Home prices rise, says FHFA

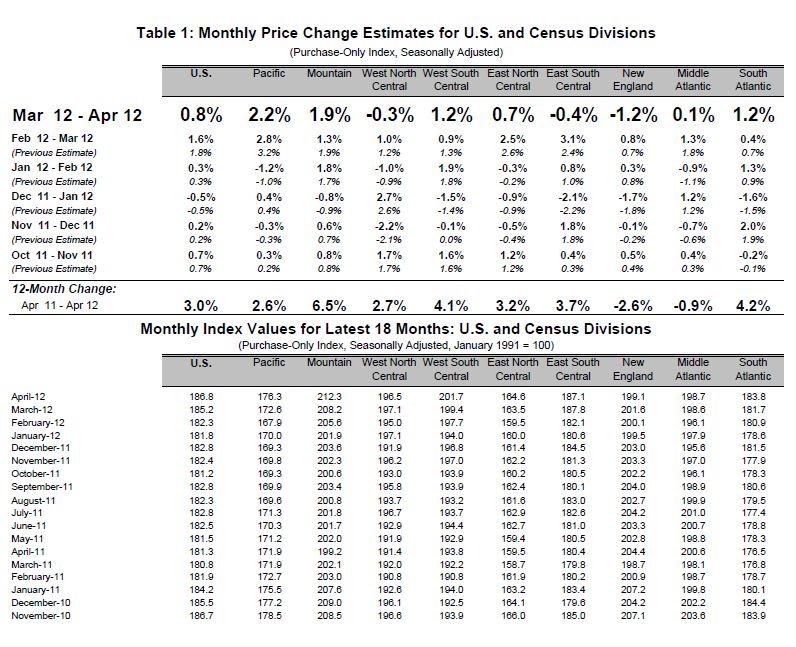

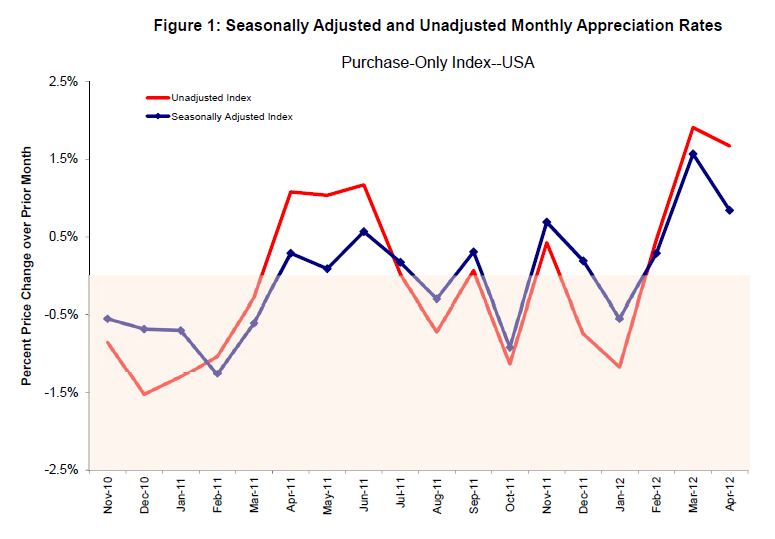

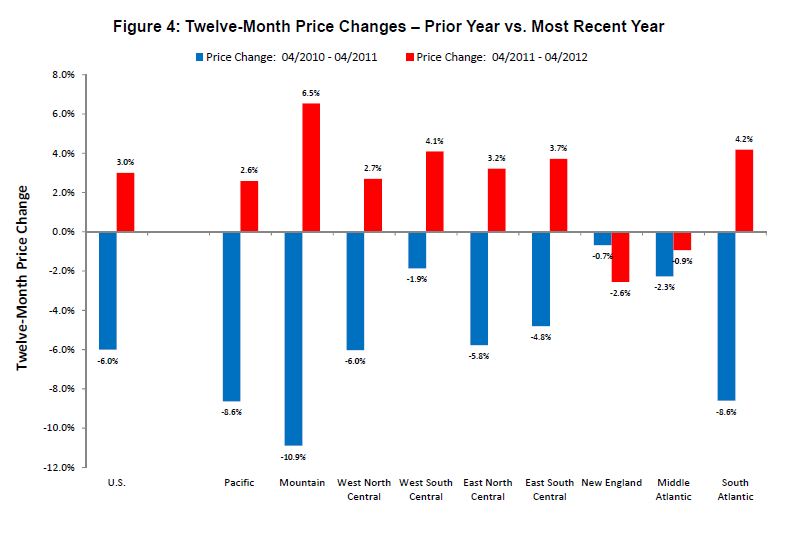

According to the Federal Housing Finance Agency’s (FHFA’s) monthly House Price Index (HPI), home prices rose 0.8 percent between March and April, on a seasonally adjusted basis. Previously, the FHFA had reported a 1.8 percent price increase in March, which has been revised to a 1.6 percent increase. Over the last year, home prices have risen 3.0 percent, the Agency reports.

The results were better than what was forecasted, as economists surveyed by Dow Jones Newswires had only expected a 0.4 percent monthly increase.

Prices, sales, and inventory levels

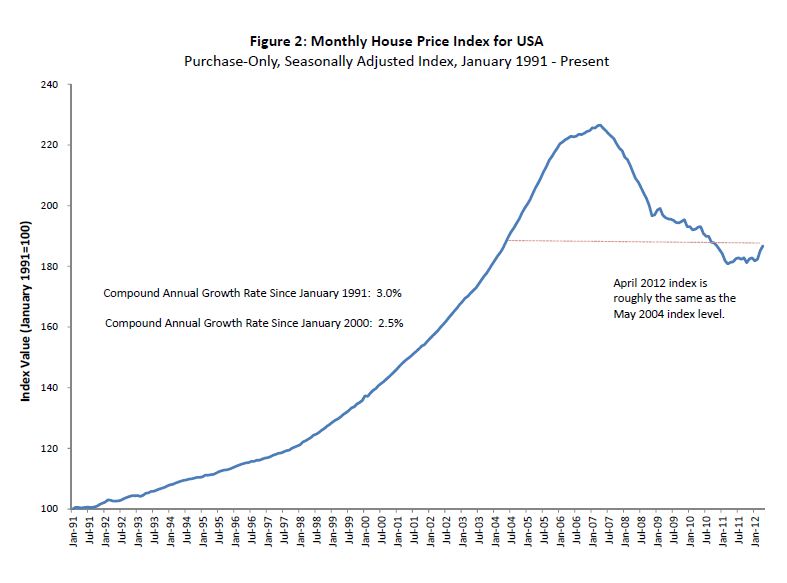

The U.S. index is down 17.6 percent from its April 2007 peak and is now roughly the same as the April 2004 index level. Today, the National Association of Realtors reported that in May, home prices rose, and sales are slowed slightly by tight supply levels.

According to Freddie Mac, the national average commitment rate for a 30-year, conventional, fixed-rate mortgage declined to a record low 3.80 percent in May from 3.91 percent in April; the rate was 4.64 percent in May 2011; recordkeeping began in 1971.

Meanwhile, banks are looking to alternatives to foreclosures that continue to punish home values, as seen in the reduced number of seizures, falling 18 percent between May 2011 and May 2012, according to RealtyTrac.

Call it a comeback?

