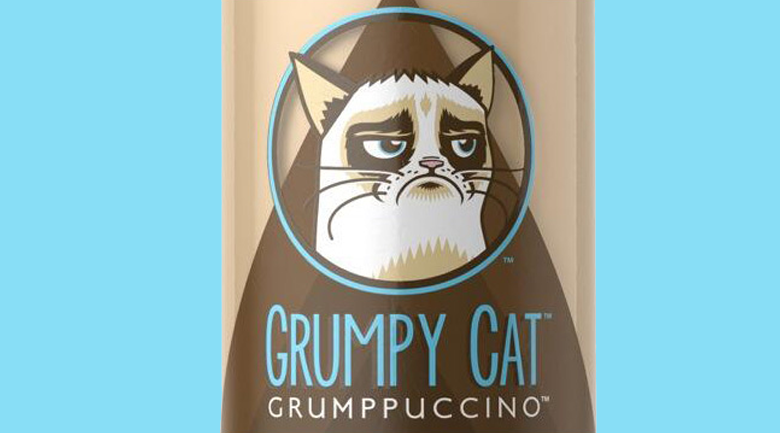

Looks like someone didn’t have their Grumppuccino this morning

For most of us, our morning coffee makes us cheerful. The same can’t be said for Grumpy Cat’s owners.

Grumpy Cat’s owners are suing Grenade Beverage and its co-founders for copyright and trademark infringement and breach of contract, according to TorrentFreak.

![]()

Grumpy beans not part of the deal

Grumpy Cat Limited had previously entered into an agreement with Grenade Beverage in 2013. The agreement gave California company, Grenade the rights to use the trademarked name and image for their “Grumpy Cat Grumppuccino.” However, Grenade crossed the line when it started selling Grumpy coffee beans in addition to the ready-to-drink coffee. Being just too much for Grumpy Cat to take, the owners decided to sue.

“Despicable misconduct”

Filed on December 11th in the district of California, the lawsuit states the “defendants’ despicable misconduct here has actually given Grumpy Cat and her owners something to be grumpy about.” Grumpy Cat Limited claims Grenade violated their initial agreement by producing another line of Grumpy Cat Products. They argue any additional products required additional negotiations and approval from Grumpy Cat.

Grenade began to sell the Grumpy Cat branded coffee beans in 2015, apparently without the permission of Grumpy Cat Limited. Grumpy Cat limited included an email exchange in the lawsuit as evidence.

Over $250,000 in damages

Other complaints alleged by Grumpy Cat Limited include not being provided with detailed accounting as required by the original agreement and not receiving royalty payments. Grumpy Cat Limited is seeking damages of up to $150,000 for each copyright infringement, damages for the infringement and dilution of its trademark, and another $100,000 for exploiting the domain name grumpycat.com which is owned by Grenade Beverage.

Grumpy cat goes to court

While this news will most likely only increase business, the cat’s owners are asking the court to stop sales and hold Grenade responsible for various copyright and trademark infringements. Whether Grumpy Cat will win this case depends on how the original licensing agreement will be interpreted by a judge. In the meantime, both parties can sit back with an ice-cold “Grumppuccino” while they wait for their day in court.

Buy ’em while you can

Get your Grumpy Cat coffee beans while they last (or before the company is forced to stop selling the product) at https://grumpycat.com. If you feel like taking your own stand, you can also join the “Grumpy Movement” with #DrinkGrumpyCat.

#GrumpyLawsuit

Nichole earned a Master's in Sociology from Texas State University and has publications in peer-reviewed journals. She has spent her career in tech and advertising. Her writing interests include the intersection of tech and society. She is currently pursuing her PhD in Communication and Media Studies at Murdoch University.