Existing home sales continue rising, inventory levels continue to tighten

According to the National Association of Realtors (NAR), existing home sales continued to improve in November with low inventory supply pressuring home prices, rising 5.9 percent for the month, spiking 14.5 percent compared to November 2011. NAR reports that sales are at the highest level since November 2009.

Dr. Lawrence Yun, NAR chief economist, said there is healthy market demand. “Momentum continues to build in the housing market from growing jobs and a bursting out of household formation. “With lower rental vacancy rates and rising rents, combined with still historically favorable affordability conditions, more people are buying homes. Areas impacted by Hurricane Sandy show storm-related disruptions but overall activity in the Northeast is up, offset by gains in unaffected areas.”

Median prices, and the impact of distressed properties

The national median existing-home price for all housing types was $180,600 in November, up 10.1 percent compared to November 2011, marking the ninth consecutive monthly year-over-year price gain, which has not happened since September 2005 to May 2006.

Distressed home sales accounted for 22 percent of November sales (12 percent were foreclosures and 10 percent were short sales), down from 24.0 percent in October and 29.0 percent in November 2011. Foreclosures sold for an average discount of 20.0 percent below market value in November, while short sales were discounted 16 percent.

Dr. Yun said, “The market share of distressed property sales will fall into the teens next year based on a diminishing number of seriously delinquent mortgages.”

Inventory levels tightening

Total housing inventory at the end of November fell 3.8 percent to 2.03 million existing homes available for sale, which represents a 4.8-month supply at the current sales pace; it was 5.3 months in October, and is the lowest housing supply since September of 2005 when it was 4.6 months.

Listed inventory is 22.5 percent below a year ago when there was a 7.1-month supply. Raw unsold inventory is now at the lowest level since December 2001 when there were 1.89 million homes on the market.

The median time on market was 70 days in November, slightly below 71 days in October, but is 28.6 percent below 98 days in November 2011. Fully 32.0 percent of homes sold in November were on the market for less than a month, while 20.0 percent were on the market for six months or longer; these findings are unchanged from October.

Buyer types in the market

First time buyers accounted for 30 percent of purchases in November, down from 31 percent in October and 35 percent in November 2011.

All-cash sales were at 30 percent of transactions in November, up slightly from 29 percent in October and 28 percent in November 2011. Investors, who account for most cash sales, purchased 19 percent of homes in November, little changed from 20 percent in October; they were 19 percent in November 2011.

Single-family home sales rose 5.5 percent to a seasonally adjusted annual rate of 4.44 million in November from 4.21 million in October, and are 12.4 percent higher than the 3.95 million-unit level in November 2011. The median existing single-family home price was $180,600 in November, up 10.1 percent from a year ago.

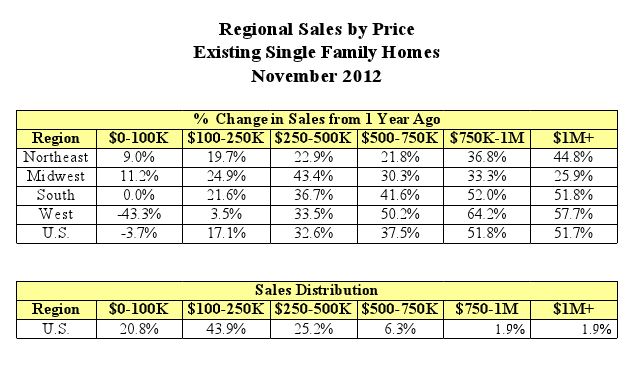

Regional performance varied

Regionally, existing-home sales in the Northeast rose 6.9 percent to an annual rate of 620,000 in November and are 14.8 percent above November 2011. The median price in the Northeast was $232,900, down 2.0 percent from a year ago.

Existing-home sales in the Midwest increased 7.2 percent in November to a pace of 1.19 million and are 21.4 percent higher than a year ago. The median price in the Midwest was $141,600, which is 7.0 percent above November 2011.

In the South, existing-home sales rose 7.9 percent to an annual level of 2.04 million in November and are 17.2 percent above November 2011. The median price in the South was $157,400, up 10.5 percent from a year ago.

Existing-home sales in the West rose 0.8 percent a pace of 1.19 million in November and are 4.4 percent higher than a year ago. With ongoing inventory constraints, the median price in the West was $248,300, which is 23.9 percent above November 2011.

Exercising cautious optimism

As opposed to former eras, the NAR is approaching their future forecasting with cautious optimism. Dr. Yun said that the housing market recovery should “continue through coming years” unless the nation falls off of the “fiscal cliff,” and assuming that there are no further limitations on the availability of mortgage credit.

Dr. Yun pointed to improving existing and new home sales and housing starts as all seeing “notable gains this year in contrast with suppressed activity in the previous four years, and all of the major home price measures are showing sustained increases.”

Many economists agree that there are gains being made in housing, but we urge all to note that these signs of improvement are only signs of improvement, and not an actual recovery, as housing is just now moving past bottoming out and we’re finding signs of life which is hopeful, but not yet a recovery.

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.

Joe Loomer

December 21, 2012 at 7:59 am

Spot on, although sales have increased at the same level here, values are only slowly starting to turn the depreciation corner.

Navy Chief, Navy Pride