Human behavior often ignored in economic theory

One of my favorite quotes ever was from a citizen of the old Soviet Union. He observed that under Collectivism, “We pretend to work, and they pretend to pay us.”

Darn us humans. We tend to go on learning curves, don’t we? Put a three year old in a corner of the room, a ‘timeout’ if you will, for behavior you wish to discourage, and they learn not to repeat it over time. We tend to go towards pleasure and away from pain. Who knew? Apparently many countries, or at least some of their leaders over the last couple centuries.

Human behavior is the one factor so many economic theories must ignore, even quash. Collectivism and its many variations is, and has been the prime example. Tell folks they’ll get a roof over their heads, and food in their bellies regardless of how much they add to the economy and watch what happens. Production falls and slacking becomes a national sport. Don’t wanna go out on a limb, but maybe that’s the reason Cubans courageously risk life and limb to get to Florida, and not the other way around.

On the other hand, honor increasing production with ever increasing rewards, and suddenly you’re experiencing surpluses out the ying yang. Seems when hard, effective work is rewarded in direct proportion to the quality/quantity of results, behavior is magically modified. What’s even more impressive is that the behavioral change was born of free will. Motivation that originates from within is powerful, and positively so.

Let’s use real estate agents as an example

Unlike most folks, agents don’t have the security born of a weekly paycheck. As we all know, most paychecks received are based on performances that vary from week to week, sometimes wildly.

Though in the end employers will fire an employee consistently failing to produce at least the minimum standard for results, paychecks get cashed till that day of reckoning comes. Not so in real estate.

Produce empirical results or perish.

Pretending to work will get them the same pay as the Soviet citizen quoted above. There’s no middle ground, no place to hide a pathetic work ethic. Work hard but still no results? No paycheck. Agent behavior producing closed transactions for their clients produces commensurate paychecks. Go figure — paying only for successful results tends to modify agent behavior.

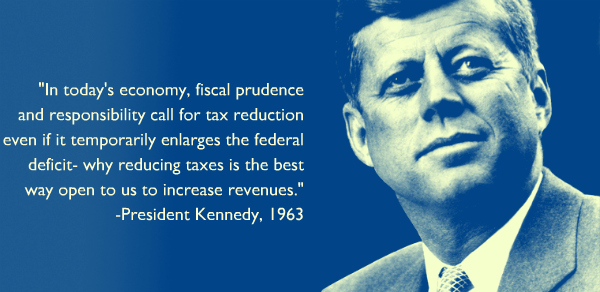

IRS impacting behavior? JFK’s take

Does the Internal Revenue Code impact Americans’ behavior — even the economy’s performance?

John Kennedy apparently thought so, and on both counts.

- “Lower rates of taxation will stimulate economic activity and so raise the levels of personal and corporate income as to yield within a few years an increased – not a reduced – flow of revenues to the federal government.” – John F. Kennedy, Jan. 17, 1963, annual budget message to the Congress, fiscal year 1964

- “In today’s economy, fiscal prudence and responsibility call for tax reduction even if it temporarily enlarges the federal deficit – why reducing taxes is the best way open to us to increase revenues.” – John F. Kennedy, Jan. 21, 1963, annual message to the Congress: “The Economic Report Of The President”

- “Our tax system still siphons out of the private economy too large a share of personal and business purchasing power and reduces the incentive for risk, investment and effort – thereby aborting our recoveries and stifling our national growth rate.” – John F. Kennedy, Jan. 24, 1963, message to Congress on tax reduction and reform, House Doc. 43, 88th Congress, 1st Session. (NOTE: Emphasis mine, as it denotes intended behavior modification)

- “A tax cut means higher family income and higher business profits and a balanced federal budget. Every taxpayer and his family will have more money left over after taxes for a new car, a new home, new conveniences, education andinvestment. Every businessman can keep a higher percentage of his profits in his cash register or put it to work expanding or improving his business, and as the national income grows, the federal government will ultimately end up with more revenues.” – John F. Kennedy, Sept. 18, 1963, radio and television address to the nation on tax-reduction bill. (NOTE: Again, emphasis mine. JFK believed lower taxes would ultimately produce higher revenues to the Treasury, which indeed happened)

Ronald Reagan’s view

Ronald Reagan believed Kennedy had this right, as he did the same thing in spades, much more aggressively, about 20 years later. He cut the top rate for personal income taxes from 70% to about 28%. The economy exploded. The tax revenues from personal income taxes and business income taxes (also cut) increased by massively from the day Reagan took office till the day he left office.

