The problems plaguing the housing sector

According to the Realtors’ Confidence Index survey released this morning by the National Association of Realtors (NAR), the real estate sector continues to be plagued not only with tight lending conditions, but “a sizeable share of real estate appraisals [that] are holding back home sales.”

The Association is careful to note that most appraisers are “competent and provide good valuations,” but that appraisals typically lag market conditions, adding that the appraisal process has changed in recent years, causing problems such as the use of out-of-area valuators (which the NAR says are “without local expertise or full access to local data, inappropriate comparisons, and excessive lender demands”). In addition, before the beginning of last year, some lenders’ loan processors edited valuations, cutting them by a certain percentage.

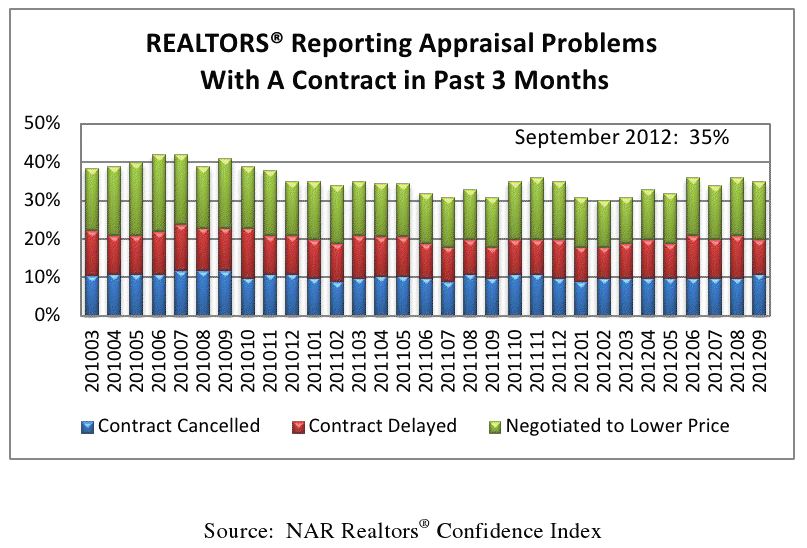

Fully 35 percent of Realtors surveyed in September report contract problems relating to home appraisals; 11.0 percent pointing to a cancelled contract due to an appraisal coming back lower than the price negotiated, while 9.0 percent report contract delays, and 15.0 percent said a contract was renegotiated to a lower sales price due to a low valuation. NAR says these findings “are notable given that homes in many areas are selling for less than replacement construction costs.”

Lawrence Yun, NAR chief economist, said there has been a steady level of appraisal issues for quite some time. “Though the real estate recovery is taking place, the combined issues of stringent mortgage lending requirements and appraisal frictions are hampering otherwise qualified buyers from purchasing a home in a timely fashion, and in some cases are preventing them from buying at all,” he said.

According to NAR, major problems reported by Realtors include:

- Some appraisers are using foreclosures, short sales and run-down properties as comparable homes, and are not making adjustments for market conditions or the condition of the property.

- Appraised values that do not reflect market conditions such as rising prices, the presence of multi-bidding and low inventory.

- Appraised values are very inconsistent and fluctuate widely.

- Out-of-town appraisers, who are not familiar with the area or local market conditions, are being used.

- Turn-around time by both appraisers and banks is slow, which delays closings.

The problems plaguing these appraisals

The trade group expresses concern that some appraisers working for an Appraisal Management Company (AMC) are operating under strict and limited parameters due to bank lending criteria, “which appears to be related to banking regulations or risk aversion on the part of the lender.” Furthermore, unreasonable “put back” risks imposed by Fannie Mae and Freddie Mac could also cause banks to set unrealistic requirements for appraisers.

Additionally, some appraisers do not currently distinguish between distressed and non-distressed properties when making comparisons for valuation purposes, despite NAR data revealing a typical foreclosure sells for a 20 percent discount, and short sales average a 15 percent discount, which NAR says is often the result of valuations made by appraisers “lacking local expertise,” who not only live outside of the market of the property being appraised, but lack full local MLS data.

NAR’s “long-standing policy” on appraisals

NAR President Moe Veissi said some appraisal practices lack common sense. “Our long-standing policy is that all appraisals should be done by licensed or certified professionals with local expertise, which also is what Fannie Mae and Freddie Mac recommend, but clearly this isn’t practiced universally.”

The association advocates an independent appraisal process and enhanced education requirements for appraisers, adding that many appraisers have “faced undue pressure,” whether from an AMC or lender which requires them to complete appraisals requiring up to 10 comparable sales (which almost guarantees the use of distressed sales as comparable properties), or they are required a complete appraisal in an “unacceptably short time frame,” and appraisers are often pressured to complete a scope of work not justified by the fee being offered. “These are major problems,” NAR notes.

“In short, there has been an inconsistent appraisal process leading to disruptive delays for home buyers and sellers,” Veissi said. “All home valuations should be made without undue pressure from any source. Even so, buyers, sellers and agents are free to ask appraisers to consider additional data and to correct errors, or discuss unique aspects of the home, the neighborhood or properties used as comps.”

Despite the appraisal industry’s attempts to adapt, AMCs continue to pressure appraisers. NAR notes that because distressed sales are declining, the ongoing appraisal problems will be alleviated as this inventory drops.

“In the meantime, buyers, sellers and real estate agents need to be aware that there are problems with some real estate appraisals, but also be aware of their rights to communicate with appraisers and lenders about errors or concerns with individual valuations,” Veissi said. “In some cases, a second appraisal may be justified.”

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.

ppiclaims49

October 11, 2012 at 5:00 am

Its good to be here, very nice post, the content is amazing, keep posting friend it will be very helpful for everyone, Thanks for sharing. I really liked it.Thanks And Regards <a href=”https://www.ppisupportline.com/”>ppi claim refunds</a>