Trulia’s American Dream Survey

Trulia released the results of its American Dream Survey Wednesday, tracking American attitudes toward homeownership since 2008, revealing that 58 percent of Americans think prices will return to their peak within 10 years, 78 percent of renters plan to buy someday, and interest in supersized homes (3,200+ sf) nearly doubled in the last year.

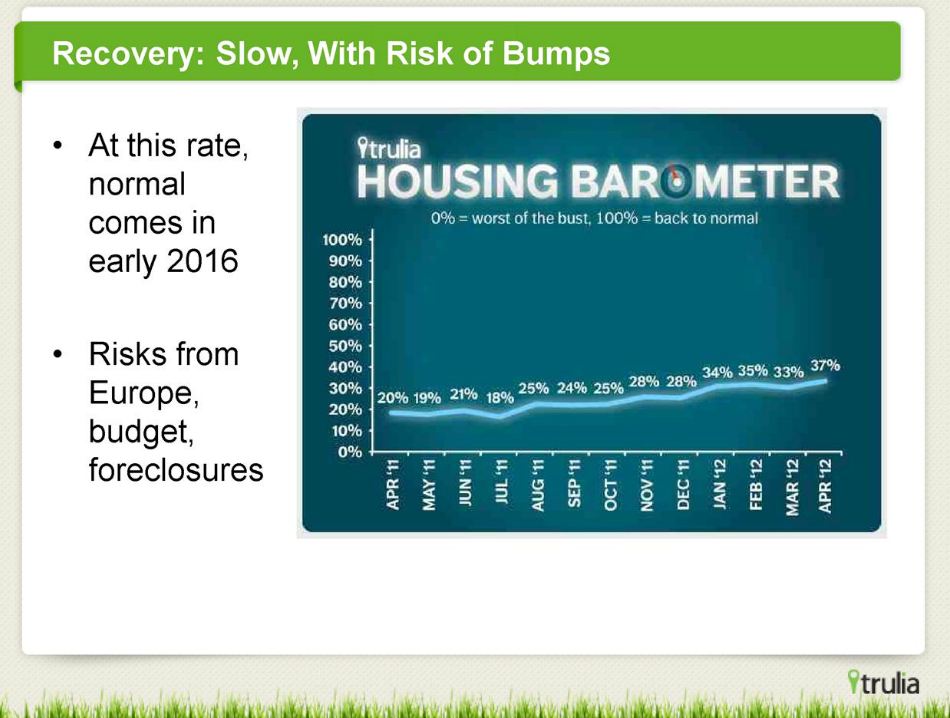

Trulia’s Chief Economist, Dr. Jed Kolko projects that at its current pace of recovery, the housing market will be back to pre-recession normal by 2016, as will the turnaround rate for renters waiting to become homeowners.

