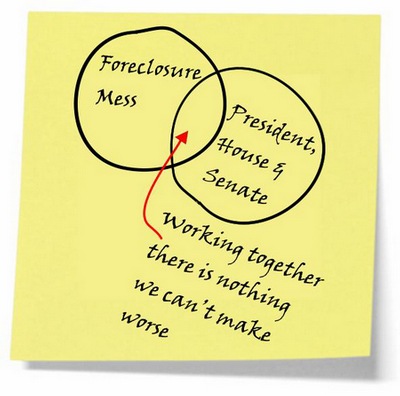

The Homeowner Rescue Bill Rescues Fannie and Freddie Investors. I don’t see any other groups being rescued.

Normally I don’t find it difficult to disagree with President George W. Bush about pretty much everything (save the curvature of the earth and that humans should breathe oxygen). This time it is different. Bush had to have been ashamed to have signed it. Just look at how it is buried on this page. Arizona Senator John Kyl was one of the 13 dissenting votes. Kyl even called a close Realtor friend of mine here in Arizona to explain why he could not vote for it – that it was simply an awful piece of legislation. It is supposed to help save 400,000 people from going into foreclosure. If that was really the purpose, considering how much it will cost (800 billion dollars), It would have been a lot cheaper to have a lottery and simply select the 400,000 supposed lucky ones and just buy their home for them.

But that really isn’t the purpose at all. It is the Fannie Mae – Freddie Mac Bail Out Bill. That is why Bush signed it. He accepted all that other crap so he could do what he had to do to keep Fannie & Freddie afloat. What I don’t understand is why (in the final form it passed in) the NAR backed it. Unless we are to assume that anything that gives any Realtor anything is “good” – no matter the cost, this one just makes no sense.

My office already has had sellers who need to do a short sale either take their home off the market or fail to let agents and buyers show their house. No need. The government is here to help them. If foreclosures are estimated to be in the range of 5.5 million between now and the end of 2010 how does “fixing it” for 400,000 solve anything? And don’t be surprised if there aren’t 400k people (not counting FNMA and FRE stockholders) who get helped at all. I predict less than half of the estimated 400,000 will have anything other than foreclosure or a short sale occur.

The change that will hurt the Phoenix market the most is the complete elimination of the AmeriDream and Nehemiah programs. Effective, October 1st – they are gone. Currently, those seller-funded down payment assistance home sales account for about half of all the homes being sold here. If it had to go away, now of all times? Homeowner Rescue Bill, my ass.

Loads of other stuff. Thanks for nothing, Barney.

Russell has been an Associate Broker with John Hall & Associates since 1978 and ranks in the top 1% of all agents in the U.S. Most recently The Wall Street Journal recognized the Top 200 Agents in America, awarding Russell # 25 for number of units sold. Russell has been featured in many books such as, "The Billion Dollar Agent" by Steve Kantor and "The Millionaire Real Estate Agent" by Gary Keller and has often been a featured speaker for national conventions and routinely speaks at various state and local association conventions. Visit him also at nohasslelisting.com and number1homeagent.com.

Jennifer in Louisville

August 12, 2008 at 4:43 am

Whats not to like…….as an investor: buy a stock, the government (aka American tax payer) covers the downside, and if the stock goes up – you make all the profit. You mean you see a problem with that???!??

But seriously, I absolutely agree. I personally believe that the this latest piece of legislation rewards those that took big risks – and the persons that went the more conservative route (i.e. putting in an actual down payment and not doing 100% financing, going with fixed rate loans, etc) – are the ones footing the bill for the people that took the risks.

Charleston real estate blog

August 12, 2008 at 6:45 am

Russell, it’s election year politics at its worst. And I’ve said for a while that with all the money being thrown around by Washington, the better solution is simply to pay off *everyone’s* mortgage. At least most taxpayers would see a tangible benefit.

Linsey

August 12, 2008 at 8:32 am

The thing that really sends me is NAR’s support. Are they asleep at the wheel?

Bob

August 12, 2008 at 9:14 am

I just got an email from someone upset because she called Countrywide to apply “for the program” and they didn’t have a clue.

As much as this bill stinks, the spin of false hope these weasels put on it is worse.

Eric Blackwell

August 12, 2008 at 10:37 am

Along Bob’s line of thought…we are getting inquiries about the program, yet when they take a closer look at it, they don’t like it. It is the ultimate political “Chinese Food”…you “feel” full…for about 20 minutes…but then what…

Eric

Dan Connolly

August 12, 2008 at 10:52 am

The bill is wrong on so many levels, from the so called first time home buyer “credit” to the reduction of the capital gains exclusions for owners who lived in their home for two out of the last five years…. and yet I have seen virtually nothing about those aspects anywhere in mainstream media.

Bob, Countrywide has it head so far up it’s own a** that it’s not even funny. I had an all cash purchaser who made an offer on one of their listings (almost full price). It took three weeks to get it accepted (verbally), then 3 weeks of emails, phone calls, begging and finally threatening to get a signed contract back and a closing attorney assigned. When the contract finally arrived we had 7 days left on a 30 day closing. The first email we got was from the asset manager telling us we had 7 days left on our contract to close. We closed in escrow and then it took 5 business days to get approval on the settlement statement. 2 weeks after closing we get an email from the manager telling us that they have assigned the file to the attorney (who already closed it) and we had 7 days to close or they would cancel the contract.

