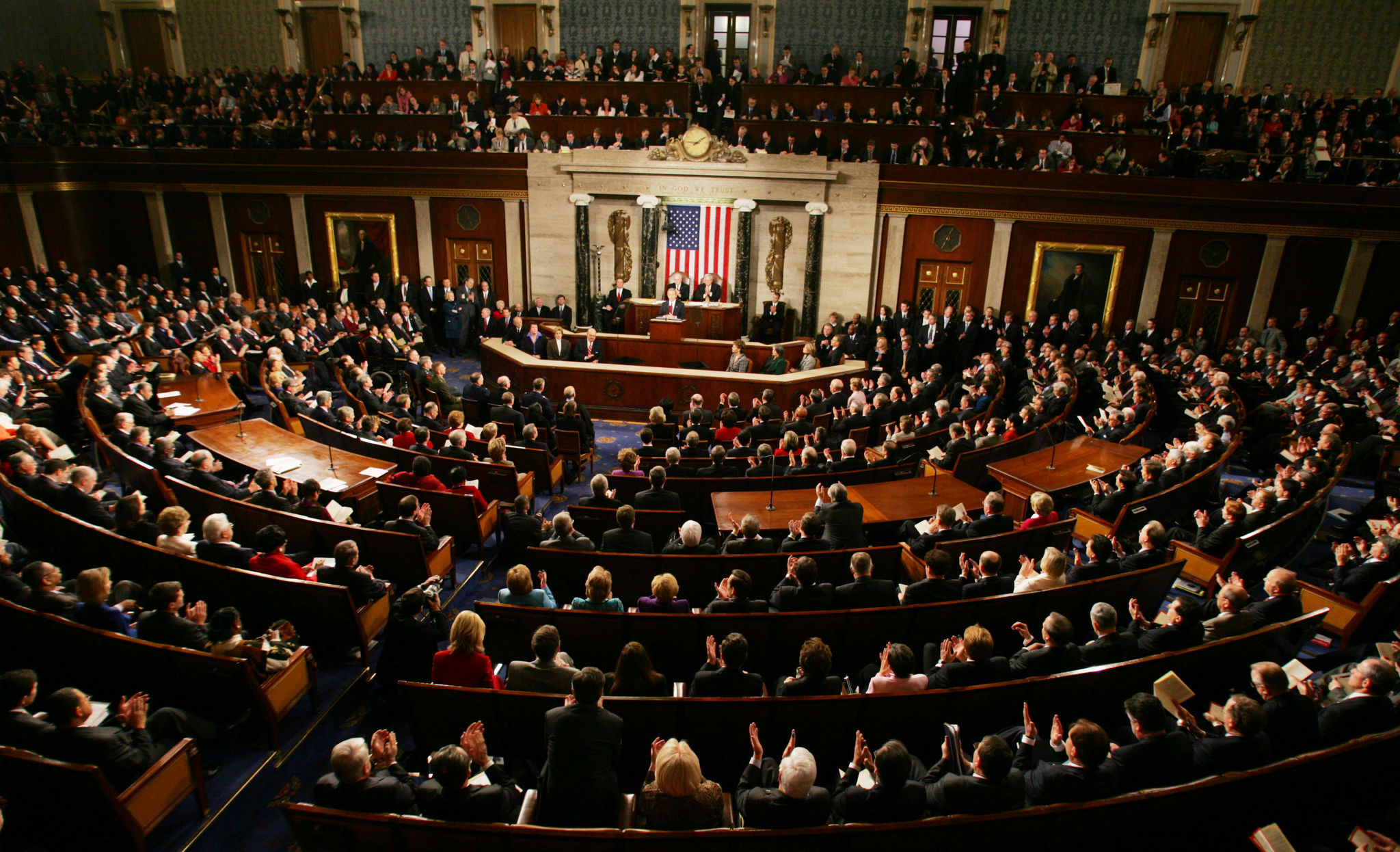

This week the House of Representatives passed a sweeping financial reform package that would deter, in part, some of the most egregious practices of the financial and mortgage industries. In essence, it would curb, or try to curb, some of the sub-prime and other “exotic” mortgage products as well as create a bit of transparency for the average consumer of these products — home buyers. Yes, there is a ton of other stuff in the bill. Consumer protection against “smoke and mirrors” credit card fees and the like. However, it is the mortgage stuff that caught my attention and the rabid (and rapid) response of the “‘Just Say No’ to Everything” party.

