said Anand Nallathambi, president and CEO of CoreLogic. “Despite the substantial decrease in negative equity, there’s more ground left to gain with the 7.1 million U.S. residences that remain underwater.”

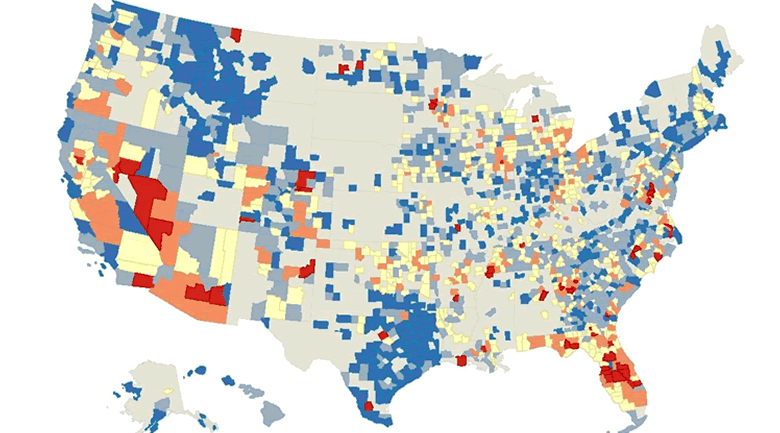

Regional performance varied

Nevada had the highest percentage of mortgaged properties in negative equity at 36.4 percent, followed by Florida (31.5 percent), Arizona (24.7 percent), Michigan (22.5 percent), and Georgia (20.7 percent). These top five states combined account for 34.9 percent of negative equity in the U.S.

Of the largest 25 metropolitan areas, Miami-Miami Beach-Kendall, Fla. had the highest percentage of mortgaged properties in negative equity at 36.5 percent, followed by Tampa-St. Petersburg-Clearwater, Fla. (33.8 percent), Phoenix-Mesa-Glendale, Ariz. (25.6 percent), Riverside-San Bernardino-Ontario, Calif. (24.8 percent) and Warren-Troy-Farmington Hills, Mich. (24.3 percent).

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.