Roost.Com launched yesterday. It was kind of hard to miss in the RE.net. If you haven’t yet heard about the site. It’s a real estate search portal that at first blush seems similar to what Greg Swann refers to as a member of the “Realty.Bot” family (Trulia, Zillow, Propsmart, Etc.). Benn would refer to them as another tech incursion. It has a slick search interface and is getting quite a bit of buzz

Roost.Com launched yesterday. It was kind of hard to miss in the RE.net. If you haven’t yet heard about the site. It’s a real estate search portal that at first blush seems similar to what Greg Swann refers to as a member of the “Realty.Bot” family (Trulia, Zillow, Propsmart, Etc.). Benn would refer to them as another tech incursion. It has a slick search interface and is getting quite a bit of buzz

Deeper analysis reveals the site to be a completely different animal. Dustin asked the question on his blog “Who Gave Roost Complete MLS listings?” and I would imagine when agents begin to discover the site they will be asking the same questions. It’s been a while since I have been involved with IDX (Internet Data Exchange) so the idea that a broker could redistribute a feed of data to a third party site intrigued me. I found out that “technically” the brokers are not providing the data to Roost.

Each market in the site is represented by an IDX feed of MLS data from a broker that is essentially a co-branded version of a broker web site. That will not be clear to you as you visit the site, nor will it be clear to any consumer, but from a purely technical standpoint it is. Still confused?

Here’s how it works. If you visit Roost.Com and select a target market you will be sent to a page that offers you search options. Roost calls this “Geo-Targeting”. The page you land on is redirected to a domain name that is either a second level domain to Roost in some markets. (https://coldwellbankeronline.idx.roost.com for Aurora IL) or a domain owned by the brokerage (https://garygreeneidx.com/ Prudential Gary Greene in Houston). I’m not sure but I think it will depend on how locked down the IDX contract language is from one area to the next as to what level you will see a domain at. Evidently there is no limitation on the number of IDX web sites that a broker can own and provide the MLS listing data to. It’s apparent that one struggle will be implementing the strategy from one market to the next.

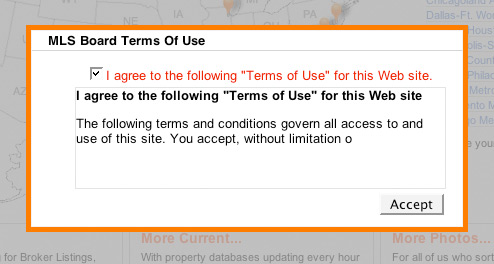

When visiting one of the Minnesota cities in Roost I was presented with a “Nag” screen that said I must agree with the MLS Terms of Service. The statement did not display completely in the text box and ended with…..You accept, without limitation o…… I figured what the hell, who wouldn’t want unlimited o’s? I’m sure it’s just a launch day bug, but it demonstrates an example of the challenge before them in having to accommodate different rules for different areas of the country.

When visiting one of the Minnesota cities in Roost I was presented with a “Nag” screen that said I must agree with the MLS Terms of Service. The statement did not display completely in the text box and ended with…..You accept, without limitation o…… I figured what the hell, who wouldn’t want unlimited o’s? I’m sure it’s just a launch day bug, but it demonstrates an example of the challenge before them in having to accommodate different rules for different areas of the country.

So the next question that is probably on your mind is how each market will be represented by more than one broker? According to Roost they will be rotating different brokers through the system. In a comment on 4Realz a Roost representative said

“Roost is a completely open/inclusive platform for any type of broker (large, small, independent, franchise group, corporate, etc)”

How will they make money? From what I have read thus far, each broker will pay based on CPC model, (cost per click). Each time a broker shows up in a rotation and someone clicks for more detail on a listing, it will redirect to the brokers “primary” IDX site and the broker will pay for that click.

I think essentially what Roost has done is create a system by which they will create and host a broker IDX web gateway with their search technology and put the clicks up for auction in each market.

The overall concept isn’t completely original, Prudential has been doing the same thing with Yahoo Real Estate for some time now but Yahoo has maintained an exclusive relationship with Prudential thus far. One of things I found interesting is that Prudential is not placing a lead capture form up before giving access to the detail info in Roost.

What does this all of this mean if you’re an agent? In the end it’s nothing more than another way to advertise listings on the web and it will be up to your broker to decide if it represents a good return on investment. Building a national portal and brand isn’t going to be easy so at this point it’s anyone’s guess whether Roost will be able to gain traction. The search technology is cool, but that alone isn’t going to equate to a rapid uptake in consumer adoption.

It’s certainly a very aggressive and creative endeavor but I think in the long haul business models like Trulia and Zillow are being built in a way that offers them much more flexibility with regard to the overall consumer experience. More importantly it gives them an ability to generate revenue from a much wider base of options without being restricted. I know the process is certainly more tedious but I personally like the strategy better. Hey who knows? I’m no genius, I just play one on this blog!