A bit of astounding trivia: JFK reduced the top rate to 70%. How many of you knew it had been approximately 90.5%! Geez, makes me wanna go out ‘n make another $100,000 for the privilege of keeping a whole $9,500 – BEFORE state taxes.

What about Americans’ behavior in today’s economy?

Both businesses and households are voting with their feet. How so? They’re moving from states they perceive to be tax happy, and prone to bleeding business in general, (Hey California!) to states that tax less and openly welcome business and business expansion/growth.

In other words, they’re changing their behavior. Check the states losing businesses and population. If you live in California and make roughly $150,000, your state income tax bill alone will likely exceed $9-10,000! Add fed taxes and you can see why many Golden Staters are now in Idaho, Texas, Florida, and the like. Even more important, former California employers and now just that — former.

They voted with their feet too. How else do ya think we got saddled with the Governator? His predecessor was far worse. That’s why he was hounded from office. Even those who insist on bleeding the golden goose of business realize they can’t bleed him dry.

Does anyone honest believe the tax code doesn’t influence business and individual behavior? Some think there’s now evidence of at least one such person.

Jeff Brown specializes in real estate investment for retirement, has practiced real estate for over 40 years and is a veteran of over 200 tax deferred exchanges, many multi-state. Brown is a second generation broker and works daily with the third generation. With CCIM training and decades of hands on experience, Brown's expertise is highly sought after, some of which he shares on his real estate investing blog.

Lani Rosales

April 13, 2011 at 2:10 pm

Jeff, this is a really great commentary on how we've gotten to where we are. We cover economics from a real estate perspective every day here but rarely get to take into account the weight of the bigger picture from a historical perspective.

I love how you've juxtaposed Kennedy and Reagan, I can't wait to see what others think…

Joe Loomer

April 13, 2011 at 3:12 pm

Great post Jeff, love your stuff.

Navy Chief, Navy Pride

Jeff Brown

April 13, 2011 at 3:14 pm

Thanks Chief.

Kim Hannemann

April 13, 2011 at 3:51 pm

You might want to check your facts.

"Ronald Reagan . . . cut the top rate for personal income taxes from 70% to about 28%. The economy exploded. The tax revenues from personal income taxes and business income taxes (also cut) increased by massively from the day Reagan took office till the day he left office."

Not so. See krugman.blogs.nytimes.com/2008/01/17/reagan-and-revenue/. This myth about an explosion of tax revenue following the Reagan cuts is thoroughly discredited.

ken brand

April 13, 2011 at 4:28 pm

Well said. Who can argue?

Jeff Brown

April 13, 2011 at 4:31 pm

There are many who'll still argue, even though it's akin to pleading the case for the dryness of water. The Office of Management and Budget has all the numbers. Facts are facts.

Al Lorenz

April 13, 2011 at 6:58 pm

I should have noticed the author in the beginning! Great stuff Jeff.

Jeff Brown

April 13, 2011 at 7:23 pm

Much appreciated, Al.

Missy Caulk

April 14, 2011 at 6:36 am

So glad you posted this, I am reading Reagan An American Life right now. I have underlined so many passages. It is amazing how many things happening today were happening back when he ran, was elected and got the economy stimulated again. I feel I am ready history, the only difference is the interest rates were high then and low now.

He sent to Congress a bill, calling for a 30% ACROSS THE BOARD tax cut for 30 years.Seems fair to me instead of all the bickering over cutting this, not cutting that going on now.

Bottom line when you give up a large % of your income in taxes, incentive to work goes down.

Jeff Brown

April 14, 2011 at 10:32 am

Hey Missy — "He sent to Congress a bill, calling for a 30% ACROSS THE BOARD tax cut for 30 years."

And the majority leaders of the House/Senate sent it back in a hearse with a joke wreath that said D.O.A. 🙂

Missy Caulk

April 14, 2011 at 12:51 pm

But, he took it first to the American People something he was known for and they loved it. He did go on to cut needless programs out of a 80 Billion dollar budget deficit that year.

It took time, like it will with where we are now. But, the spending must end.