Freelancing on the rise

We have long reported on freelancing and how it’s on the rise. More Americans than ever before are freelancing, choosing to ditch the boss and security of a full-time job. One of the worst things about working for yourself is paying your own taxes.

However, as a business owner, the IRS allows for deductions to help off-set your taxes and help you keep more of your hard-earned income.

Do you know which deductions freelancers are entitled to?

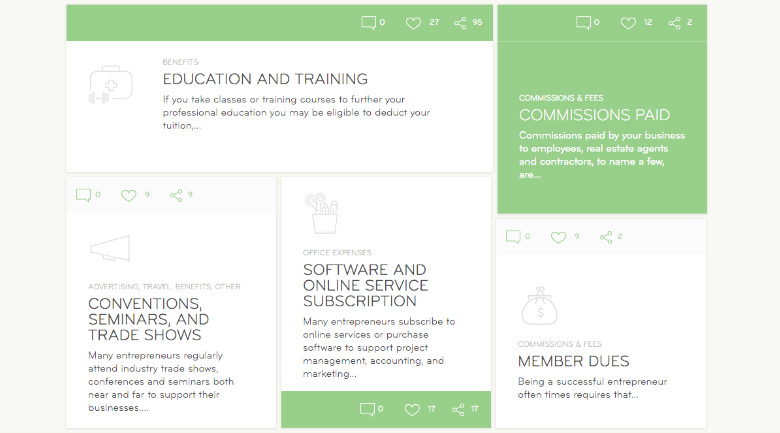

In 2015, the tax code was over 70,000 pages. How anyone can keep up with that information from year to year is astonishing. Short of having a CPA in your back pocket, how can freelancers keep up with what can be deducted or not? Hurdlr, Inc. has put together a great website to provide quick answers about what can and cannot be deducted.

What’s great about 99Deductions is that it’s not just geared toward one type of freelancer. AirBNB hosts, landlords, photographers, and Uber Drivers can use the site to make sure they’re taking advantage of every deduction available to them.

Users have the option to choose their line of “work,” then they can choose which aspect of the tax code they need information for. Each section goes into a great deal of detail. 99Deductions also has a comment section, in which many users have asked questions, but I could not find where they were providing answers. Hopefully, those comments will let their team identify places where further information is needed.

How 99Deductions came to be

99Deductions was developed to complement Hurdlr’s app, which tracks expenses, income, and other financial information. Hurdlr extracts information from popular apps to help you keep track of all that financial data which can be overwhelming. I don’t use it personally, but it does look promising for freelancers without a traditional accounting program.

99Deductions offers a great deal of information, but it does offer a disclaimer: “The information contained in this document is provided for informational purposes only and should not be construed as financial or tax advice. It is not intended to be a substitute for obtaining accounting or other financial advice from an appropriate financial advisor or for the purpose of avoiding U.S. Federal, state or local tax payments and penalties.”

In other words, don’t ditch your CPA just yet. Freelancers need other professionals to help them maximize their business expenses and profits.

#99Deductions

Dawn Brotherton is a Sr. Staff Writer at The American Genius with an MFA in Creative Writing from the University of Central Oklahoma. She is an experienced business writer with over 10 years of experience in SEO and content creation. Since 2017, she has earned $60K+ in grant writing for a local community center, which assists disadvantaged adults in the area.