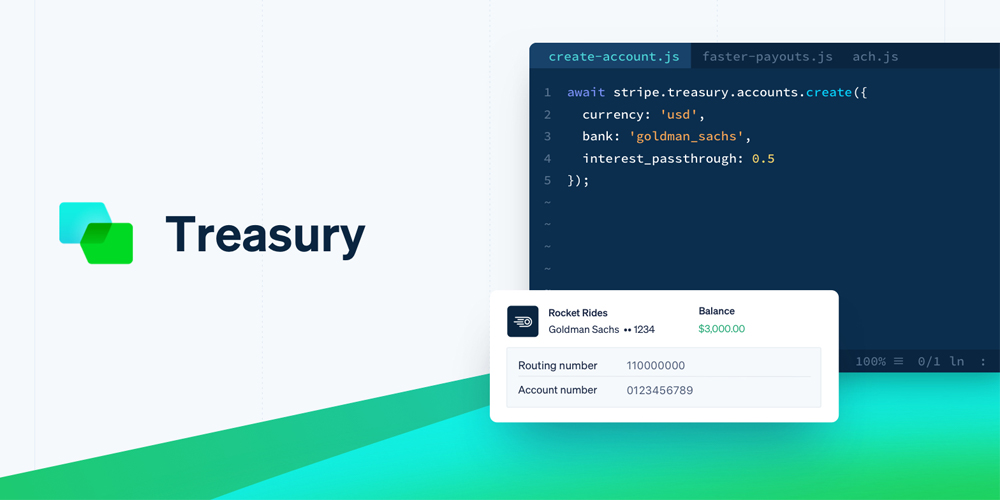

Startup technology company Stripe is bringing banking to the 21st century. Recently, the company released a banking-as-a-service (BaaS) API called Stripe Treasury. This enables Stripe’s platform users to “build a full-featured, scalable financial product” for their customers.

Stripe Treasury lets you embed financial services into your marketplace or platform. In doing so, businesses can create bank accounts for their customers that easily send, receive, and store funds.

For instance, you can create an FDIC insurance-eligible account that earns interest and supports remote check deposit. You can make a one-time payment or set up recurring payments to pay bills. And, you can transfer funds through domestic or international wires.

“Everything about running an online business has been transformed by technology, but business banking has largely been left behind,” said Karim Temsamani, Head of Banking and Financial Products at Stripe. “But we’re changing this, just like we set out to change payments a decade ago. Offering a user-centric banking experience should be as easy as spinning up a virtual server—that’s what we’re starting to accomplish at Stripe with our bank partner network.”

By partnering with a network of global banks, Stripe Treasury can make it easier for businesses to embed banking services into their platform. Currently, Stripe’s partner network includes Goldman Sachs Bank USA and Evolve Bank & Trust as US partners, and Citibank N.A. and Barclays as global expansion partners.

According to recent Stripe research, accessing financial services for businesses today is an extensive process. To set up a bank account, it can take online businesses an average of seven days. To open an account, about 23% of businesses need to send over a fax, and about 55% of businesses are required to physically visit a branch to open an account.

From the research, Stripe also received feedback from users wanting a “digital solution for financial services” they can use directly from the software platform that powers their operations. So, Stripe Treasury is Stripe’s way of removing some of those barriers to create a solution.

“Together, Stripe and Goldman Sachs are focused on relieving the frustrations internet businesses find in making banking work for them,” said Hari Moorthy, Goldman Sachs Global Head of Transaction Banking. “The millions of ambitious, fast-growing businesses in the Stripe ecosystem will soon discover a dramatically improved end-to-end digital banking experience.”

Right now, Stripe Treasury is still invite-only, but it does have one big user. Major e-commerce platform Shopify will be the first to partner with Stripe Treasury. It will use the BaaS API to power Shopify Balance, the company’s business account built for independent businesses and entrepreneurs.

“At Shopify, we’re focused on reducing the barriers to entrepreneurship. As part of that mission, we will soon launch Shopify Balance to empower our merchants to take control of their finances,” said Tui Allen, Senior Product Lead for Banking at Shopify. “We’re excited to partner with Stripe to provide our merchants with critical financial tools and products for their banking experience, specifically designed for their businesses’ financial needs.”

With Shopify Balance, Shopify customers can open a bank account directly through Shopify. And, Shopify Balance will include a one-stop-shop account within the Shopify admin. Customers will be able to view cash flow, pay bills, and track expenses.

Shopify Balance will also have a Shopify Balance Card. With these physical and virtual cards, merchants can make a purchase in-store, online, or through their mobile wallets. They will even be able to withdraw money from ATMs. Additionally, there will be plenty of perks like cashback and discounts on everyday business spending.

The financial services Stripe Treasury offers do look like they can help businesses minimize the lengthy process used today to complete everyday banking needs. It might also create a new revenue stream for businesses by allowing them to perform like a bank.

Veronica Garcia has a Bachelor of Journalism and Bachelor of Science in Radio/TV/Film from The University of Texas at Austin. When she’s not writing, she’s in the kitchen trying to attempt every Nailed It! dessert, or on the hunt trying to find the latest Funko Pop! to add to her collection.

Pingback: This app simplifies your website's growth and marketing

Pingback: You know what fintech is, but do you know what embedded fintech is?