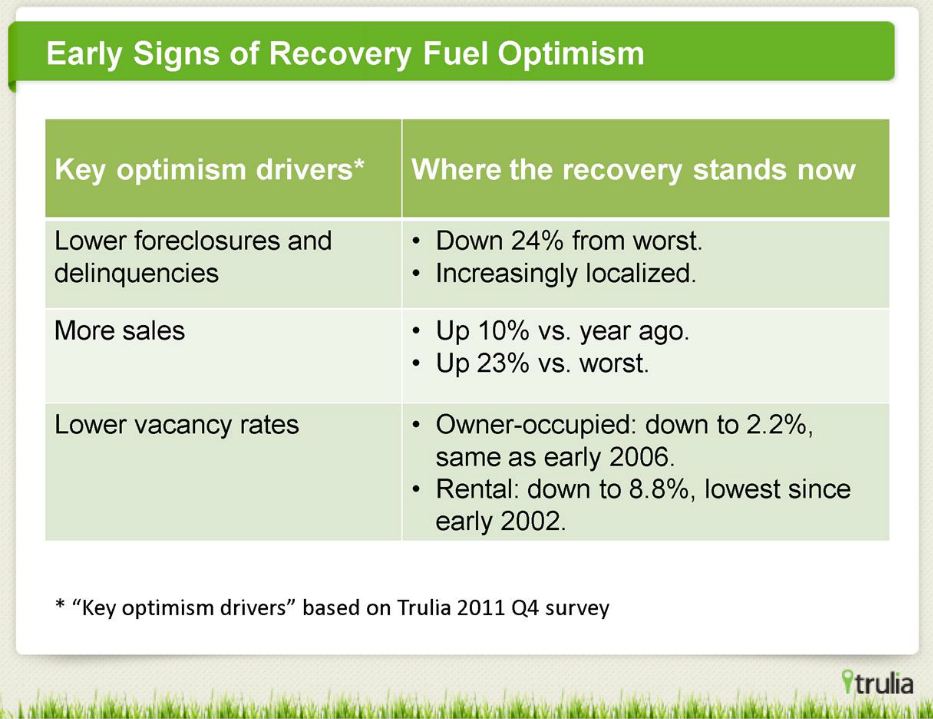

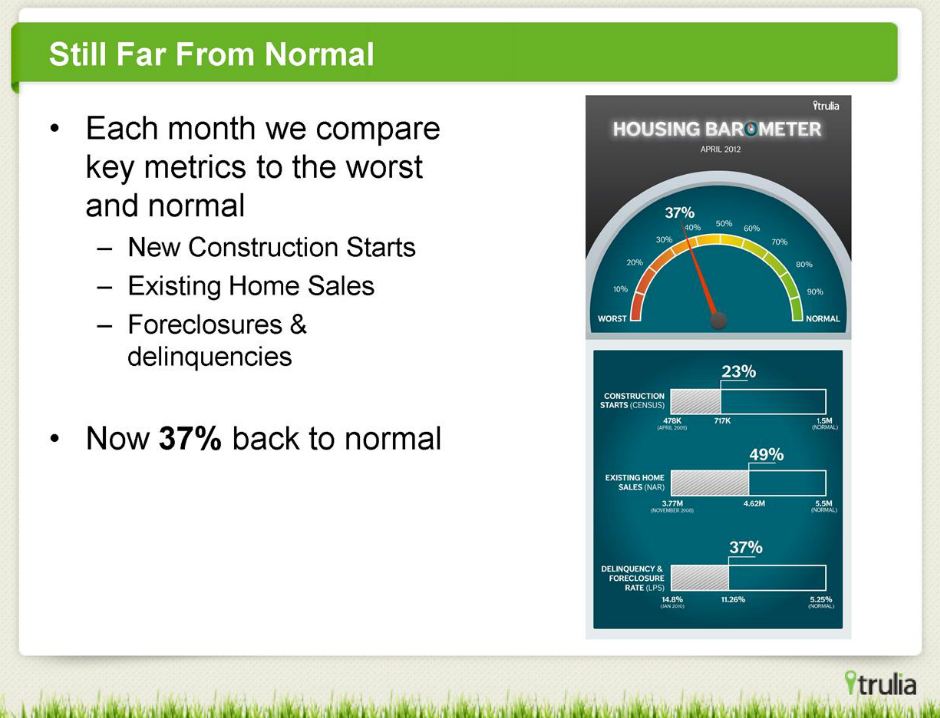

Despite recent reports that the recession cut Americans’ net worth in half, Dr. Kolko reports that there is renewed optimism “for a good reason,” even if there are unrealistic price expectations in the market, particularly in the hardest hit areas. The top three key optimism drivers for consumers are lower foreclosures and delinquencies (which have dropped 24 percent from its worst point during the recession), increased sales (up 10 percent in the last year), and lower vacancy rates (rental vacancies have hit ten year low).

“Optimism is essential for housing recovery,” said Dr. Kolko, “but too much optimism could lead to next bubble. Right now, optimism is outpacing the reality of what is on the market.”

