Home prices at pre-recession levels

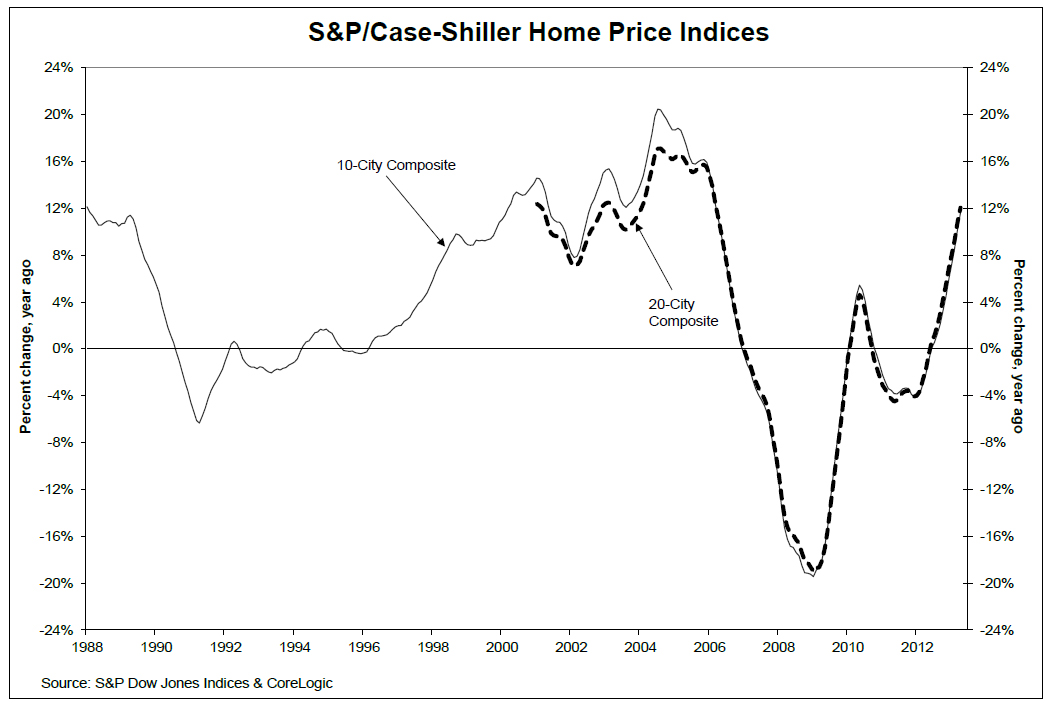

According to the S&P/Case-Shiller Home Price Index released today, home prices jumped 12.1 percent between April 2012 and April 2013, for many cities representing the largest annual gains in history. The Index measures the 10 largest metro areas and the 20 largest, both of which improved roughly 2.5 percent compared to March, marking the fourth consecutive month of positive annual returns.

Atlanta, Dallas, Detroit, and Minneapolis posted their highest annual gains since the index began, and for the month, all cities improved, with Detroit as the only exception.

Broad based housing recovery

Dr. David Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices said in a statement, “The recovery is definitely broad based. The two Composites showed the largest year-over-year gains in seven years.”

“Last week’s comments from the Fed and the resulting sharp increase in Treasury yields sparked fears that rising mortgage rates will damage the housing rebound,” Dr. Blitzer added. “Home buyers have survived rising mortgage rates in the past, often by shifting from fixed rate to adjustable rate loans. In the housing boom, bust and recovery, banks’ credit quality standards were more important than the level of mortgage rates. The most recent Fed Senior Loan Officer Opinion Survey shows that some banks are easing credit restrictions. Given this, the recovery should continue.”

Case-Shiller and runaway appreciation

“Recent economic data on home sales and inventories confirm the housing recovery’s strength,” Dr. Blitzer noted.

Zillow Chief Economist Dr. Stan Humphries observed, “Today’s Case-Shiller numbers may reflect where the housing market has been in some of the frothier metros, but they are not indicative of where it’s headed. The housing market worm has turned over the past few weeks – inventory levels are beginning to show signs of easing, and mortgage interest rates are creeping up. Going forward, both of these factors will help mitigate extreme price spikes caused by very strong housing demand and very low housing supply.”

Dr. Humphries added, “Runaway appreciation in many of the large, coastal metros that form the backbone of the Case-Shiller indices will begin to moderate. Home value appreciation in some of these areas will have to slow down, or potentially fall, as higher bottom-line prices are no longer masked by rock-bottom mortgage rates. In general, the national housing recovery is strong and sustainable, but pockets of volatility will emerge as local fundamentals shift. Buyers expecting home values to continue rising at this pace indefinitely may be in for a shock.”

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.