Paula Henry

August 12, 2008 at 11:36 am

Russell – you so eloquently speak the truth about the BS of this Homeowner Resue Bill. 🙂 I doubt I will have many, if any sellers actually assisted by this bill.

NAR backing may seem a logical solution if only for the appearance of backing a plan to help homeowners, but when the details are revealed and many homeowners do not get the help they think they will, will the NAR then face the wrath of homeowners who look at our profession and our Association as the ones who could not make it work. You know someone will have to accept the blame when the chips fall. It won’t be the next president.

DPA’s are the one program we needed to keep. Yes, they can often be a pain – but they are good programs. Without looking at all the details, the first-time homebuyer “loan” may be a benefit, but will not replace the DPA’s. We have a similar program here, Indiana Housing, which is a loan to first time homebuyers for downpayment. It has qualification guidelines and stricter than normal Inspection and repair guidelines which can quickly cause a transaction to fall apart when all parties are not aware of the repurcussions of the program. I wonder if we will see such guidelines with the first-time homebuyer program.

Bob

August 12, 2008 at 12:25 pm

Bush had no choice. This isn’t about homeowners or even specifically Fannie and Freddie.

This was a quid pro quo cram down to bailout certain Asian investors who are financing our debt. The payoff for us are sovereign wealth fundslike this one with $29 billion earmarked to take a ton of residential property off the books for maybe 50 cents on the dollar with the goal of getting to the bottom of this mess sooner.

Carolyn Gjerde-Tu

August 12, 2008 at 3:47 pm

The “hope” portion of the bill is also puzzling. Not sure why an existing lender would agree to accept less than what they are owed and not be allowed to stay on as mortgage holder. It is my understanding that the new loan will be for 90% of the appraised current value and has to be a different lender than the current one.

Vicki Moore

August 12, 2008 at 5:02 pm

I’m going to click my heels: There’s no place like home. There’s no place like home. That’ll be just as productive;

Mack in Atlanta

August 13, 2008 at 3:52 am

The estimates that I have seen are that 300,000 buyers will not be able to purchase homes in the next year due to the elimination of seller funded dpa.

Holly White

August 13, 2008 at 11:50 am

Some rescue. Ameridream eliminated and the downpayment requirement was boosted from 3% to 3.5%. Now this is something we can really work with. What a joke.

Paul Francis, CRS

August 16, 2008 at 3:38 am

Personally.. I call it the Lenders Relief Bill myself.. Just like you we also have strapped homeowners here in Las Vegas with a false sense of hope (IMO) that are doing the same thing as yours and counting on the Foreclosure Rescue part of the bill. Which, from what I understand.. there is no requirement for the original lenders to participate in this to begin with…

The only true relief there can be for Las Vegas real estate is to specifically address short sales and come up with a better solution in just letting everybody move on…

Smoke and Mirrors?

Matthew Rathbun

August 16, 2008 at 9:31 am

I would like to have seen this money used to regulate the lender’s reactions to the market. We should be putting requirements on the lenders to respond in more reasonable time frames, to actually workout loan options for those who could be helped (fixed interest rates as opposed to just letting ARM continue to escalate)

Take these funds and hire federal employees to go into the lenders offices and look into why it takes 4 months to get an answer for an offer to purchase for an offer that only requires $10,000 forgiveness from Lender, while they are answering $50,000 less than payoff in two weeks.

Again, use the money not in the form of the a “bail-out” but in the form of temporary oversight of the lenders until this mess clears up!

Joe Manausa - Tallahassee Real Estate

August 28, 2008 at 3:15 pm

Well written and well said Russell. Specifically, the loss of the two down-payment assistance programs is going to hurt all of our real estate markets. These were great programs for people getting into their first home that will now have to wait. The market needs an enema and this bill is only prolonging a blood-letting and perhaps creating a blood-bath.

Steve Simon

September 8, 2008 at 5:36 am

Fannie and Freddie, have been bailed out, its official, but its not enough…

September 8th, 2008

Over the weekend the two largest secondary market (where loans are bought and sold) players in history FNMA (Federal National Mortgage Association) and FHLMC (Federal Home Loan Mortgage Corp.) were officially bailed out and had their leadership axed for new Generals!

great if you’re talking about a quick fix, but not an answer that will work for the long term.

You can read a few hundred more additional words of mine at my blog (you can find it if you really want to 🙂 ), but this really is a band-aid, and election year bandage designed to keep blood off the floor, for now…

Adam

September 19, 2008 at 11:11 pm

As a distress homeowner, I’d like to know how to apply for this bill?

I did call my lender and they said they don’t know yet and you have to wait till October 1st.

I bought my house in June of 2006 for $345k with 10% down, now, the same house just sold for $194k. Whereas, my loan balance is $305k and my mortgage payment eats 48% of my net income.

Does any one has a good advice what can I do?

So far, the only option I see is to walk out, even though, I paid till now $100k between down payment and interest.

Thanks

Bob

September 20, 2008 at 8:52 am

Adam, what state are you in?

Adam

September 20, 2008 at 8:54 am

I live in Orlando, Florida

Bob

September 20, 2008 at 12:32 pm

Talk to an attorney who understands what your options are and can explain the potential consequences of each option. If you need a referral, let me know.