Optimism outpacing the market realities

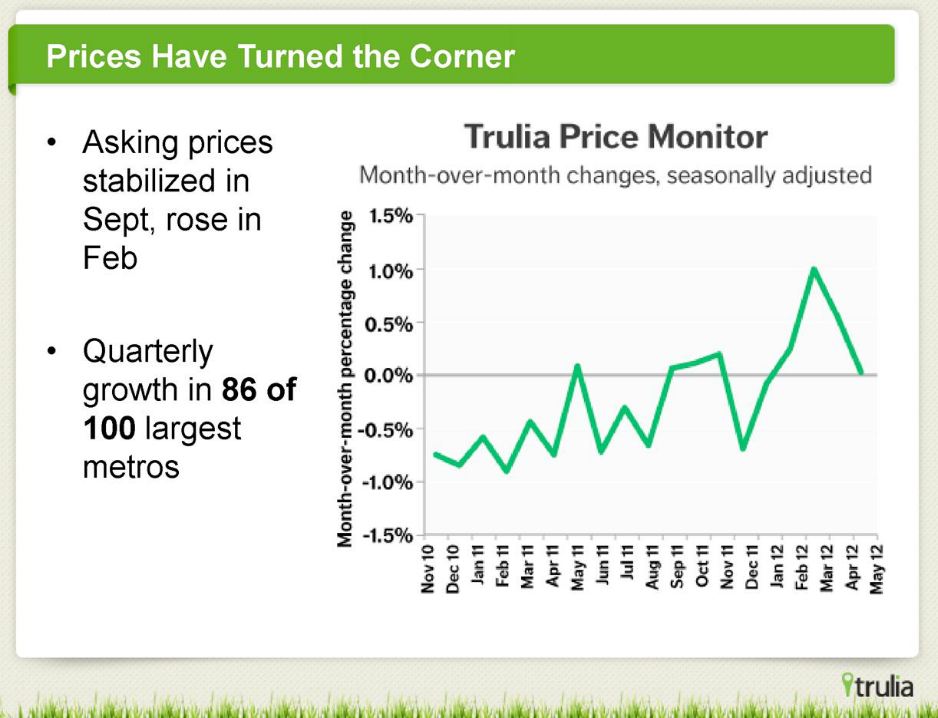

Trulia reports that sales prices of homes on their site have risen quarter over quarter in 86 of the 100 largest U.S. metros as of May, and cites that 61 percent of Americans believe home prices in their local market will rise in the next year.

“American’s hope for a real estate market bounce-back may be too high,” the company reports. “Even though prices in many markets reached unprecedented and unsustainable levels during the boom, 58 percent of Americans believe home prices in their local markets will return to their previous high in the next 10 years.”

Supersize me

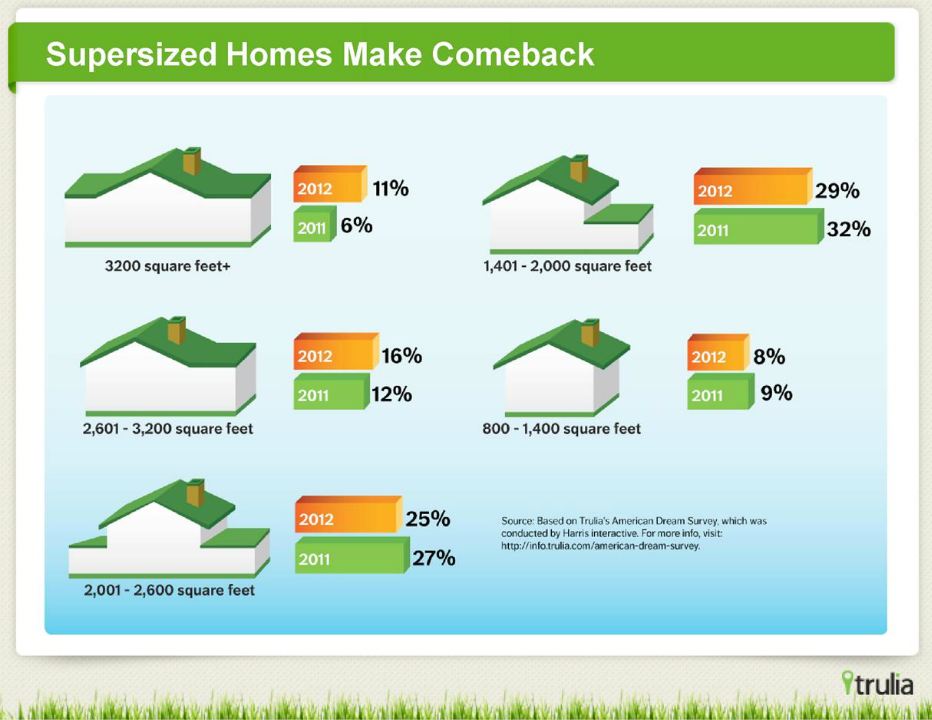

During the recession, Americans got quite realistic about what their next home looked like, and as housing shows signs of improvement, even though slight, the affinity for big homes is on the rise.

According to the survey, more than one in four Americans who believe home ownership is part of achieving their personal American Dream said that their ideal home size is over 2,600 square feet – up from 17 percent in 2011. In fact, interest in homes of more than 3,200 square feet nearly doubled in the last year from 6 percent in 2011 to 11 percent in 2012.

Dr. Kolko noted that “developers are on top of this trend and are responding” by increasing the size once again of new homes being built. We have not seen a dramatic increase in the size of homes built this year, but Dr. Kolko points out that builders are shifting their plans.

Starter home reality check

Homeownership remains central to the American Dream. Fully 72 percent said owning a home is part of achieving their personal American Dream, and the number of renters saying they’ll never buy a home has fallen.