This week the House of Representatives passed a sweeping financial reform package that would deter, in part, some of the most egregious practices of the financial and mortgage industries. In essence, it would curb, or try to curb, some of the sub-prime and other “exotic” mortgage products as well as create a bit of transparency for the average consumer of these products — home buyers. Yes, there is a ton of other stuff in the bill. Consumer protection against “smoke and mirrors” credit card fees and the like. However, it is the mortgage stuff that caught my attention and the rabid (and rapid) response of the “‘Just Say No’ to Everything” party.

Rather than acknowledge that ” …risk management without the management…” bought the entire American economy to it’s knees and required massive Government intervention to prevent total economic meltdown, the financial industry along with their Republican allies in the Congress are prepared to spend whatever it takes to stop the bill from becoming law. Excuse me? Has anyone been awake for the last three years?

Big banks and other enormous “too big too fail” financial institutions played fast and loose with mortgages and people’s home and shelter in the name of “capitalism” and making the really big bucks. When they failed — and, by the way, they did fail — they came crawling to their kindly Uncle Sam for billions in bailout dollars. When the new majority stock holder balked at the gargantuan bonuses these gamblers were demanding to try and repair the damage, the money boys — nary a girl in sight — threw a tantrum. Now, that the Government wants to implement some oversight to make sure this sort of thing doesn’t happen again, they’re really throwing a hissy fit.

The Wall Street lobby machine is being oiled and greased to stop what, in many ways, is modest reform.

Don’t Worry. There’s Still Time to Stop the Bus.

Since this has really only passed the House of Representatives, it still needs to go through the Senate and, perhaps, a conference committee before it reaches the President’s desk for signature and enactment. My guess is that it won’t make it through the Senate. There will be lots of talk about self-policing and free markets and yadda, yadda, yadda.

The lobbyists will be out in full force and the members of the Senate from the “‘Just Say No’ to Everything” party along with Joe Lieberman will put a halt to any meaningful reform. Unfortunately, the Democratic majority in the Senate is not as large as it is in the House and it’ll be easier to slow it, morph it or outright kill it.

Can I Have That 100%, Interest Only, No Doc, Neg Am ARM at 4.5%, Please

Think that’s a hoot, huh? It really wasn’t that long ago when stuff similar to this was a way of life. Lots of people were making money hand over fist and now we’re all crying the blues. The thing that is wrong with “capitalism” as it is espoused by most of these folks is that it really isn’t about equal opportunity or the mythical “up by our own bootstraps” mentality. It is about the wealthier and better educated preying on those that don’t have a chance in the same arena. This is exploitation and deception in it’s rawest form.

Yes, it’s time for the Government to step in and protect the American nation, as a whole. Financial and mortgage reform is needed and it’s needed now.

“Loves sunrise walks on the beach, quaint B & Bs, former Barbie® boyfriend..." Ken is a sole practitioner and Realtor Extraordinaire in the beautiful MD Suburbs of DC. When he's not spouting off on Agent Genius he holds court from his home office in Glenn Dale, MD or the office for RE/MAX Advantage Realty in Fulton, MD...and always on the MD Suburbs of DC Blog

Missy Caulk

December 13, 2009 at 12:01 pm

And don’t forget where the “right to own a home came from” and who benefited the most from the let everybody buy a house.

I thought those types of loans were already gone? I haven’t been able to find them in my area.

Salaries of GM, Citi, AIG, et all….bonuses…. yea they make me sick. But, not enough to want the government telling them what to make or cutting them. They were not too big to fail and should of been allowed to. Now because “we” bailed them out and in some cases own them, “we” can tell them what to do.

As far as the GFE…I’ve looked at it. Somewhat confusing but for the most part I like the way things are disclosed. Basically we will get used to it. Better for the consumers.

Now if you can find one of those no-doc loans for self employed folks out there anywhere, let me know. We have always used one prior to them being called liar loans and abolished.

Bob Wilson

December 13, 2009 at 12:26 pm

Ken, while your editorials are an entertaining read, what I see is blind faith in one party fueled by disgust for the other. I think it would behoove you to be original instead of a print parody of Rachel Madow and Kieth Oberman. That would require that you do more than regurgitate the same spin and actually do some research. If you did, you would learn that the allies of the financial institutions live on both sides of the aisle and the White House is still cutting back room deals.

Bob Wilson

December 13, 2009 at 12:51 pm

That quote is from an article entitled “Obama’s Big Sellout” published this week on December 9th in Rolling Stone, not exactly the flag bearer of the right.