Reality Check?

In reading the multitudinous stories about the Fannie/Freddie bailout/debacle/needed reform/callitwhatyouwill, one of the more stalwart voices in the economic world demonstrated the need for perspective. In Monday’s Wall Street Journal story titled Plan Skirts Housing’s Biggest Troubles, this sentence was striking and bewildering:

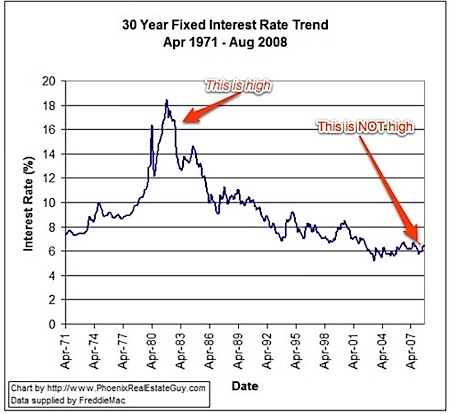

The most immediate change could come in the form of lower mortgage interest rates. They have remained relatively high — above 6% — for much of the past year amid credit-market troubles.

Really? 6% is relatively high? Perhaps to the collective short-sightedness that has been one of the contributing factors to the current housing market shift, but not to those who see housing as a long-term, buy (and live in) and hold investment.

Take a look at the above chart, share it with your colleagues and clients. Relative to the recent real estate market, 6.5% may be considered high, but relative to historical trends, six to eight percent is LOW. Let’s shift the perspective from one that tracks the housing market on a week-to-week and month-by-month basis and recognize that “relatively” 6% is as close to free money as we’re likely to see.

Dad, Husband, Charlottesville Realtor, real estate Blogger, occasional speaker - Inman Connects, NAR Conferences - based in Charlottesville, Virginia. A native Virginian, I graduated from VMI in 1998, am a third generation Realtor (since 2001) and have been "publishing" as a real estate blogger since January 2005. I've chosen to get involved in Realtor Associations on the local, state & national levels, having served on the NAR's RPR & MLS groups. Find me in Charlottesville, Crozet and Twitter.

Ken Brand

September 11, 2008 at 11:47 am

Brilliant.

Thanks,

kb

Bob

September 11, 2008 at 12:12 pm

I started in 1990. When rates dropped below 10%, my broker threw a party.

Benn Rosales

September 11, 2008 at 12:19 pm

Bob, help me with more perspective here, what was the median price when 10% was a good day?

ush

September 11, 2008 at 12:20 pm

The rates may be lower today, but the post does not take into account that cost of homes is much higher, while wages have not increased by the same rate.

If we were to adjust the chart to take the rise in wages factor, one would have a clearer picture, and observe that the combination of rates and home prices make the home buying financing more similar than not, regardless of the rate.

That is, in summary, the % of income remains similar, regardless of the interest rate.

my 2 cents.

Jim Duncan

September 11, 2008 at 12:25 pm

Bob – I’ve had clients who did the same. Imagine that – single digit interest rates!

Ush – I’ll see what I can find.

Thomas Johnson

September 11, 2008 at 1:42 pm

WSJ is referring to the spread between Treasuries and MBS. For some reason they seem to think that after the Chicoms and the Russians threatened Paulson into bailing them out, that the spread will narrow, all is well, no problem my communist friends, you can buy our mortgage backed bonds once more. With the Chinese economy slowing, they may have less appetite for our debt anyway, but I doubt they will give us those narrow spreads for a long time.

Matthew Rathbun

September 12, 2008 at 8:36 pm

Sigh… Jim, I just don’t know anymore. I don’t think a truer thing has been said about all these projections than “shortsighted.”

Everyone seems to being focused on what to do to fix it “right now.” My question is what processes are being put into place to stop this from happening in the future? We’ve had since the Great Depression to determine a way to stabilize rates and make the mortgage debt issue more sold – no one has been able to do it, so how are these analysis able to tell us anything?

I almost think most of them will say anything to get published…

Steve Simon

September 16, 2008 at 6:33 am

Regarding comment #7

Mathew your comment is the key that most have missed (in the Government and the Media).

Not the current problem, but how to avoid a repeat performance in the future.

I have written (on my blog) for months, that they just keep running from one fresh wound to the next with a bandage; rather than changing the direction the industry was moving in…

For two years plus FNMA and FHLMC were in trouble. There should have been money set aside for audit of the loans and docs that were producing these results!

They would have seen much earlier than 2008 that there was significant “Pilot Error” in the banking and appraisal industries.

Fllorida had hundreds of “Air Loans” (listening to the Chief Attorney from the State’s DBPR at a Licens Law Instructor’s Seminar), they told us in some case $300,000 had been loaned on properties that didn’t even exist! No house, no borrower, just a made up file, hence, “Air Loan”!

125% LTV financing, seller downpayment gift to the buyer, it goes on and on…

Just enforce the guidelines that were there, prosecute the fraud and out and out criminal scam and we would be better off in the future.

I have twenty posts discussing the related topics of appraiser regulation and what should have been done on my site, but I see very little designed for long term improvement.

They are dooming us to a repeat of this debacle if they don’t jail a lot of people and let a lot of folks lose what was a foolish investment. Trying to erase a mistake usually creates a bigger mess…