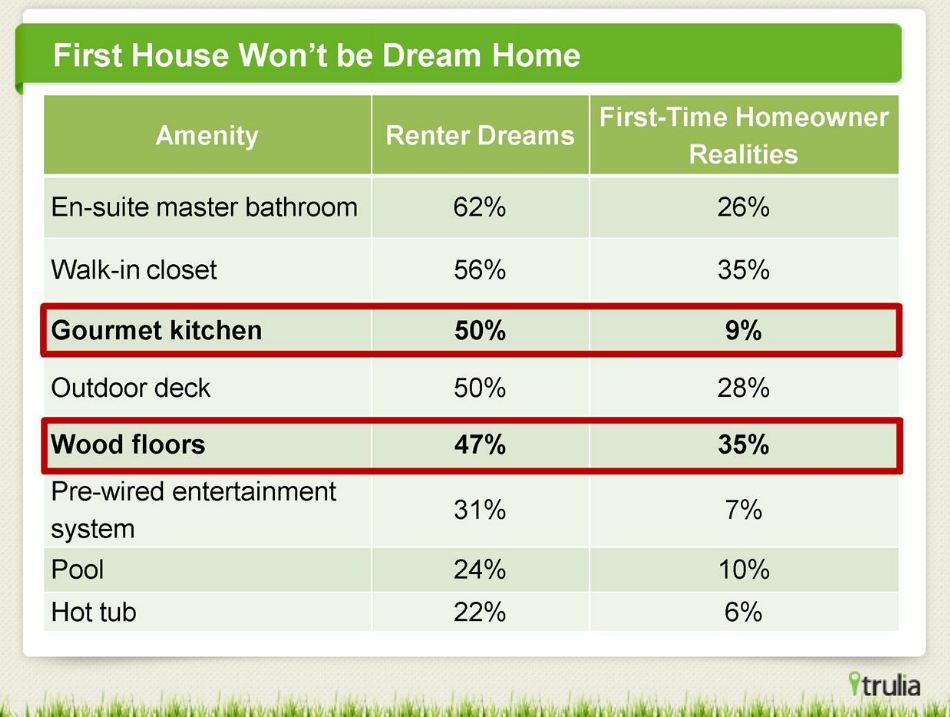

This take us back to unrealistic optimism, as future homeowners were asked what would make them fall in love with a home if they were in the market for a home today. The top amenities were a master bathroom (62 percent), walk-in closet (56 percent) and gourmet kitchen (50 percent), but only 26 percent of homeowners said that they had an en-suite master bathroom in their first home, while just 35 percent had a walk-in closet and 9 percent had a gourmet kitchen.

It is our assertion that these expectations could be set not only by optimism about housing, but with the improving multifamily units coming online, as renters in many markets are getting used to luxury amenities, and wishing for them in their first home. Additionally, overall optimism is naturally fueled by the bargains being found in short sales and foreclosures, setting consumers’ expectations high that they too will get a good deal, then wait out the recovery to gain equity.

Returning to normal by 2016?

“As the economy recovers, people are dreaming bigger, but most won’t realize their dreams anytime soon,” said Dr. Kolko. “Few homebuyers – and even fewer first-timers – can afford 3,000 square feet and a gourmet kitchen. Buyers need to take a hard look at what they can actually afford, and give themselves some cushion in case a Euro crisis or federal budget battle pushes us back into recession.”

Trulia reports that a year ago, housing was at 20 percent of its normal, pre-recession rate, which has risen to 37 percent this year. At the current pace, Trulia predicts a housing recovery, or a return to “normal” to be achieved by 2016, but cautions that the hardest hit cities like Las Vegas may not match the national norms.

Additionally, 78 percent of renters plan to buy someday, but when exactly is “someday” for them? New data from Freddie Mac reveals that 1.5 million households moved to rental units in the last year, and as rents rise, vacancies continue to drop, so how will the market recover as we become a renter nation?

Dr. Kolko tells AGBeat, “Credit is still tight and rising rents are hurting renters’ ability to save for a down payment. Recovery is several years away, and the turnaround rate [for renters to become homeowners] is closer to 2016 as well.”

American Dream Survey

Below are some of the key findings of Trulia’s American Dream Survey:

About the survey: Harris Interactive conducted this online survey on behalf of Trulia among 2,205 U.S. adults, age 18 and over, between May 22 – 24 and among 2,230 U.S. adults, age 18 and older, between June 4-6, 2012.

The American Genius is news, insights, tools, and inspiration for business owners and professionals. AG condenses information on technology, business, social media, startups, economics and more, so you don’t have to.