Small things go unnoticed

In our busy day-to-day lives, we often overlook the small things. However, those seemingly “small” things sometimes turn out to have large significance.

![]()

Many are diligent about keeping track of their spending and finances. But, sometimes, this can be one of those small things that we overlook.

A helping hand

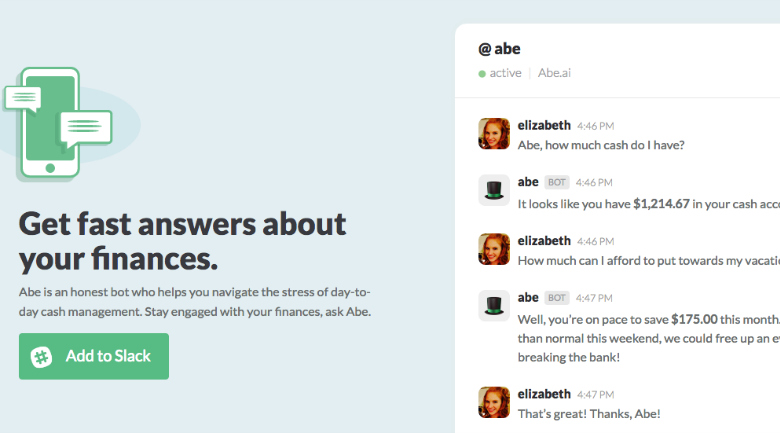

Luckily for us financial ne’er do wells, there is now something designed to help us track our spending. Meet Abe.

Abe is a chatbot designed to help keep track of your finances.

The bot lives within Slack, where you are able to send him a private message.

“Abe allows you to get fast answers about your personal finances. A bot for your money on Slack, SMS, Facebook’s Messenger, and Amazon’s Alexa,” says Abe developers.

Honest Abe

With this technology, you are able to connect all of your financial accounts. Then, you are able to ask Abe questions about your money.

Based on his top hot logo symbol, Abe is designed to be as honest as his assumed namesake. He lives to help navigate the stresses of day-to-day cash management.

How Abe operates

An example chat conversation with Abe shows his ability to answer questions and give financial advice.

elizabeth 4:46 PM

Abe, how much cash do I have?

abe BOT 4:46 PM

It looks like you have $1,214.67 in your cash accounts!

elizabeth 4:46 PM

How much can I afford to put towards my vacation?

abe BOT 4:47 PM

Well, you’re on pace to save $175.00 this month. If you spend $25.00 less than normal this weekend, we could free up an even $200.00 without breaking the bank!

elizabeth 4:47 PM

That’s great! Thanks, Abe!

Other capabilities

Some other questions Abe is able to answer include: What can I afford?, What did I spend last week?, When is my credit card bill due?, How much credit do I have?

As previously stated, Abe currently housed in Slack but is expected to grow in order to work with SMS, Facebook Messenger, and Amazon Echo.

Bank-level security measures are used to ensure the safety of a user’s personal and financial information.

Who is this beneficial for?

While this may seem like an easy thing to track alone, Abe can definitely be helpful for those who are not familiar with online financial tracking information. Abe can also be helpful for younger individuals who are learning how to build credit and track spending.

#HonestAbe.AI

Staff Writer, Taylor Leddin is a publicist and freelance writer for a number of national outlets. She was featured on Thrive Global as a successful woman in journalism, and is the editor-in-chief of The Tidbit. Taylor resides in Chicago and has a Bachelor in Communication Studies from Illinois State University.

Pingback: Cleo app wants to to be your robot financial assistant - The American Genius

Pingback: The most dynamic way to chart and track your goal progress - The American Genius

Pingback: Become the person that is good with money without a lobotomy - The American Genius