A long-running debate

Years ago, a real estate battle boiled over with Realtors and brokers educated on listing syndication arguing how data should or should not be shared with third party media sites. Since then, the debate over who should have what, how it should be presented, and who should get paid, has died down – until recently.

As more brokers either lose market share or become educated on listing syndication (or both), some are considering the option of pulling their listings from third party real estate sites, or from the MLS altogether, both of which have recently been achieved by a select few high profile brokerages, with several smaller groups with few listings pulling out with barely a notice.

Although the debate is not new, it has been reignited by select groups across the nation privately debating how their data is being handled. One of the models the industry has looked to is the Milwaukee brokerage, Shorewest, who pulled their listings from syndication last fall.

Shorewest pulls listings

WAV Group Partner, Victor Lund told AGBeat, “As you can see by the graph [below] – Shorewest is the #1 website in their market, and they do not syndicate – proving that brokers and agents do not need to syndicate to drive traffic and leads on their listings. In fact, this may argue that the opposite is true – if you do not syndicate, you provide consumers with an incentive to visit your broker or agent website to find the cheeze. In this case, the cheeze is listing accuracy, comprehensive listing inventory, and most of all, the service of a real estate professional.”

This now infamous graph has spread across Association committees and brokers’ desks like wild fire as Shorewest performs well in their market without their listings being featured in every real estate search site. The inherent problem is that alternative data contradicts this very chart that could lead some brokers to make business decisions for their companies (and their agents). Without getting into the validity or invalidity of each set of data and how it is measured, it is most important to note that any business making a decision about listing syndication should look at as many data sets as possible.

An alternative view

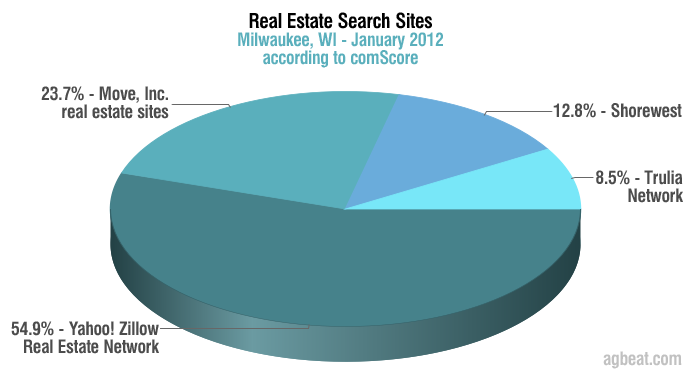

The graph above uses Experian Hitwise data, but comparing the numbers to comScore data presents an alternative picture. Just comparing the three most common real estate search sites with Shorewest in Milwaukee, WI in January presents an interesting picture:

Of note, neither measuring service takes mobile use into account. Although Trulia and Zillow could not determine their mobile use data in Milwaukee specifically, Curt Beardsley, Vice President of Customer and Industry Development at Move, Inc. told AGBeat that Realtor.com alone saw roughly 24,000 unique visitors in January through their mobile app, on top of the 89,000 unique visitors measured above.

Of the 89,000 unique visitors to Move sites, the company says 83,000 visited Realtor.com and asserts they are not losing market share. Realtor.com notes that Shorewest and Realtor.com have a “shared audience” of 17,000 people, according to comScore, meaning that 17,000 people visited both sites.

Picking winners and losers

Part of the story that many are not picking up on is that companies like Shorewest are within their right to pick winners and losers when it comes to syndication, for example, as of publication of this article, Shorewest is still syndicating their listings to Realtor.com, just not to Trulia or Zillow. Pulling listings is not always a black and white proposition.

The recent IDX battle in Austin makes it clear that there remains a great deal of market confusion not only over the differences between syndication and IDX, but of what rules reign where and what moves each brokerage is making regarding their data.

Many moving pieces of this puzzle

Despite many asserting that this is only a broker issue, there are many moving pieces regarding listing syndication, and each entity has a unique stake and agenda when it comes to data syndication. Realtors, brokers, and homeowners have far different objectives than third party real estate media sites who have different goals than MLSs, listing syndicators, association executives, association committees, and much different goals than the third party advisors and consultants to each of these entities that are in the thick of the debate. Although the comScore data compared to the Hitwise data is not a game changer for some, it should illuminate to the masses that using a single source to determine that opting out of listing syndication is best. It is notable that all three major search sites rely on comScore data for direct metrics.

