TreeSwing will attract new investors

At SXSWi this year, we were bored. It was a common sentiment. We visited nearly every single trade show booth, attended dozens of panels and parties, and although one of the only things people could remember from the week conference was the Hater app, but when we were asked what we thought was innovative, our answer was consistently TreeSwing. It’s not out yet, so it isn’t a hit yet, but while everyone was looking for the next Twitter, TreeSwing was a humble gem on the southern most edge of the trade show floor, and it is poised to overhaul the very core of investing.

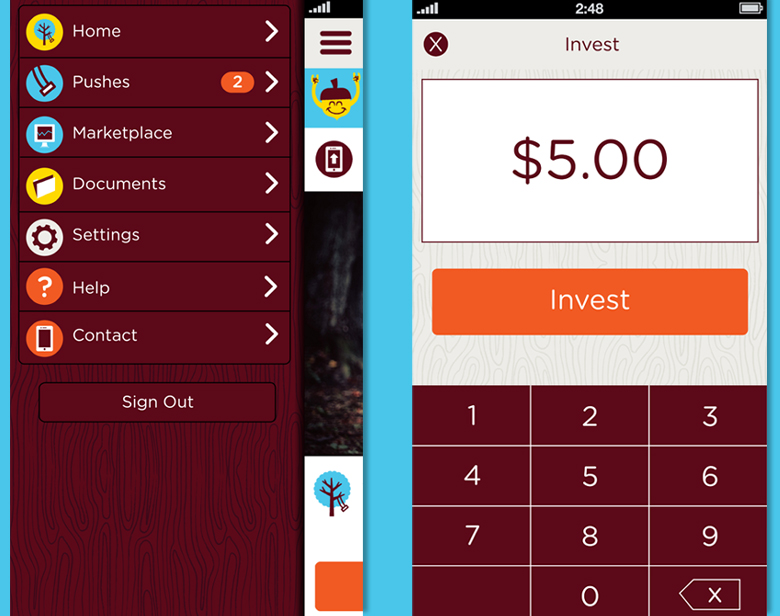

The idea behind the gorgeously designed TreeSwing is that the free app makes the mutual fund marketplace accessible to any consumer, even brand new hobbyists. Do you have $5? You can invest. Only want to try it with one dollar? No problem. Traditionally, this type of investing involves transaction fees, hefty minimum balances and investments, and required monthly purchases, but because TreeSwing is built using the infrastructure of parent company DST Systems, that is all done away with.

Because of the lifted restrictions that usually keep people out of the market, the company says they are seeking to make it so accessible that the millions of Americans who aren’t currently investing can’t help but to jump in.

How TreeSwing is different: focus is behavior, not market shifts

Brian Smith, Design and Product Manager for TreeSwing tells AGBeat that the data is “bite-sized,” allowing beginners to get started and asserts that they put complete control in the hands of the investor so they can “make mindful choices.” The $1 minimum is suspected to get people hooked as if they’ve gamified investing.

What most people don’t know about the app yet (because well, it’s not out yet) is that it will eventually be linked to FourSquare so that you are prompted to consider investing based on your frequently visited locations – genius! They even send notifications like, “It’s Global Pi Day, want to invest $3.14 today?” and so forth to keep people engaged.

The company says they are focusing on investing behaviors, not market fluctuations, and by making investing part of life on a weekly, even daily basis. “I believe we’ve built something that will lower the financial, behavioral, and emotional barriers to the investment process,” said Smith.

Anyone can sign up to be notified when the app launches by visiting TreeSwing.com. We predict the app will be popular because it tears down the barriers traditionally surrounding mutual fund investing, makes it easy to understand, and inexpensive to get started. It truly was the only exciting moment at SXSWi this year, one that many people missed because they were too focused on social media. They’ll figure it out.

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

Pingback: Openfolio: Gamification of investments is an interesting concept - AGBeat