Small business benefits on a budget

Modern employees are dynamic and so are their family and home situations. Every employee has different needs, and those needs can actually affect their work performance, both negatively and positively. It all depends on if those needs are being met appropriately. As an employer, you can provide those everyday solutions to your employees and their families.

Offering health benefits is great, but not every company can afford to do that. No matter if you offer medical benefits or not, there is something that every business can offer its employees that can improve productivity.

When your small business can’t afford benefits or wants to add more

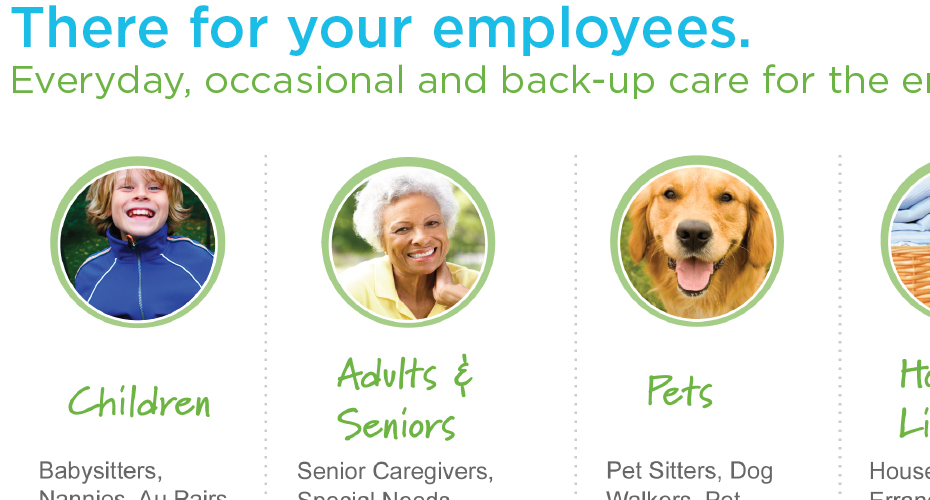

Your employees have elderly parents, children, and beloved pets. If your employee has a usual babysitter but that falls through, what are your employee’s options? They can find someone else last minute or they can stay home from work because they have no other option. Care.com gives your employees many more options to consider, including back-up childcare. But the company offers more than just childcare, it includes tutors, special needs care, senior caregivers, pet sitters and dog walkers, and even housesitters and housekeeping.

The truth is that most, if not all of your employees worry about their home lives, including pets and loved ones which can distract from their work. However, by providing one more helpful benefit to their current benefit packages, Care.com says it will increase productivity, as it’s estimated that 60 percent will be able to regain their professional focus, and employee loyalty. They note that 91 percent of employees will feel more positive about their jobs and their employers with these extra benefits.

What it really boils down to is giving your employees peace of mind so they can put some of their worries out of their thoughts. Or perhaps you don’t have the means to provide full medical benefits, free meals, dry cleaning, happy hour every Friday, or trampolines and skateboarding parks in the office, but that doesn’t mean you can’t offer something worthwhile to your employees. Keep in mind that joining Care.com doesn’t mean all those services are covered like an insurance plan. What it provides is access to contact information of background-checked housesitters and babysitters. The cost of the services after that are up to the employees, which some employers will agree to cover.

Alternative small business benefits packages

As an alternative to Care.com, there are additional small business benefits providers that offer affordable benefits packages that include health care, like Aetna for 2-50 employees or MetLife’s small business benefits packages, and business owners should do research not only through Google but by consulting their financial advisor who will know their needs best. Regardless of which avenue you choose as a business owner, providing incentives for employees is shown to produce higher quality job applicants, ultimately meaning higher quality work and production.

The American Genius Staff Writer: Charlene Jimenez earned her Master's Degree in Arts and Culture with a Creative Writing concentration from the University of Denver after earning her Bachelor's Degree in English from Brigham Young University in Idaho. Jimenez's column is dedicated to business and technology tips, trends and best practices for entrepreneurs and small business professionals.