Net worth slipping away

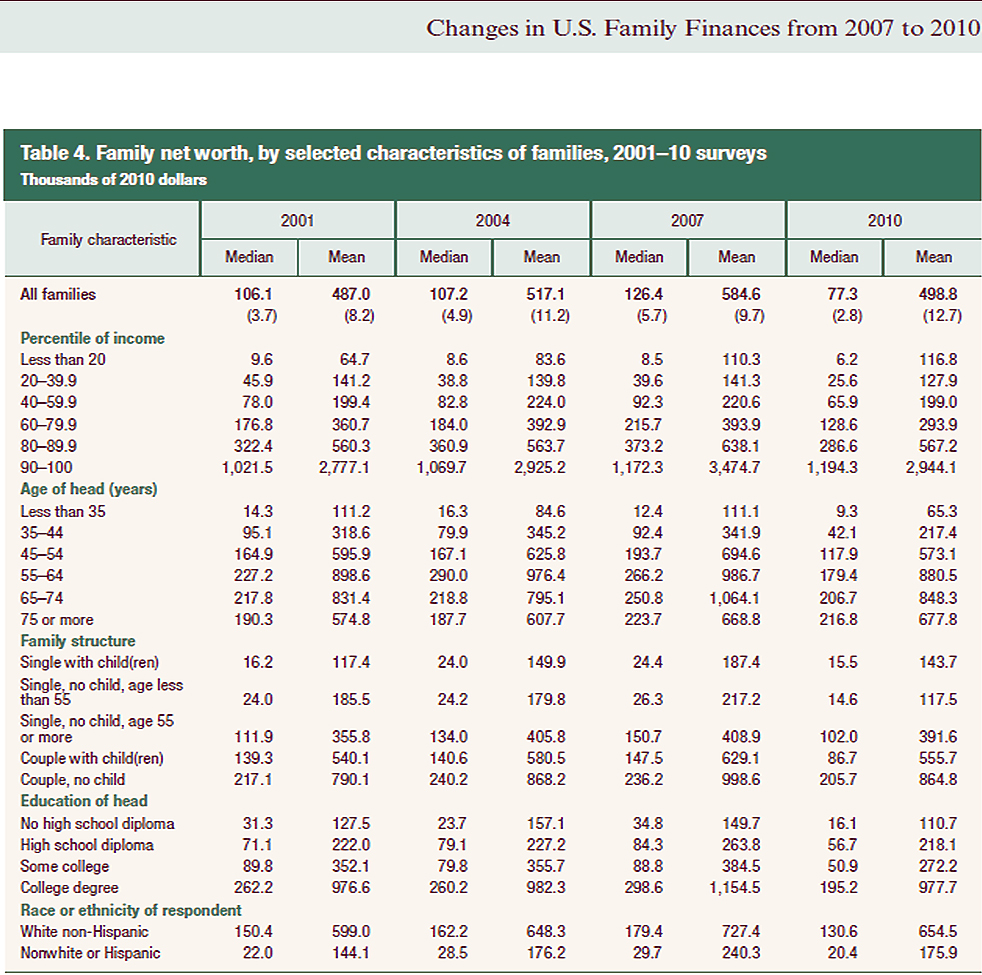

According to the long awaited Federal Reserve Survey of Consumer Finance, the recession has, in fact, hurt American families. The median family net worth plummeted 40 percent from $126,400 in 2007 to only $77,300 in 2010, the last year of the study. The report, released every three years also reveals that the median family income dropped 7.7 percent from $49,600 in 2007 to $45,800 in 2010. Brutal.

Families considered to be middle class were hit the hardest, with those in the 60th to 80th percentile seeing a 40.4 percent drop in net worth – from $215,700 all the way down to $128,600, and families in the 20th to 40th percentile saw a 35.4 percent drop in net worth from $39,600 to a staggering $25,600.

As of 2010, single people over the age of 55 had their net worth drop to nearly 2001 levels, while couples with children were the hardest hit family type, seeing a 41.2 percent drop in median net worth over the three years.

The survey results were expected to be bad, but the final results were staggering, with most Americans’ net worths falling as their property values plummeted during “The Great Recession” as the Fed is calling the economic crisis that some argue is not yet over.

[ba-quote]The survey says, “Families’ finances are affected by both their own decisions and the state of the broader economy. Over the 2007–10 period, the U.S. economy experienced its most substantial downturn since the Great Depression. Real gross domestic product (GDP) fell nearly 5.1 percent between the third quarter of 2007 and the second quarter of 2009, the official period of recession as determined by the National Bureau of Economic Research. During the same period, the unemployment rate rose from 5.0 percent to 9.5 percent, the highest level since 1983. Recovery from the so-called Great Recession has also been particularly slow; real GDP did not return to pre-recession levels until the third quarter of 2011. The unemployment rate continued to rise through the third quarter of 2009 and remained over 9.4 percent during 2010. The rate of inflation, as measured by the consumer price index for all urban consumers (CPI-U-RS), decreased somewhat over the period from an annual average of 2.8 percent in 2007 to 1.6 percent in 2010.[/ba-quote]

Net worth is down, yet spending is up?

Some have already interpreted the report as Americans’ belts loosening and a willingness to spend coming back, but the Federal Reserve survey says, “The share of families with any type of debt decreased 2.1 percentage points to 74.9 percent over the 2007–10 period, reversing an increase that had taken place since 2001.”

Outstanding credit card balances fell 0.6 percent over the three year period, and the survey does reveal spending, but more so to pay down debt than going out on shopping sprees and letting cash flow freely. Also noted in the report is the type of debts carried having shifted. Families with credit card debt declined by 6.7 percent to 39.4 percent, and the median balance of credit card debt fell to $2,600, representing a 16.1 percent decline during the survey period.

The number of credit cards carried by American families fell, with 32 percent saying in 2010 that they now had no credit cards, up five percent in the three years studied.

The middle class has most clearly been at the brunt of The Great Recession’s brutal blow, with all fingers pointing back to the housing market and the homeowners’ plight of continually falling home values. During this election year, it is not expected that any meaningful legislation on housing will pass, but in 2013, it will be interesting to see how statistics like the Fed’s new report play out on the national stage.

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.

David Pylyp

June 11, 2012 at 11:02 pm

Corporate greed and fraud has cut net worth in half, and then we bailed them out….

ThomasABJohnson

June 11, 2012 at 11:40 pm

The private sector is doing just fine losing half it’s net worth according to the President.

The Heddings Property Group, LLC

June 12, 2012 at 11:41 am

Just crazy.

Stephanie L Davis

June 12, 2012 at 12:43 pm

So sad.

Pakistan Real Estate

July 6, 2012 at 3:30 am

Recession has paralyzed every single business across the world. Unemployment and downsizing has affected the working class of US. This is also a big reason that has shaken the net worth of US.