Speaking to May’s data (one month ahead of FHFA data), the National Association of Realtors’ Chief Economist, Dr. Lawrence Yun said, “The recovery is occurring despite excessively tight credit conditions and higher downpayment requirements, which are negating the impact of record high affordability conditions.”

The FHFA monthly index is calculated using purchase prices of houses backing mortgages that have been sold to or guaranteed by Fannie Mae or Freddie Mac. For the nine census divisions, seasonally adjusted monthly price changes from March to April ranged from -1.2 percent in the New England division to +2.2 percent in the Pacific division.

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.

bobzmiranda

June 25, 2012 at 4:04 am

Some people may decide to refinance out of their existing ARM and into a new ARM loan as a temporary solution for avoiding bigger payments. Use 123 Refinance to find rates.

neighborworkspr

June 25, 2012 at 10:56 am

@CENTURY21 @AGBeat so, now’s the time to buy, but be prepared. contact a neighborworks homeownership advisor – https://t.co/9oJ5Vp3R

Pakistan Real Estate

June 29, 2012 at 3:55 am

The global recession has its consequences on every business all over the world. The real estate business was also one of these businesses. But, nowadays, this business has jumped up again and has taken off the shoal of downfall. This is a positive sign for the people related to real estate businesses. The investment rates of this business are also immensely increasing and soon the real estate market will claim its crown back.