June Home Price Index is up

According to CoreLogic’s June Home Price Index (HPI), home prices rose 2.5 percent, representing the fourth consecutive year-over-year increase, and the company is forecasting another year-over-year increase in July of 2.0 percent. Compared to May, home prices rose 1.3 percent in June, also marking the fourth consecutive month of improvement.

Excluding distressed sales, home prices rose 3.2 percent in June 2012 compared to June 2011, while rising 2.0 percent in June 2012 compared to May 2012, the fifth consecutive month-over-month increase. The Pending HPI indicates that July home prices for all types of sales will increase 0.4 percent in next month’s report.

Housing turning the corner?

“Home prices are responding positively to reductions in both visible and shadow inventory over the past year,” said Dr. Mark Fleming, chief economist for CoreLogic. “This trend is a bright spot because the decline in shadow inventory translates to fewer distressed sales, which helps sustain price appreciation.”

“At the halfway point, 2012 is increasingly looking like the year that the residential housing market may have turned the corner,” said Anand Nallathambi, president and CEO of CoreLogic. “While first-half gains have given way to second-half declines over the past three years, we see encouraging signs that modest price gains are supportable across the country in the second-half of 2012.”

Regional performance varied

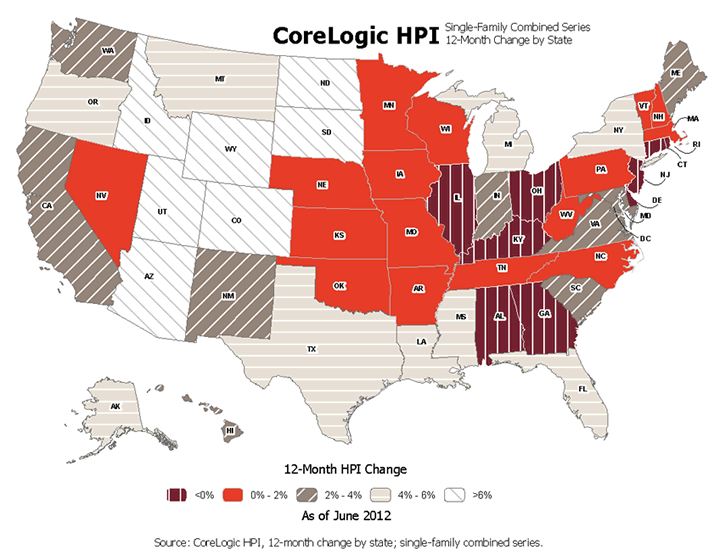

Including distressed sales, the five states with the highest appreciation were Arizona (+13.8 percent), Idaho (10.4 percent), South Dakota (+10.1 percent), Utah (+8.3 percent), and Wyoming (+7.7 percent) and the five with the greatest depreciation were Alabama (-4.8 percent), Connecticut (-4.0 percent), Illinois (-3.4 percent), Georgia (-2.9 percent), and Delaware (-2.8 percent).

Excluding distressed sales, the five states with the highest appreciation were South Dakota (+10.2 percent), Utah (+9.1 percent), Montana (+8.7 percent), Arizona (+8.7 percent), and Wyoming (+6.9 percent), and the five with the greatest depreciation were Delaware (-3.6 percent), Alabama (-3.1 percent), Connecticut (-2.1 percent), New Jersey (-0.9 percent), and Kentucky (-0.4 percent).

The five states with the largest peak-to-current declines including distressed transactions are Nevada (-57.1 percent), Florida (-45.3 percent), Arizona (-44.1 percent), California (-39.2 percent), and Michigan (-39.0 percent).

CoreLogic reports that of the top 100 Core Based Statistical Areas (CBSAs) measured by population, 27 are showing year-over-year declines in June, five fewer than in May.

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.