But I’ve never had anything repossessed!

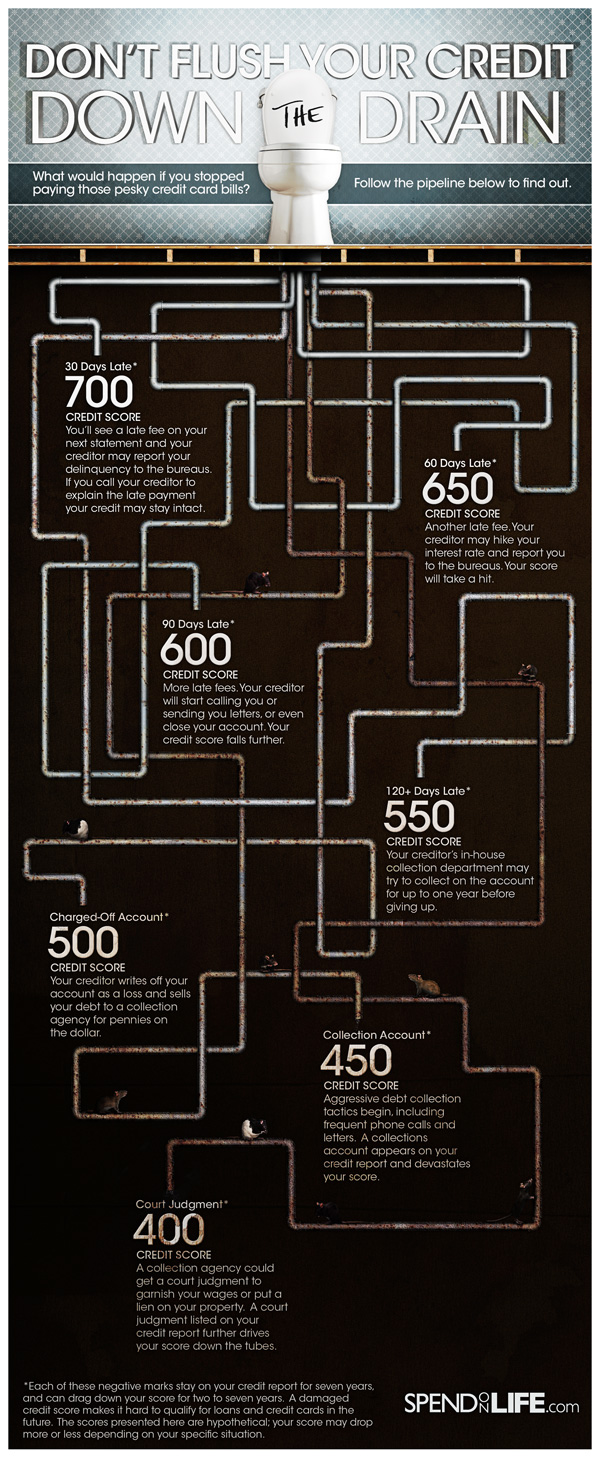

How many times have you had to explain to a frustrated client how credit bureaus rank credit scores and that it isn’t always about whether or not something was repossessed or foreclosed upon, that sometimes it’s more about how many times you pay late and how late you pay, determining the amount of risk a lender takes when loaning money? Don’t take for granted that it’s common sense to you, some people have never considered their credit before!

How many times have you had to explain to a frustrated client how credit bureaus rank credit scores and that it isn’t always about whether or not something was repossessed or foreclosed upon, that sometimes it’s more about how many times you pay late and how late you pay, determining the amount of risk a lender takes when loaning money? Don’t take for granted that it’s common sense to you, some people have never considered their credit before!

It can be heartbreaking for someone who thought they were in the clear or for those who have just been declined for a loan. Perhaps if they learned from your blog prior to their application process in a visual way how credit scores work, they would understand more thoroughly (not everyone learns from being told out loud or via email, sometimes it takes tools like infographics). It might be helpful to post the following chart on your own blog and teach your consumers how credit works and what local options people have for each credit level.

Credit scores chart

click the image to enlarge, courtesy of SpendOnLife.com

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.