In light of the fragmentation of the real estate data industry, the goal of all brokers deciding how to handle their data should be to do as much research as possible, and to understand not only how data works, but to obtain a real picture of what will happen if they pull listings from syndication – in some cases, a local site like Shorewest will perform well, in others, it will be crushed by the mega real estate sites. Seeing a single chart or hearing a single consultant speak on the topic can be inspiring, but should not be the sole reason for making a business-altering decision.

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

Jonathan Dalton

March 19, 2012 at 8:17 pm

Pretty charts, but to me the only number that matters is market share – not online market share, but hard and fast sales market share. If that hasn’t changed, clearly not being on Zillow or Trulia hasn’t made the slightest bit of difference.

These two sites add zero value to the real estate space. End of story.

Kris Berg

March 20, 2012 at 10:27 am

Precisely. Unique visitors, hits, eyeballs, online traffic share — these things do not have any nexus to homes sold, sale price or market time. People walking through the door with their agents do. We seem to be repeatedly confusing agent marketing opportunities with property marketing.

Benn Rosales

March 20, 2012 at 10:55 am

The only confusion I see is a fundamental ignorance in understanding pieces of a sales funnel, and what each piece intricately means to the final result you describe. Web search is inherent, and agent marketing via search sites may or may not be a viable means of obtaining a consumer – this article simply says as a broker, you’d better know before you pull your plug.

The article is about broker choice, not public pressure, or the push from the crowd from a cliff. 90k uniques is a ton of uniques to a market, and that’s just Milwaukee focused.

I found it insanely interesting that Realtor.com purports 17k uniques between themselves and shorewest website, it tells me there is a connection/delivery from point a to point b.

Ted

March 19, 2012 at 10:36 pm

One of my listings was hurt by an online 3rd party value. That value was $65k below our list. It was off by a mile. Many buyers find a property and then check the value via those sites – if that value is wrong, the seller is hurt and the buyer is given an improper expectation.

What I find ridiculous and amusing is the agents who mis-represent this story. A property these days does not need to be syndicated up the Wazzoo to be found. Otherwise the search term “”insert the name of your city here” real estate or homes for sale” would not be the highest cost adsense real estate search term at google 😉 Consumer’s will find the properties – piece of cake. I watch techno-tards do it everyday.

Most buyers I deal with are frustrated by the inaccuracy’s of the 3rd party real estate sites, because those sites have inventory that is stale. Buyers typically give me the addresses and I call back explaining those properties have either sold or are under contract. Additionally some of the 3rd party sites list the defaulted properties from the public records as for sale at the price of the default amount and buyers think they can buy those properties for 10 cents on the dollar.

Syndication just for syndication sake is a goofy argument. What has been going on for the last several years is a mess and part of it is the fault of the MLSs and part is the fault of the 3rd party vendors. Listings are a private employment contract between seller and broker, the MLS is a private agreement between brokers to share listing inventories and cooperate on compensation – there is no public right to this data. The 3rd party vendors are lucky that the brokers were not smart enough to offer a robust platform before the 3rd parties beat them to the punch.

The buyers are getting the shaft right now. No I am not a fan of single agent dual agency – outlaw it and I would be fine. But I would not mind if I could get a chance to tell a buyer about property features that may not be available via IDX or 3rd party sites – that is something that the buyer’s agent will not be able to do without talking to me or visting the property.

I have yet to see data that shows that homes sell faster and for more money because they are syndicated up the Wazoo. What selles a house is Price, Condition and Location. Get those right and the properties sell.

You can market the #$%^ out of an over priced listing – syndicated it up the Wazoo, Fly the Goodyear Blimp over your overpriced listing with an advertisement and it still wont sell. Funny how when homes are priced right their DOM is very very short.

Ivan Ronskonski

May 1, 2012 at 7:01 pm

Come on – your buyers get information from you (via MLS) on every matching listing before they hit any of the web sites. So when selling those sites do nothing to find real buyers. Unqualified lookers early in the process, sure. But all you need to sell the house is price, condition, and accurate MLS entry.